Spencer Stuart Board Index

2ipnQXb

2ipnQXb

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ADDED PERSPECTIVE (continued)<br />

»»<br />

Inquiries from mutual funds, which<br />

represented 26% of shareholder contacts<br />

(an increase from 16% last year), tended to<br />

be about proxy access, CEO compensation,<br />

director tenure and board refreshment.<br />

»»<br />

Activist shareholders accounted for 17% of<br />

the inquiries, and their top issues were proxy<br />

access, companies’ political contributions/<br />

activities and strategic alternatives.<br />

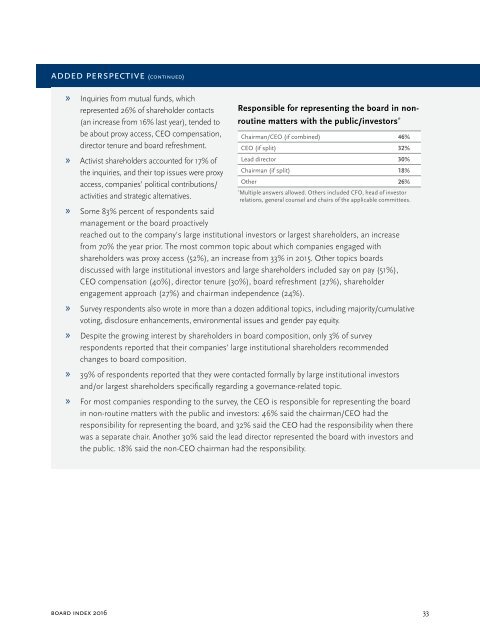

Responsible for representing the board in nonroutine<br />

matters with the public/investors *<br />

Chairman/CEO (if combined) 46%<br />

CEO (if split) 32%<br />

Lead director 30%<br />

Chairman (if split) 18%<br />

Other 26%<br />

*<br />

Multiple answers allowed. Others included CFO, head of investor<br />

relations, general counsel and chairs of the applicable committees.<br />

»»<br />

Some 83% percent of respondents said<br />

management or the board proactively<br />

reached out to the company's large institutional investors or largest shareholders, an increase<br />

from 70% the year prior. The most common topic about which companies engaged with<br />

shareholders was proxy access (52%), an increase from 33% in 2015. Other topics boards<br />

discussed with large institutional investors and large shareholders included say on pay (51%),<br />

CEO compensation (40%), director tenure (30%), board refreshment (27%), shareholder<br />

engagement approach (27%) and chairman independence (24%).<br />

»»<br />

Survey respondents also wrote in more than a dozen additional topics, including majority/cumulative<br />

voting, disclosure enhancements, environmental issues and gender pay equity.<br />

»»<br />

Despite the growing interest by shareholders in board composition, only 3% of survey<br />

respondents reported that their companies’ large institutional shareholders recommended<br />

changes to board composition.<br />

»»<br />

39% of respondents reported that they were contacted formally by large institutional investors<br />

and/or largest shareholders specifically regarding a governance-related topic.<br />

»»<br />

For most companies responding to the survey, the CEO is responsible for representing the board<br />

in non-routine matters with the public and investors: 46% said the chairman/CEO had the<br />

responsibility for representing the board, and 32% said the CEO had the responsibility when there<br />

was a separate chair. Another 30% said the lead director represented the board with investors and<br />

the public. 18% said the non-CEO chairman had the responsibility.<br />

board index 2016 33