Subject

StatementofAccounts2015-2016V11StA

StatementofAccounts2015-2016V11StA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Capital Grants - Receipts in Advance<br />

Notes to the Core Financial Statements<br />

Please see note 38 for a breakdown of Capital Grants Receipts in Advance.<br />

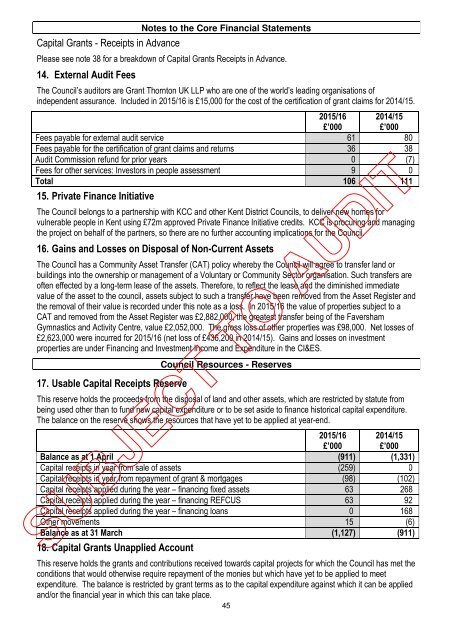

14.<br />

External Audit Fees<br />

The Council’s auditors are Grant Thornton UK LLP who are one of the world’s leading organisations of<br />

independent assurance. Included in 2015/16 is £15,000 for the cost of the certification of grant claims for 2014/15.<br />

2015/16<br />

£’000<br />

2014/15<br />

£’000<br />

Fees payable for external audit service 61 80.<br />

Fees payable for the certification of grant claims and returns 36 38.<br />

Audit Commission refund for prior years 0 (7)<br />

Fees for other services: Investors in people assessment 9 0.<br />

Total 106 111.<br />

15. Private Finance Initiative<br />

The Council belongs to a partnership with KCC and other Kent District Councils, to deliver new homes for<br />

vulnerable people in Kent using £72m approved Private Finance Initiative credits. KCC is procuring and managing<br />

the project on behalf of the partners, so there are no further accounting implications for the Council.<br />

16. Gains and Losses on Disposal of Non-Current Assets<br />

The Council has a Community Asset Transfer (CAT) policy whereby the Council will agree to transfer land or<br />

buildings into the ownership or management of a Voluntary or Community Sector organisation. Such transfers are<br />

often effected by a long-term lease of the assets. Therefore, to reflect the lease and the diminished immediate<br />

value of the asset to the council, assets subject to such a transfer have been removed from the Asset Register and<br />

the removal of their value is recorded under this note as a loss. In 2015/16 the value of properties subject to a<br />

CAT and removed from the Asset Register was £2,882,000, the greatest transfer being of the Faversham<br />

Gymnastics and Activity Centre, value £2,052,000. The gross loss of other properties was £98,000. Net losses of<br />

£2,623,000 were incurred for 2015/16 (net loss of £436,200 in 2014/15). Gains and losses on investment<br />

properties are under Financing and Investment Income and Expenditure in the CI&ES.<br />

Council Resources – Reserves<br />

17. Usable Capital Receipts Reserve<br />

Council Resources - Reserves<br />

This reserve holds the proceeds from the disposal of land and other assets, which are restricted by statute from<br />

being used other than to fund new capital expenditure or to be set aside to finance historical capital expenditure.<br />

The balance on the reserve shows the resources that have yet to be applied at year-end.<br />

2015/16<br />

£’000<br />

2014/15<br />

£’000<br />

Balance as at 1 April (911) (1,331)<br />

Capital receipts in year from sale of assets (259) 0.<br />

Capital receipts in year from repayment of grant & mortgages (98) (102)<br />

Capital receipts applied during the year – financing fixed assets 63. 268.<br />

Capital receipts applied during the year – financing REFCUS 63. 92.<br />

Capital receipts applied during the year – financing loans 0. 168.<br />

Other movements 15. (6)<br />

Balance as at 31 March (1,127) (911)<br />

18. Capital Grants Unapplied Account<br />

This reserve holds the grants and contributions received towards capital projects for which the Council has met the<br />

conditions that would otherwise require repayment of the monies but which have yet to be applied to meet<br />

expenditure. The balance is restricted by grant terms as to the capital expenditure against which it can be applied<br />

and/or the financial year in which this can take place.<br />

45