Iraqi Kurdistan All in the Timing

GEO_ExPro_v12i6

GEO_ExPro_v12i6

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Regional Update<br />

Markets Behav<strong>in</strong>g<br />

Differently<br />

The Middle East – one of <strong>the</strong> most stable E&P markets<br />

The Middle East is <strong>the</strong> largest produc<strong>in</strong>g area with<strong>in</strong> <strong>the</strong> E&P<br />

<strong>in</strong>dustry, with a total production of around 41 MMboepd <strong>in</strong> 2015,<br />

while Western Europe is <strong>the</strong> largest offshore market <strong>in</strong> terms of<br />

spend<strong>in</strong>g. These markets are expected to behave differently dur<strong>in</strong>g<br />

<strong>the</strong> current downwards cycle.<br />

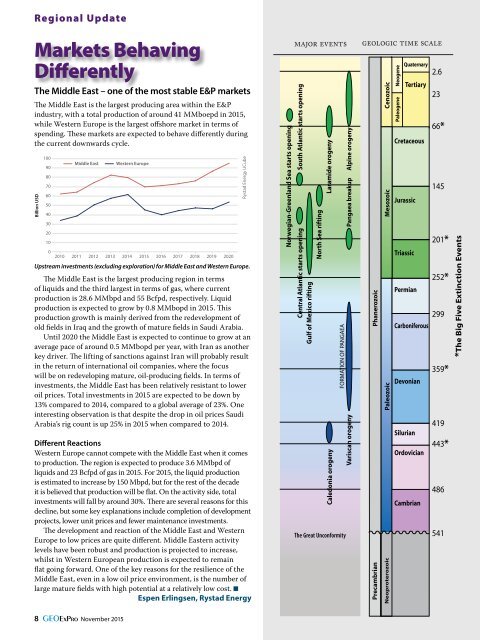

Billion USD<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Middle East<br />

Western Europe<br />

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020<br />

Upstream <strong>in</strong>vestments (exclud<strong>in</strong>g exploration) for Middle East and Western Europe.<br />

The Middle East is <strong>the</strong> largest produc<strong>in</strong>g region <strong>in</strong> terms<br />

of liquids and <strong>the</strong> third largest <strong>in</strong> terms of gas, where current<br />

production is 28.6 MMbpd and 55 Bcfpd, respectively. Liquid<br />

production is expected to grow by 0.8 MMbopd <strong>in</strong> 2015. This<br />

production growth is ma<strong>in</strong>ly derived from <strong>the</strong> redevelopment of<br />

old fields <strong>in</strong> Iraq and <strong>the</strong> growth of mature fields <strong>in</strong> Saudi Arabia.<br />

Until 2020 <strong>the</strong> Middle East is expected to cont<strong>in</strong>ue to grow at an<br />

average pace of around 0.5 MMbopd per year, with Iran as ano<strong>the</strong>r<br />

key driver. The lift<strong>in</strong>g of sanctions aga<strong>in</strong>st Iran will probably result<br />

<strong>in</strong> <strong>the</strong> return of <strong>in</strong>ternational oil companies, where <strong>the</strong> focus<br />

will be on redevelop<strong>in</strong>g mature, oil-produc<strong>in</strong>g fields. In terms of<br />

<strong>in</strong>vestments, <strong>the</strong> Middle East has been relatively resistant to lower<br />

oil prices. Total <strong>in</strong>vestments <strong>in</strong> 2015 are expected to be down by<br />

13% compared to 2014, compared to a global average of 23%. One<br />

<strong>in</strong>terest<strong>in</strong>g observation is that despite <strong>the</strong> drop <strong>in</strong> oil prices Saudi<br />

Arabia’s rig count is up 25% <strong>in</strong> 2015 when compared to 2014.<br />

Different Reactions<br />

Western Europe cannot compete with <strong>the</strong> Middle East when it comes<br />

to production. The region is expected to produce 3.6 MMbpd of<br />

liquids and 23 Bcfpd of gas <strong>in</strong> 2015. For 2015, <strong>the</strong> liquid production<br />

is estimated to <strong>in</strong>crease by 150 Mbpd, but for <strong>the</strong> rest of <strong>the</strong> decade<br />

it is believed that production will be flat. On <strong>the</strong> activity side, total<br />

<strong>in</strong>vestments will fall by around 30%. There are several reasons for this<br />

decl<strong>in</strong>e, but some key explanations <strong>in</strong>clude completion of development<br />

projects, lower unit prices and fewer ma<strong>in</strong>tenance <strong>in</strong>vestments.<br />

The development and reaction of <strong>the</strong> Middle East and Western<br />

Europe to low prices are quite different. Middle Eastern activity<br />

levels have been robust and production is projected to <strong>in</strong>crease,<br />

whilst <strong>in</strong> Western European production is expected to rema<strong>in</strong><br />

flat go<strong>in</strong>g forward. One of <strong>the</strong> key reasons for <strong>the</strong> resilience of <strong>the</strong><br />

Middle East, even <strong>in</strong> a low oil price environment, is <strong>the</strong> number of<br />

large mature fields with high potential at a relatively low cost.<br />

Espen Erl<strong>in</strong>gsen, Rystad Energy<br />

Rystad Energy UCube<br />

Norwegian-Greenland Sea starts open<strong>in</strong>g<br />

Central Atlantic starts open<strong>in</strong>g<br />

South Atlantic starts open<strong>in</strong>g<br />

Gulf of Mexico rift<strong>in</strong>g<br />

North Sea rift<strong>in</strong>g<br />

Caledonia orogeny Laramide orogeny<br />

FORMATION OF PANGAEA<br />

The Great Unconformity<br />

Alp<strong>in</strong>e orogeny<br />

Pangaea breakup<br />

Variscan orogeny<br />

Phanerozoic<br />

Paleozoic<br />

Mesozoic<br />

Cenozoic<br />

Precambrian<br />

Neoproterozoic<br />

Paleogene Neogene<br />

Quaternary<br />

Tertiary<br />

Cretaceous<br />

Jurassic<br />

Triassic<br />

Permian<br />

Carboniferous<br />

Devonian<br />

Silurian<br />

Ordovician<br />

Cambrian<br />

2.6<br />

23<br />

66*<br />

145<br />

201*<br />

252*<br />

299<br />

359*<br />

419<br />

443*<br />

486<br />

541<br />

*The Big Five Ext<strong>in</strong>ction Events<br />

8 GEOExPro November 2015