Subject

StatementofAccounts2015-2016V11StA

StatementofAccounts2015-2016V11StA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

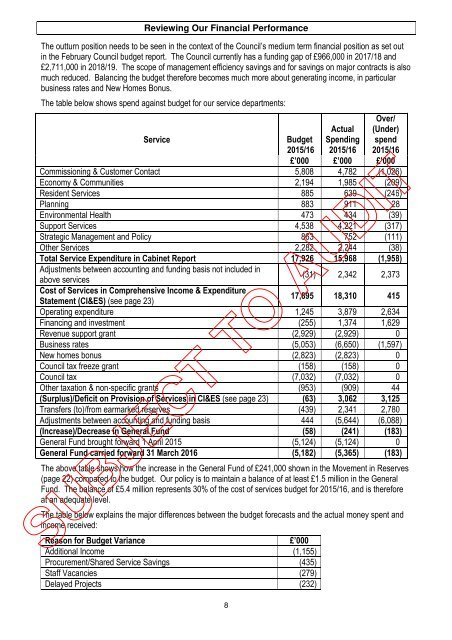

Reviewing Our Financial Performance<br />

The outturn position needs to be seen in the context of the Council’s medium term financial position as set out<br />

in the February Council budget report. The Council currently has a funding gap of £966,000 in 2017/18 and<br />

£2,711,000 in 2018/19. The scope of management efficiency savings and for savings on major contracts is also<br />

much reduced. Balancing the budget therefore becomes much more about generating income, in particular<br />

business rates and New Homes Bonus.<br />

The table below shows spend against budget for our service departments:<br />

8<br />

Actual<br />

Spending<br />

2015/16<br />

Over/<br />

(Under)<br />

spend<br />

2015/16<br />

Service<br />

Budget<br />

2015/16<br />

£’000 £’000 £’000<br />

Commissioning & Customer Contact 5,808. 4,782. (1,026)<br />

Economy & Communities 2,194. 1,985. (209)<br />

Resident Services 885. 639. (246)<br />

Planning 883. 911. 28.<br />

Environmental Health 473. 434. (39)<br />

Support Services 4,538. 4,221. (317)<br />

Strategic Management and Policy 863. 752. (111)<br />

Other Services 2,282. 2,244. (38)<br />

Total Service Expenditure in Cabinet Report 17,926. 15,968. (1,958)<br />

Adjustments between accounting and funding basis not included in<br />

(31) 2,342. 2,373.<br />

above services<br />

Cost of Services in Comprehensive Income & Expenditure<br />

Statement (CI&ES) (see page 23)<br />

17,895. 18,310. 415.<br />

Operating expenditure 1,245. 3,879. 2,634.<br />

Financing and investment (255) 1,374. 1,629.<br />

Revenue support grant (2,929) (2,929) 0.<br />

Business rates (5,053) (6,650) (1,597)<br />

New homes bonus (2,823) (2,823) 0.<br />

Council tax freeze grant (158) (158) 0.<br />

Council tax (7,032) (7,032) 0.<br />

Other taxation & non-specific grants (953) (909) 44.<br />

(Surplus)/Deficit on Provision of Services in CI&ES (see page 23) (63) 3,062. 3,125.<br />

Transfers (to)/from earmarked reserves (439) 2,341. 2,780.<br />

Adjustments between accounting and funding basis 444. (5,644) (6,088)<br />

(Increase)/Decrease in General Fund (58) (241) (183)<br />

General Fund brought forward 1 April 2015 (5,124) (5,124) 0.<br />

General Fund carried forward 31 March 2016 (5,182) (5,365) (183)<br />

The above table shows how the increase in the General Fund of £241,000 shown in the Movement in Reserves<br />

(page 22) compared to the budget. Our policy is to maintain a balance of at least £1.5 million in the General<br />

Fund. The balance of £5.4 million represents 30% of the cost of services budget for 2015/16, and is therefore<br />

at an adequate level.<br />

The table below explains the major differences between the budget forecasts and the actual money spent and<br />

income received:<br />

Reason for Budget Variance £’000<br />

Additional Income (1,155)<br />

Procurement/Shared Service Savings (435)<br />

Staff Vacancies (279)<br />

Delayed Projects (232)