BK Perspective Real Estate USA 2016

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Perspective</strong> on <strong>Real</strong> <strong>Estate</strong> <strong>2016</strong> - U.S.<br />

Office<br />

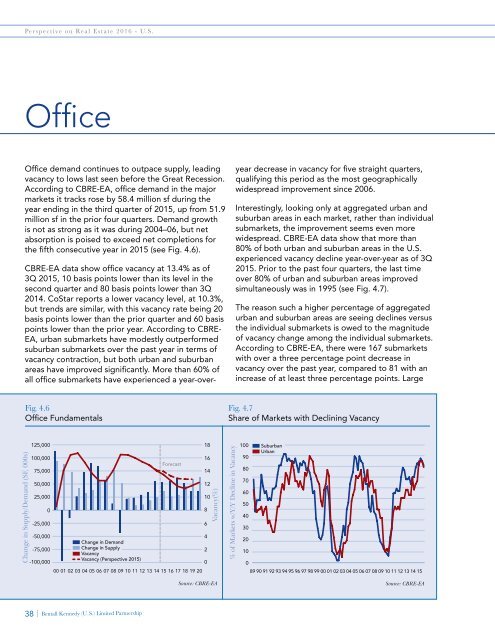

Office demand continues to outpace supply, leading<br />

vacancy to lows last seen before the Great Recession.<br />

According to CBRE-EA, office demand in the major<br />

markets it tracks rose by 58.4 million sf during the<br />

year ending in the third quarter of 2015, up from 51.9<br />

million sf in the prior four quarters. Demand growth<br />

is not as strong as it was during 2004–06, but net<br />

absorption is poised to exceed net completions for<br />

the fifth consecutive year in 2015 (see Fig. 4.6).<br />

CBRE-EA data show office vacancy at 13.4% as of<br />

3Q 2015, 10 basis points lower than its level in the<br />

second quarter and 80 basis points lower than 3Q<br />

2014. CoStar reports a lower vacancy level, at 10.3%,<br />

but trends are similar, with this vacancy rate being 20<br />

basis points lower than the prior quarter and 60 basis<br />

points lower than the prior year. According to CBRE-<br />

EA, urban submarkets have modestly outperformed<br />

suburban submarkets over the past year in terms of<br />

vacancy contraction, but both urban and suburban<br />

areas have improved significantly. More than 60% of<br />

all office submarkets have experienced a year-overyear<br />

decrease in vacancy for five straight quarters,<br />

qualifying this period as the most geographically<br />

widespread improvement since 2006.<br />

Interestingly, looking only at aggregated urban and<br />

suburban areas in each market, rather than individual<br />

submarkets, the improvement seems even more<br />

widespread. CBRE-EA data show that more than<br />

80% of both urban and suburban areas in the U.S.<br />

experienced vacancy decline year-over-year as of 3Q<br />

2015. Prior to the past four quarters, the last time<br />

over 80% of urban and suburban areas improved<br />

simultaneously was in 1995 (see Fig. 4.7).<br />

The reason such a higher percentage of aggregated<br />

urban and suburban areas are seeing declines versus<br />

the individual submarkets is owed to the magnitude<br />

of vacancy change among the individual submarkets.<br />

According to CBRE-EA, there were 167 submarkets<br />

with over a three percentage point decrease in<br />

vacancy over the past year, compared to 81 with an<br />

increase of at least three percentage points. Large<br />

Fig. 4.6<br />

Office Fundamentals<br />

Fig. 4.7<br />

Share of Markets with Declining Vacancy<br />

Change in Supply/Demand (SF, 000s)<br />

125,000<br />

100,000<br />

75,000<br />

50,000<br />

25,000<br />

0<br />

-25,000<br />

Forecast<br />

-50,000<br />

4<br />

Change in Demand<br />

-75,000<br />

Change in Supply<br />

Vacancy<br />

2<br />

-100,000<br />

Vacancy (<strong>Perspective</strong> 2015)<br />

0<br />

00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

Vacancy(%)<br />

Source: CBRE-EA<br />

% of Markets w/Y/Y Decline in Vacancy<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Suburban<br />

Urban<br />

89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15<br />

Source: CBRE-EA<br />

38 | Bentall Kennedy (U.S.) Limited Partnership