You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Europe's role in upholding an unjust tax system<br />

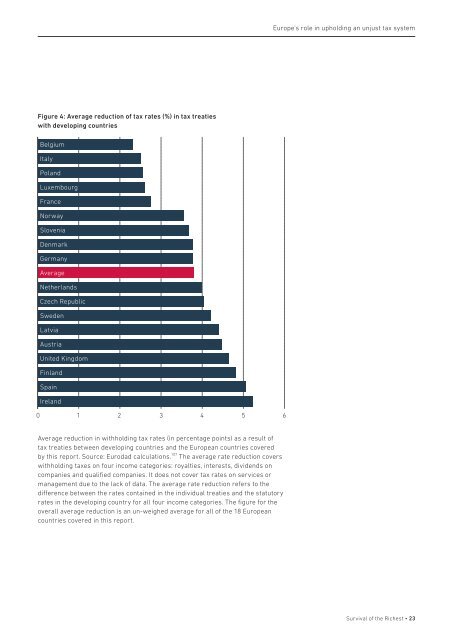

Figure 4: Average reduction <strong>of</strong> tax rates (%) in tax treaties<br />

with developing countries<br />

Belgium<br />

Italy<br />

Poland<br />

Luxembourg<br />

France<br />

Norway<br />

Slovenia<br />

Denmark<br />

Germany<br />

Average<br />

Ne<strong>the</strong>rlands<br />

Czech Republic<br />

Sweden<br />

Latvia<br />

Austria<br />

United Kingdom<br />

Finland<br />

Spain<br />

Ireland<br />

0<br />

1 2<br />

3<br />

4<br />

5<br />

6<br />

Average reduction in withholding tax rates (in percentage points) as a result <strong>of</strong><br />

tax treaties between developing countries and <strong>the</strong> European countries covered<br />

by this report. Source: Eurodad calculations. 107 The average rate reduction covers<br />

withholding taxes on four income categories: royalties, interests, dividends on<br />

companies and qualified companies. It does not cover tax rates on services or<br />

management due to <strong>the</strong> lack <strong>of</strong> data. The average rate reduction refers to <strong>the</strong><br />

difference between <strong>the</strong> rates contained in <strong>the</strong> individual treaties and <strong>the</strong> statutory<br />

rates in <strong>the</strong> developing country for all four income categories. The figure for <strong>the</strong><br />

overall average reduction is an un-weighed average for all <strong>of</strong> <strong>the</strong> 18 European<br />

countries covered in this report.<br />

<strong>Survival</strong> <strong>of</strong> <strong>the</strong> <strong>Richest</strong> • 23