BK Perspective Real Estate USA 2016

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Perspective</strong> on <strong>Real</strong> <strong>Estate</strong> <strong>2016</strong> - U.S.<br />

Industrial<br />

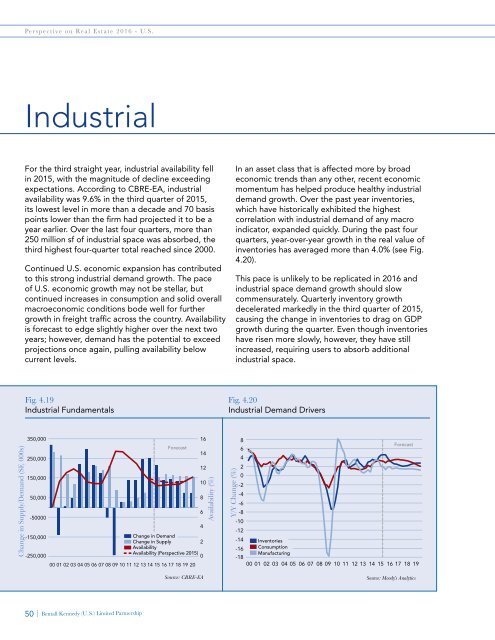

For the third straight year, industrial availability fell<br />

in 2015, with the magnitude of decline exceeding<br />

expectations. According to CBRE-EA, industrial<br />

availability was 9.6% in the third quarter of 2015,<br />

its lowest level in more than a decade and 70 basis<br />

points lower than the firm had projected it to be a<br />

year earlier. Over the last four quarters, more than<br />

250 million sf of industrial space was absorbed, the<br />

third highest four-quarter total reached since 2000.<br />

Continued U.S. economic expansion has contributed<br />

to this strong industrial demand growth. The pace<br />

of U.S. economic growth may not be stellar, but<br />

continued increases in consumption and solid overall<br />

macroeconomic conditions bode well for further<br />

growth in freight traffic across the country. Availability<br />

is forecast to edge slightly higher over the next two<br />

years; however, demand has the potential to exceed<br />

projections once again, pulling availability below<br />

current levels.<br />

In an asset class that is affected more by broad<br />

economic trends than any other, recent economic<br />

momentum has helped produce healthy industrial<br />

demand growth. Over the past year inventories,<br />

which have historically exhibited the highest<br />

correlation with industrial demand of any macro<br />

indicator, expanded quickly. During the past four<br />

quarters, year-over-year growth in the real value of<br />

inventories has averaged more than 4.0% (see Fig.<br />

4.20).<br />

This pace is unlikely to be replicated in <strong>2016</strong> and<br />

industrial space demand growth should slow<br />

commensurately. Quarterly inventory growth<br />

decelerated markedly in the third quarter of 2015,<br />

causing the change in inventories to drag on GDP<br />

growth during the quarter. Even though inventories<br />

have risen more slowly, however, they have still<br />

increased, requiring users to absorb additional<br />

industrial space.<br />

Fig. 4.19<br />

Industrial Fundamentals<br />

Fig. 4.20<br />

Industrial Demand Drivers<br />

Change in Supply/Demand (SF, 000s)<br />

350,000<br />

250,000<br />

150,000<br />

50,000<br />

-50000<br />

-150,000<br />

-250,000<br />

Forecast<br />

16<br />

14<br />

12<br />

10<br />

4<br />

Change in Demand<br />

Change in Supply<br />

2<br />

Availability<br />

Availability (<strong>Perspective</strong> 2015)<br />

0<br />

00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20<br />

8<br />

6<br />

Availability (%)<br />

Y/Y Change (%)<br />

8<br />

Forecast<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

-8<br />

-10<br />

-12<br />

-14 Inventories<br />

-16 Consumption<br />

Manufacturing<br />

-18<br />

00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19<br />

Source: CBRE-EA<br />

Source: Moody's Analytics<br />

50 | Bentall Kennedy (U.S.) Limited Partnership