Debtfree DIGI September 2016

SA's Free Debt Counselling and Debt Review Industry Magazine. Are Garnishee orders dead? What did the Constitutional Court say? How can you deal with Debt Stress? This and more in this months issue

SA's Free Debt Counselling and Debt Review Industry Magazine. Are Garnishee orders dead? What did the Constitutional Court say? How can you deal with Debt Stress? This and more in this months issue

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

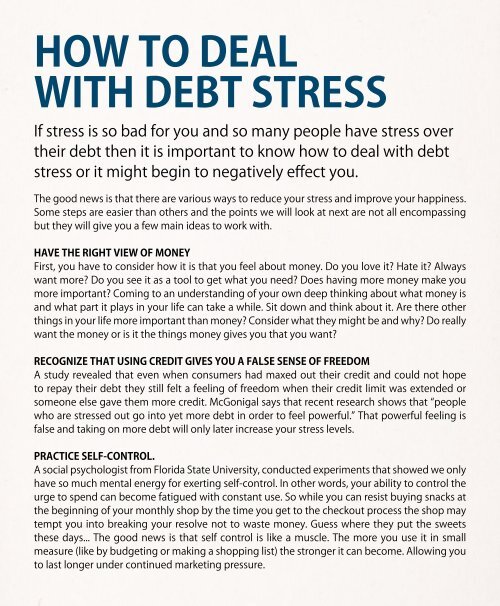

How to Deal<br />

With Debt Stress<br />

If stress is so bad for you and so many people have stress over<br />

their debt then it is important to know how to deal with debt<br />

stress or it might begin to negatively effect you.<br />

The good news is that there are various ways to reduce your stress and improve your happiness.<br />

Some steps are easier than others and the points we will look at next are not all encompassing<br />

but they will give you a few main ideas to work with.<br />

Have The Right View Of Money<br />

First, you have to consider how it is that you feel about money. Do you love it? Hate it? Always<br />

want more? Do you see it as a tool to get what you need? Does having more money make you<br />

more important? Coming to an understanding of your own deep thinking about what money is<br />

and what part it plays in your life can take a while. Sit down and think about it. Are there other<br />

things in your life more important than money? Consider what they might be and why? Do really<br />

want the money or is it the things money gives you that you want?<br />

Recognize That Using Credit Gives You a False Sense Of Freedom<br />

A study revealed that even when consumers had maxed out their credit and could not hope<br />

to repay their debt they still felt a feeling of freedom when their credit limit was extended or<br />

someone else gave them more credit. McGonigal says that recent research shows that “people<br />

who are stressed out go into yet more debt in order to feel powerful.” That powerful feeling is<br />

false and taking on more debt will only later increase your stress levels.<br />

Practice Self-Control.<br />

A social psychologist from Florida State University, conducted experiments that showed we only<br />

have so much mental energy for exerting self-control. In other words, your ability to control the<br />

urge to spend can become fatigued with constant use. So while you can resist buying snacks at<br />

the beginning of your monthly shop by the time you get to the checkout process the shop may<br />

tempt you into breaking your resolve not to waste money. Guess where they put the sweets<br />

these days... The good news is that self control is like a muscle. The more you use it in small<br />

measure (like by budgeting or making a shopping list) the stronger it can become. Allowing you<br />

to last longer under continued marketing pressure.