BK Perspective Real Estate USA 2016

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Perspective</strong> on <strong>Real</strong> <strong>Estate</strong> <strong>2016</strong> - U.S.<br />

Apartment<br />

Demand Growth* (%)<br />

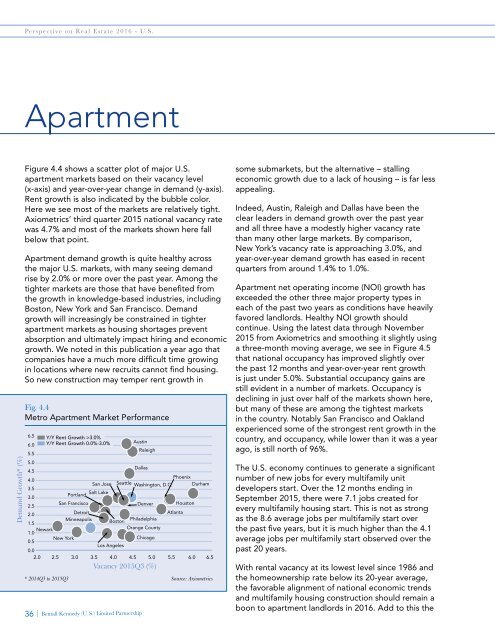

Figure 4.4 shows a scatter plot of major U.S.<br />

apartment markets based on their vacancy level<br />

(x-axis) and year-over-year change in demand (y-axis).<br />

Rent growth is also indicated by the bubble color.<br />

Here we see most of the markets are relatively tight.<br />

Axiometrics’ third quarter 2015 national vacancy rate<br />

was 4.7% and most of the markets shown here fall<br />

below that point.<br />

Apartment demand growth is quite healthy across<br />

the major U.S. markets, with many seeing demand<br />

rise by 2.0% or more over the past year. Among the<br />

tighter markets are those that have benefited from<br />

the growth in knowledge-based industries, including<br />

Boston, New York and San Francisco. Demand<br />

growth will increasingly be constrained in tighter<br />

apartment markets as housing shortages prevent<br />

absorption and ultimately impact hiring and economic<br />

growth. We noted in this publication a year ago that<br />

companies have a much more difficult time growing<br />

in locations where new recruits cannot find housing.<br />

So new construction may temper rent growth in<br />

Fig. 4.4<br />

Metro Apartment Market Performance<br />

5.5<br />

6.5 Y/Y Rent Growth >3.0%<br />

6.0 Y/Y Rent Growth 0.0%-3.0% Austin<br />

Raleigh<br />

5.0<br />

4.5<br />

Dallas<br />

Phoenix<br />

4.0<br />

San Jose Seattle Washington, D.C. Durham<br />

3.5<br />

Portland<br />

Salt Lake<br />

3.0<br />

2.5<br />

2.0<br />

San Francisco<br />

Detroit<br />

Denver Houston<br />

Atlanta<br />

1.5<br />

Minneapolis Boston<br />

Philadelphia<br />

Newark<br />

Orange County<br />

1.0<br />

0.5<br />

New York<br />

Chicago<br />

Los Angeles<br />

0.0<br />

2.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6.0 6.5<br />

* 2014Q3 to 2015Q3<br />

Vacancy 2015Q3 (%)<br />

36 | Bentall Kennedy (U.S.) Limited Partnership<br />

Source: Axiometrics<br />

some submarkets, but the alternative – stalling<br />

economic growth due to a lack of housing – is far less<br />

appealing.<br />

Indeed, Austin, Raleigh and Dallas have been the<br />

clear leaders in demand growth over the past year<br />

and all three have a modestly higher vacancy rate<br />

than many other large markets. By comparison,<br />

New York’s vacancy rate is approaching 3.0%, and<br />

year-over-year demand growth has eased in recent<br />

quarters from around 1.4% to 1.0%.<br />

Apartment net operating income (NOI) growth has<br />

exceeded the other three major property types in<br />

each of the past two years as conditions have heavily<br />

favored landlords. Healthy NOI growth should<br />

continue. Using the latest data through November<br />

2015 from Axiometrics and smoothing it slightly using<br />

a three-month moving average, we see in Figure 4.5<br />

that national occupancy has improved slightly over<br />

the past 12 months and year-over-year rent growth<br />

is just under 5.0%. Substantial occupancy gains are<br />

still evident in a number of markets. Occupancy is<br />

declining in just over half of the markets shown here,<br />

but many of these are among the tightest markets<br />

in the country. Notably San Francisco and Oakland<br />

experienced some of the strongest rent growth in the<br />

country, and occupancy, while lower than it was a year<br />

ago, is still north of 96%.<br />

The U.S. economy continues to generate a significant<br />

number of new jobs for every multifamily unit<br />

developers start. Over the 12 months ending in<br />

September 2015, there were 7.1 jobs created for<br />

every multifamily housing start. This is not as strong<br />

as the 8.6 average jobs per multifamily start over<br />

the past five years, but it is much higher than the 4.1<br />

average jobs per multifamily start observed over the<br />

past 20 years.<br />

With rental vacancy at its lowest level since 1986 and<br />

the homeownership rate below its 20-year average,<br />

the favorable alignment of national economic trends<br />

and multifamily housing construction should remain a<br />

boon to apartment landlords in <strong>2016</strong>. Add to this the