BK Perspective Real Estate USA 2016

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Perspective</strong> on <strong>Real</strong> <strong>Estate</strong> <strong>2016</strong> - U.S.<br />

Apartment<br />

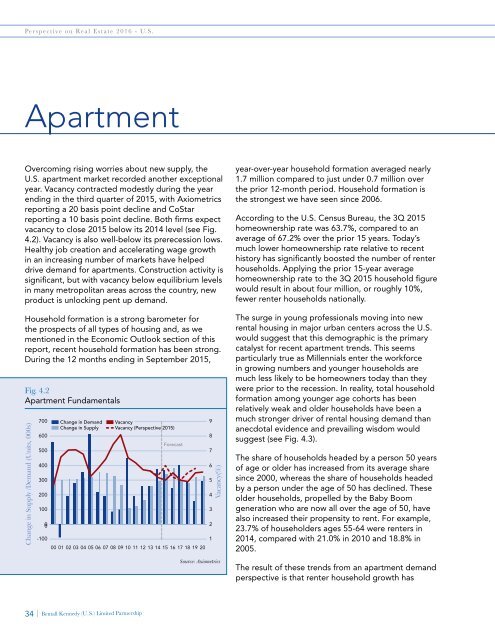

Overcoming rising worries about new supply, the<br />

U.S. apartment market recorded another exceptional<br />

year. Vacancy contracted modestly during the year<br />

ending in the third quarter of 2015, with Axiometrics<br />

reporting a 20 basis point decline and CoStar<br />

reporting a 10 basis point decline. Both firms expect<br />

vacancy to close 2015 below its 2014 level (see Fig.<br />

4.2). Vacancy is also well-below its prerecession lows.<br />

Healthy job creation and accelerating wage growth<br />

in an increasing number of markets have helped<br />

drive demand for apartments. Construction activity is<br />

significant, but with vacancy below equilibrium levels<br />

in many metropolitan areas across the country, new<br />

product is unlocking pent up demand.<br />

Household formation is a strong barometer for<br />

the prospects of all types of housing and, as we<br />

mentioned in the Economic Outlook section of this<br />

report, recent household formation has been strong.<br />

During the 12 months ending in September 2015,<br />

Fig. 4.2<br />

Apartment Fundamentals<br />

Change in Supply /Demand (Units, 000s)<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

-100<br />

00<br />

Change in Demand<br />

Change in Supply<br />

Vacancy<br />

Vacancy (<strong>Perspective</strong> 2015)<br />

Forecast<br />

01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

Vacancy(%)<br />

Source: Axiometrics<br />

year-over-year household formation averaged nearly<br />

1.7 million compared to just under 0.7 million over<br />

the prior 12-month period. Household formation is<br />

the strongest we have seen since 2006.<br />

According to the U.S. Census Bureau, the 3Q 2015<br />

homeownership rate was 63.7%, compared to an<br />

average of 67.2% over the prior 15 years. Today’s<br />

much lower homeownership rate relative to recent<br />

history has significantly boosted the number of renter<br />

households. Applying the prior 15-year average<br />

homeownership rate to the 3Q 2015 household figure<br />

would result in about four million, or roughly 10%,<br />

fewer renter households nationally.<br />

The surge in young professionals moving into new<br />

rental housing in major urban centers across the U.S.<br />

would suggest that this demographic is the primary<br />

catalyst for recent apartment trends. This seems<br />

particularly true as Millennials enter the workforce<br />

in growing numbers and younger households are<br />

much less likely to be homeowners today than they<br />

were prior to the recession. In reality, total household<br />

formation among younger age cohorts has been<br />

relatively weak and older households have been a<br />

much stronger driver of rental housing demand than<br />

anecdotal evidence and prevailing wisdom would<br />

suggest (see Fig. 4.3).<br />

The share of households headed by a person 50 years<br />

of age or older has increased from its average share<br />

since 2000, whereas the share of households headed<br />

by a person under the age of 50 has declined. These<br />

older households, propelled by the Baby Boom<br />

generation who are now all over the age of 50, have<br />

also increased their propensity to rent. For example,<br />

23.7% of householders ages 55-64 were renters in<br />

2014, compared with 21.0% in 2010 and 18.8% in<br />

2005.<br />

The result of these trends from an apartment demand<br />

perspective is that renter household growth has<br />

34 | Bentall Kennedy (U.S.) Limited Partnership