Spencer Stuart Board Index

2ipnQXb

2ipnQXb

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Three-quarters of boards grant stock to directors as<br />

part of compensation<br />

»<br />

» 76% of S&P 500 boards provide stock grants to directors in addition to paying a cash retainer, compared<br />

with 64% a decade ago. The average targeted dollar value of annual stock grants is $155,328.<br />

»»<br />

By comparison, stock options for directors have become much less common. 14% of S&P 500<br />

companies now offer option plans, compared with 51% in 2006. The average targeted value of annual<br />

stock option grants is $95,402.<br />

»»<br />

51% of boards allow directors to choose to receive their compensation in cash, stock or stock units, but<br />

only 4% offer stock options as an alternative choice.<br />

»»<br />

Eight boards, 2% of the total, pay director retainers fully in stock.<br />

»»<br />

91% of boards disclose having share ownership guidelines for directors, which are meant to align<br />

directors’ interests with those of stockholders. A decade ago, 62% disclosed director share ownership<br />

guidelines. Typically, these guidelines require directors to own a certain number of shares or a multiple<br />

of the retainer value within a specified number of years.<br />

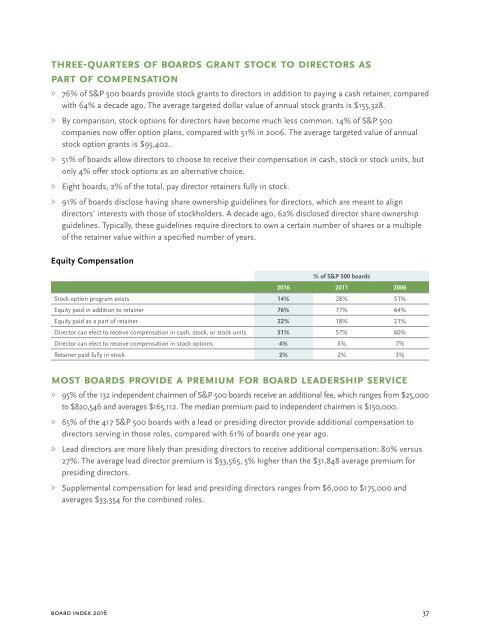

Equity Compensation<br />

% of S&P 500 boards<br />

2016 2011 2006<br />

Stock option program exists 14% 28% 51%<br />

Equity paid in addition to retainer 76% 77% 64%<br />

Equity paid as a part of retainer 22% 18% 21%<br />

Director can elect to receive compensation in cash, stock, or stock units 51% 57% 60%<br />

Director can elect to receive compensation in stock options 4% 5% 7%<br />

Retainer paid fully in stock 2% 2% 3%<br />

Most boards provide a premium for board leadership service<br />

»<br />

» 95% of the 132 independent chairmen of S&P 500 boards receive an additional fee, which ranges from $25,000<br />

to $820,546 and averages $165,112. The median premium paid to independent chairmen is $150,000.<br />

»»<br />

65% of the 417 S&P 500 boards with a lead or presiding director provide additional compensation to<br />

directors serving in those roles, compared with 61% of boards one year ago.<br />

»»<br />

Lead directors are more likely than presiding directors to receive additional compensation: 80% versus<br />

27%. The average lead director premium is $33,565, 5% higher than the $31,848 average premium for<br />

presiding directors.<br />

»»<br />

Supplemental compensation for lead and presiding directors ranges from $6,000 to $175,000 and<br />

averages $33,354 for the combined roles.<br />

board index 2016 37