BK Perspective Real Estate USA 2016

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Perspective</strong> on <strong>Real</strong> <strong>Estate</strong> <strong>2016</strong> - U.S.<br />

Technology Drivers & Disruptors<br />

Codeacademy, Khan Academy and Skillshare, allow users<br />

anywhere to learn to write code for little to no money.<br />

Technology will reduce the barriers and costs associated with<br />

educating and training workers for jobs in the new economy<br />

as technological innovation reduces the need for less skilled<br />

workers.<br />

All of these technologies, plus a number of others, have led<br />

to rapid growth in STEM (science, technology, engineering<br />

and math) employment and in the rise of technology as<br />

America’s primary growth engine. Significant investment<br />

and wealth have been created alongside the hope that<br />

these technologies are poised for exponential growth. Many<br />

of these new technology firms are private companies that<br />

have been funded by venture capital firms, high net worth<br />

investors, private equity firms and the like. Investment<br />

analysts have nicknamed private companies with valuations of<br />

$1 billion or more “Unicorns.”<br />

According to CB Insights, there were 144 “Unicorns” with a<br />

cumulative valuation of $525 billion at the end of 2015. The<br />

most highly valued of these, one and a half year-old, Uber,<br />

had a valuation of $51 billion. Fourteen firms had a valuation<br />

of $10 billion or more and seven had a valuation of $5 to<br />

$9.9 billion. Mutual funds, banks, sovereign wealth funds and<br />

hedge funds have recently begun investing in these start-ups<br />

as well, and more than two-thirds of Unicorn companies now<br />

have one or more such investors. All of this capital flowing<br />

into technology start-ups has caused some to question<br />

whether we are in the midst of a technology bubble that<br />

could rival the 1998-2001 dot.com bubble.<br />

While private market valuations are incredibly high and<br />

there are some signs that many of these values will not hold<br />

up, this cycle is different in many ways from that of the dot.<br />

com era. First, most (but not all) of these companies have<br />

proprietary technologies, are creating products and services<br />

that the market desires and are generating revenues. Second,<br />

public sector valuations are not nearly as high as they were<br />

during the go-go days of the late-1990s. As of year-end 2015,<br />

the P/E of the technology sector was 23.8. By contrast, in<br />

March 2000, technology companies had a mean P/E ratio<br />

of 156. Third, the current technology boom is much more<br />

multifaceted and is not as one dimensional as was the dot.<br />

com boom, which primarily focused on online retailing.<br />

There are, however, significant risks. Firstly, private market<br />

valuations are incredibly high and recent evidence suggests<br />

that many of those valuations may not materialize when and<br />

if the firms go public. In 2015, just five Unicorn companies<br />

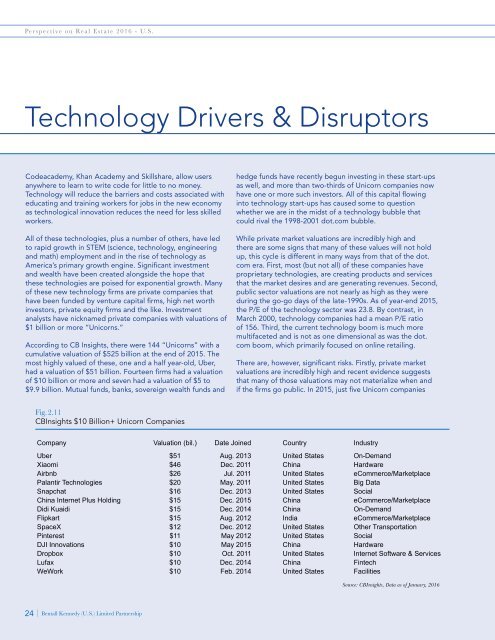

Fig. 2.11<br />

CBInsights $10 Billion+ Unicorn Companies<br />

Company Valuation (bil.) Date Joined Country Industry<br />

Uber $51 Aug. 2013 United States On-Demand<br />

Xiaomi $46 Dec. 2011 China Hardware<br />

Airbnb $26 Jul. 2011 United States eCommerce/Marketplace<br />

Palantir Technologies $20 May. 2011 United States Big Data<br />

Snapchat $16 Dec. 2013 United States Social<br />

China Internet Plus Holding $15 Dec. 2015 China eCommerce/Marketplace<br />

Didi Kuaidi $15 Dec. 2014 China On-Demand<br />

Flipkart $15 Aug. 2012 India eCommerce/Marketplace<br />

SpaceX $12 Dec. 2012 United States Other Transportation<br />

Pinterest $11 May 2012 United States Social<br />

DJI Innovations $10 May 2015 China Hardware<br />

Dropbox $10 Oct. 2011 United States Internet Software & Services<br />

Lufax $10 Dec. 2014 China Fintech<br />

WeWork $10 Feb. 2014 United States Facilities<br />

Source: CBInsights, Data as of January, <strong>2016</strong><br />

24 | Bentall Kennedy (U.S.) Limited Partnership