BK Perspective Real Estate USA 2016

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Perspective</strong> on <strong>Real</strong> <strong>Estate</strong> <strong>2016</strong> - U.S.<br />

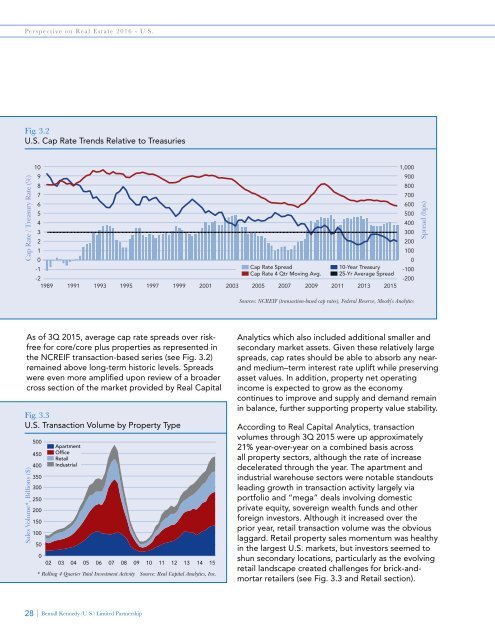

Fig. 3.2<br />

U.S. Cap Rate Trends Relative to Treasuries<br />

Cap Rate / Treasury Rate (%)<br />

10<br />

1,000<br />

9<br />

900<br />

8<br />

800<br />

7<br />

700<br />

6<br />

600<br />

5<br />

500<br />

4<br />

400<br />

3<br />

300<br />

2<br />

200<br />

1<br />

100<br />

0<br />

0<br />

-1<br />

Cap Rate Spread<br />

10-Year Treasury -100<br />

Cap Rate 4 Qtr Moving Avg. 25-Yr Average Spread<br />

-2<br />

-200<br />

1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015<br />

Spread (bps)<br />

Sources: NCREIF (transaction-based cap rates), Federal Reserve, Moody's Analytics<br />

As of 3Q 2015, average cap rate spreads over riskfree<br />

for core/core plus properties as represented in<br />

the NCREIF transaction-based series (see Fig. 3.2)<br />

remained above long-term historic levels. Spreads<br />

were even more amplified upon review of a broader<br />

cross section of the market provided by <strong>Real</strong> Capital<br />

Fig. 3.3<br />

U.S. Transaction Volume by Property Type<br />

Sales Volume*, Billions ($)<br />

500<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

Apartment<br />

Office<br />

Retail<br />

Industrial<br />

02 03 04 05 06 07 08 09 10 11 12 13 14 15<br />

* Rolling 4 Quarter Total Investment Activity<br />

Source: <strong>Real</strong> Capital Analytics, Inc.<br />

Analytics which also included additional smaller and<br />

secondary market assets. Given these relatively large<br />

spreads, cap rates should be able to absorb any nearand<br />

medium–term interest rate uplift while preserving<br />

asset values. In addition, property net operating<br />

income is expected to grow as the economy<br />

continues to improve and supply and demand remain<br />

in balance, further supporting property value stability.<br />

According to <strong>Real</strong> Capital Analytics, transaction<br />

volumes through 3Q 2015 were up approximately<br />

21% year-over-year on a combined basis across<br />

all property sectors, although the rate of increase<br />

decelerated through the year. The apartment and<br />

industrial warehouse sectors were notable standouts<br />

leading growth in transaction activity largely via<br />

portfolio and “mega” deals involving domestic<br />

private equity, sovereign wealth funds and other<br />

foreign investors. Although it increased over the<br />

prior year, retail transaction volume was the obvious<br />

laggard. Retail property sales momentum was healthy<br />

in the largest U.S. markets, but investors seemed to<br />

shun secondary locations, particularly as the evolving<br />

retail landscape created challenges for brick-andmortar<br />

retailers (see Fig. 3.3 and Retail section).<br />

28 | Bentall Kennedy (U.S.) Limited Partnership