Spencer Stuart Board Index

2ipnQXb

2ipnQXb

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

number of<br />

directors<br />

independent<br />

directors <strong>Board</strong> fees ($)<br />

Percentage of<br />

total compensation<br />

AVERAGE<br />

COMPENSATION PER<br />

NON-EMPLOYEE<br />

DIRECTOR<br />

MEETINGS PER YEARª<br />

COMPANY SALES<br />

($ IN MILLIONS)<br />

SEPARATE<br />

CHAIRMAN/CEO<br />

RETIREMENT AGE<br />

AVERAGE TENURE<br />

(years)<br />

BOARD RETAINER<br />

<strong>Board</strong> Retainer<br />

Footnotes<br />

INDEPENDENT<br />

DIRECTORS<br />

AVERAGE AGE<br />

all other<br />

OPTIONS<br />

TOTAL<br />

STOCK<br />

CASH<br />

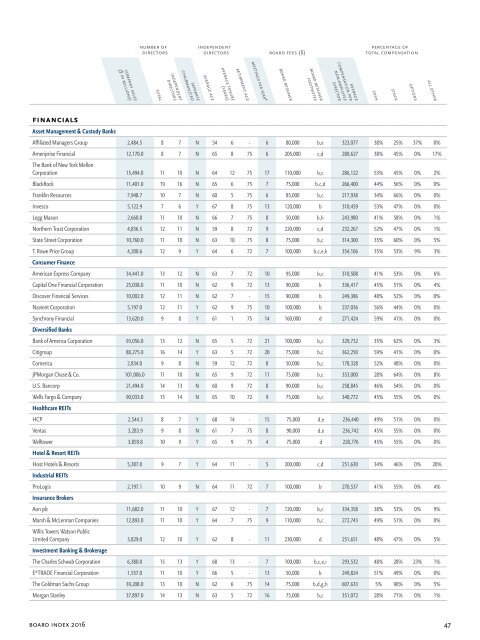

FINANCIALS<br />

Asset Management & Custody Banks<br />

Affiliated Managers Group 2,484.5 8 7 N 54 6 - 6 80,000 b,e 323,077 38% 25% 37% 0%<br />

Ameriprise Financial 12,170.0 8 7 N 65 8 75 6 205,000 c,d 280,627 38% 45% 0% 17%<br />

The Bank of New York Mellon<br />

Corporation 15,494.0 11 10 N 64 12 75 17 110,000 b,c 286,122 53% 45% 0% 2%<br />

BlackRock 11,401.0 19 16 N 65 6 75 7 75,000 b,c,d 266,400 44% 56% 0% 0%<br />

Franklin Resources 7,948.7 10 7 N 60 5 75 6 85,000 b,c 217,938 34% 66% 0% 0%<br />

Invesco 5,122.9 7 6 Y 67 8 75 13 120,000 b 310,459 53% 47% 0% 0%<br />

Legg Mason 2,660.8 11 10 N 66 7 75 8 50,000 b,h 243,980 41% 58% 0% 1%<br />

Northern Trust Corporation 4,856.5 12 11 N 59 8 72 9 220,000 c,d 232,267 52% 47% 0% 1%<br />

State Street Corporation 10,760.0 11 10 N 63 10 75 8 75,000 b,c 314,300 35% 60% 0% 5%<br />

T. Rowe Price Group 4,200.6 12 9 Y 64 6 72 7 100,000 b,c,e,k 354,106 35% 53% 9% 3%<br />

Consumer Finance<br />

American Express Company 34,441.0 13 12 N 63 7 72 10 95,000 b,c 310,508 41% 53% 0% 6%<br />

Capital One Financial Corporation 25,038.0 11 10 N 62 9 72 13 90,000 b 336,417 45% 51% 0% 4%<br />

Discover Financial Services 10,002.0 12 11 N 62 7 - 15 90,000 b 249,386 48% 52% 0% 0%<br />

Navient Corporation 5,197.0 12 11 Y 62 9 75 10 100,000 b 237,036 56% 44% 0% 0%<br />

Synchrony Financial 13,620.0 9 8 Y 61 1 75 14 160,000 d 271,424 59% 41% 0% 0%<br />

Diversified Banks<br />

Bank of America Corporation 93,056.0 13 12 N 65 5 72 21 100,000 b,c 329,732 35% 62% 0% 3%<br />

Citigroup 88,275.0 16 14 Y 63 5 72 20 75,000 b,c 362,250 59% 41% 0% 0%<br />

Comerica 2,834.0 9 8 N 59 12 72 8 50,000 b,c 178,328 52% 48% 0% 0%<br />

JPMorgan Chase & Co. 101,006.0 11 10 N 65 9 72 11 75,000 b,c 353,000 28% 64% 0% 8%<br />

U.S. Bancorp 21,494.0 14 13 N 60 9 72 8 90,000 b,c 258,845 46% 54% 0% 0%<br />

Wells Fargo & Company 90,033.0 15 14 N 65 10 72 9 75,000 b,c 340,772 45% 55% 0% 0%<br />

Healthcare REITs<br />

HCP 2,544.3 8 7 Y 68 14 - 15 75,000 d,e 236,440 49% 51% 0% 0%<br />

Ventas 3,283.9 9 8 N 61 7 75 8 90,000 d,e 236,742 45% 55% 0% 0%<br />

Welltower 3,859.8 10 9 Y 65 9 75 4 75,000 d 228,776 45% 55% 0% 0%<br />

Hotel & Resort REITs<br />

Host Hotels & Resorts 5,387.0 9 7 Y 64 11 - 5 200,000 c,d 251,630 34% 46% 0% 20%<br />

Industrial REITs<br />

ProLogis 2,197.1 10 9 N 64 11 72 7 100,000 b 270,537 41% 55% 0% 4%<br />

Insurance Brokers<br />

Aon plc 11,682.0 11 10 Y 67 12 - 7 120,000 b,c 334,358 38% 53% 0% 9%<br />

Marsh & McLennan Companies 12,893.0 11 10 Y 64 7 75 9 110,000 b,c 272,743 49% 51% 0% 0%<br />

Willis Towers Watson Public<br />

Limited Company 3,829.0 12 10 Y 62 8 - 11 230,000 d 251,651 48% 47% 0% 5%<br />

Investment Banking & Brokerage<br />

The Charles Schwab Corporation 6,380.0 15 13 Y 68 13 - 7 100,000 b,c,e,i 293,532 48% 28% 23% 1%<br />

E*TRADE Financial Corporation 1,557.0 11 10 Y 66 5 - 13 50,000 b 249,824 51% 49% 0% 0%<br />

The Goldman Sachs Group 39,208.0 13 10 N 62 6 75 14 75,000 b,d,g,h 607,633 5% 90% 0% 5%<br />

Morgan Stanley 37,897.0 14 13 N 63 5 72 16 75,000 b,c 351,072 28% 71% 0% 1%<br />

board index 2016 47