Subject

StatementofAccounts2015-2016V11StA

StatementofAccounts2015-2016V11StA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

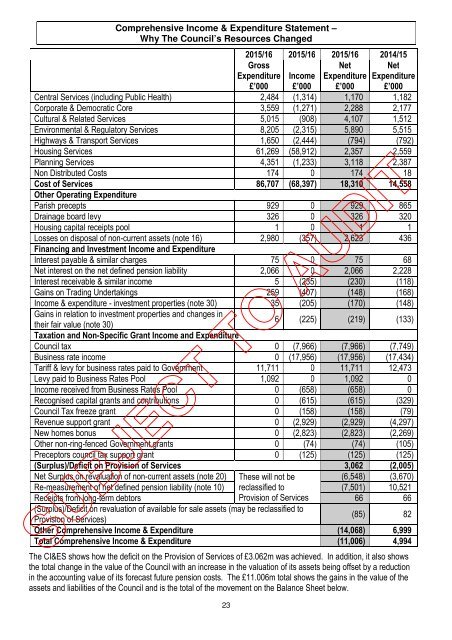

Comprehensive Income & Expenditure Statement<br />

Comprehensive Income & Expenditure Statement –<br />

Why The Council’s Resources Changed<br />

2015/16 2015/16 2015/16 2014/15<br />

Gross<br />

Net Net<br />

Expenditure Income Expenditure Expenditure<br />

£’000 £’000 £’000 £’000<br />

Central Services (including Public Health) 2,484 (1,314) 1,170. 1,182.<br />

Corporate & Democratic Core 3,559 (1,271) 2,288. 2,177.<br />

Cultural & Related Services 5,015 (908) 4,107. 1,512.<br />

Environmental & Regulatory Services 8,205 (2,315) 5,890. 5,515.<br />

Highways & Transport Services 1,650 (2,444) (794) (792)<br />

Housing Services 61,269 (58,912) 2,357. 2,559.<br />

Planning Services 4,351 (1,233) 3,118. 2,387.<br />

Non Distributed Costs 174 0. 174. 18.<br />

Cost of Services 86,707 (68,397) 18,310. 14,558.<br />

Other Operating Expenditure<br />

Parish precepts 929 0. 929. 865.<br />

Drainage board levy 326 0. 326. 320.<br />

Housing capital receipts pool 1 0. 1. 1.<br />

Losses on disposal of non-current assets (note 16) 2,980 (357) 2,623. 436.<br />

Financing and Investment Income and Expenditure<br />

Interest payable & similar charges 75 0. 75. 68.<br />

Net interest on the net defined pension liability 2,066 0. 2,066. 2,228.<br />

Interest receivable & similar income 5 (235) (230) (118)<br />

Gains on Trading Undertakings 259 (407) (148) (168)<br />

Income & expenditure - investment properties (note 30) 35 (205) (170) (148)<br />

Gains in relation to investment properties and changes in<br />

their fair value (note 30)<br />

6 (225) (219) (133)<br />

Taxation and Non-Specific Grant Income and Expenditure<br />

Council tax 0 (7,966) (7,966) (7,749)<br />

Business rate income 0 (17,956) (17,956) (17,434)<br />

Tariff & levy for business rates paid to Government 11,711 0. 11,711. 12,473.<br />

Levy paid to Business Rates Pool 1,092 0. 1,092. 0.<br />

Income received from Business Rates Pool 0 (658) (658) 0.<br />

Recognised capital grants and contributions 0 (615) (615) (329)<br />

Council Tax freeze grant 0 (158) (158) (79)<br />

Revenue support grant 0 (2,929) (2,929) (4,297)<br />

New homes bonus 0 (2,823) (2,823) (2,269)<br />

Other non-ring-fenced Government grants 0 (74) (74) (105)<br />

Preceptors council tax support grant 0 (125) (125) (125)<br />

(Surplus)/Deficit on Provision of Services 3,062. (2,005)<br />

Net Surplus on revaluation of non-current assets (note 20) These will not be<br />

(6,548) (3,670)<br />

Re-measurement of net defined pension liability (note 10) reclassified to<br />

(7,501) 10,521.<br />

Receipts from long-term debtors Provision of Services<br />

66. 66.<br />

(Surplus)/Deficit on revaluation of available for sale assets (may be reclassified to<br />

Provision of Services)<br />

(85) 82.<br />

Other Comprehensive Income & Expenditure (14,068) 6,999.<br />

Total Comprehensive Income & Expenditure (11,006) 4,994.<br />

The CI&ES shows how the deficit on the Provision of Services of £3.062m was achieved. In addition, it also shows<br />

the total change in the value of the Council with an increase in the valuation of its assets being offset by a reduction<br />

in the accounting value of its forecast future pension costs. The £11.006m total shows the gains in the value of the<br />

assets and liabilities of the Council and is the total of the movement on the Balance Sheet below.<br />

23