BK Perspective Real Estate USA 2016

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Perspective</strong> on <strong>Real</strong> <strong>Estate</strong> <strong>2016</strong> - U.S.<br />

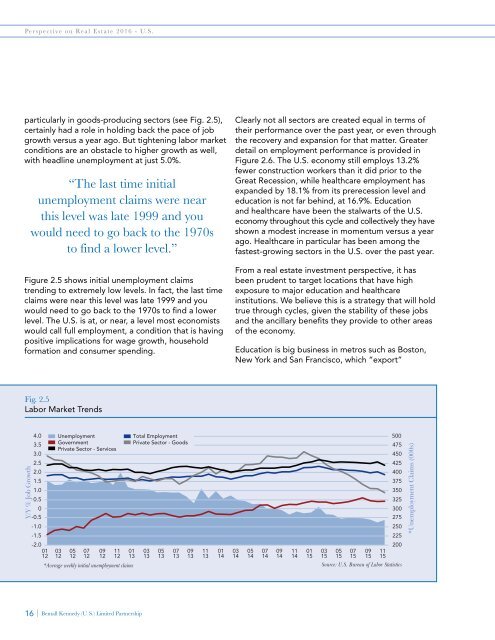

particularly in goods-producing sectors (see Fig. 2.5),<br />

certainly had a role in holding back the pace of job<br />

growth versus a year ago. But tightening labor market<br />

conditions are an obstacle to higher growth as well,<br />

with headline unemployment at just 5.0%.<br />

“The last time initial<br />

unemployment claims were near<br />

this level was late 1999 and you<br />

would need to go back to the 1970s<br />

to find a lower level.”<br />

Figure 2.5 shows initial unemployment claims<br />

trending to extremely low levels. In fact, the last time<br />

claims were near this level was late 1999 and you<br />

would need to go back to the 1970s to find a lower<br />

level. The U.S. is at, or near, a level most economists<br />

would call full employment, a condition that is having<br />

positive implications for wage growth, household<br />

formation and consumer spending.<br />

Clearly not all sectors are created equal in terms of<br />

their performance over the past year, or even through<br />

the recovery and expansion for that matter. Greater<br />

detail on employment performance is provided in<br />

Figure 2.6. The U.S. economy still employs 13.2%<br />

fewer construction workers than it did prior to the<br />

Great Recession, while healthcare employment has<br />

expanded by 18.1% from its prerecession level and<br />

education is not far behind, at 16.9%. Education<br />

and healthcare have been the stalwarts of the U.S.<br />

economy throughout this cycle and collectively they have<br />

shown a modest increase in momentum versus a year<br />

ago. Healthcare in particular has been among the<br />

fastest-growing sectors in the U.S. over the past year.<br />

From a real estate investment perspective, it has<br />

been prudent to target locations that have high<br />

exposure to major education and healthcare<br />

institutions. We believe this is a strategy that will hold<br />

true through cycles, given the stability of these jobs<br />

and the ancillary benefits they provide to other areas<br />

of the economy.<br />

Education is big business in metros such as Boston,<br />

New York and San Francisco, which “export”<br />

Fig. 2.5<br />

Labor Market Trends<br />

Y/Y % Job Growth<br />

4.0<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0<br />

-0.5<br />

-1.0<br />

-1.5<br />

-2.0<br />

01<br />

12<br />

Unemployment<br />

Government<br />

Private Sector - Services<br />

03<br />

12<br />

05<br />

12<br />

07<br />

12<br />

09<br />

12<br />

11<br />

12<br />

*Average weekly initial unemployment claims<br />

Total Employment<br />

Private Sector - Goods<br />

01<br />

13<br />

03<br />

13<br />

05<br />

13<br />

07<br />

13<br />

09<br />

13<br />

11<br />

13<br />

01<br />

14<br />

03<br />

14<br />

05<br />

14<br />

07<br />

14<br />

09<br />

14<br />

11<br />

14<br />

01<br />

15<br />

03<br />

15<br />

05<br />

15<br />

07<br />

15<br />

09<br />

15<br />

11<br />

15<br />

500<br />

475<br />

450<br />

425<br />

400<br />

375<br />

350<br />

325<br />

300<br />

275<br />

250<br />

225<br />

200<br />

Source: U.S. Bureau of Labor Statistics<br />

*Unemployment Claims (000s)<br />

16 | Bentall Kennedy (U.S.) Limited Partnership