Subject

StatementofAccounts2015-2016V11StA

StatementofAccounts2015-2016V11StA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Core Financial Statements<br />

• Liquidity Risk – the possibility that the Council might not have the funds available to meet its payment<br />

commitments; and,<br />

• Market Risk – the possibility that a financial gain or loss might arise for the Council due to movements in<br />

interest rates, market prices, foreign currency exchange rates, etc. The Council’s investment in the<br />

CCLA is subject to the risk of falling commercial property prices. This risk is limited by the Council’s<br />

maximum exposure to property investments of £1.5m. A 5% fall in commercial property prices would<br />

result in a £75,000 charge to Other Comprehensive Income & Expenditure – this would have no impact<br />

on the General Fund until the investment was sold.<br />

Credit Risk<br />

The Council has adopted CIPFA’s Code of Practice on Treasury Management (and subsequent amendments),<br />

and complies with the Prudential Code for Capital Finance in Local Authorities.<br />

Credit risk arises from deposits with banks and financial institutions (counterparties), as well as credit exposure to<br />

the Council’s customers. The Council protects the security of the cash it deposits with counterparties using a<br />

number of risk management techniques. Principal among these is the evaluation of counterparty risk, which uses<br />

a combination of credit ratings and limits on the term and maximum value of any deposits.<br />

The Council seeks to reduce counterparty risk by adjusting the maximum amounts that may be invested with<br />

institutions. The details can be found in the Council’s Treasury Management Strategy.<br />

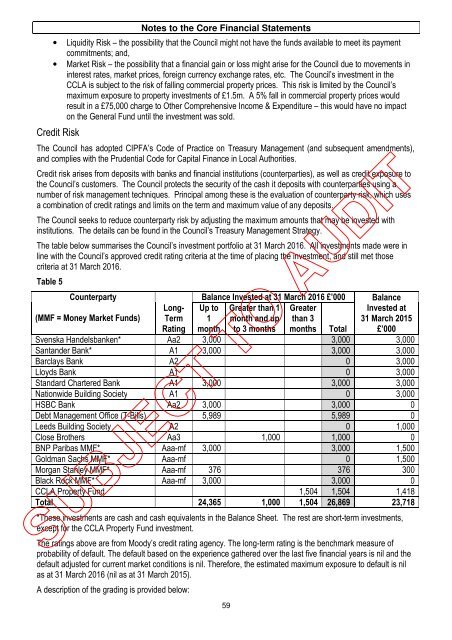

The table below summarises the Council’s investment portfolio at 31 March 2016. All investments made were in<br />

line with the Council’s approved credit rating criteria at the time of placing the investment, and still met those<br />

criteria at 31 March 2016.<br />

Table 5<br />

Counterparty<br />

(MMF = Money Market Funds)<br />

Long-<br />

Term<br />

Rating<br />

Balance Invested at 31 March 2016 £’000<br />

Up to Greater than 1 Greater<br />

1 month and up than 3<br />

month to 3 months months Total<br />

59<br />

Balance<br />

Invested at<br />

31 March 2015<br />

£’000<br />

Svenska Handelsbanken* Aa2 3,000 3,000 3,000<br />

Santander Bank* A1 3,000 3,000 3,000<br />

Barclays Bank A2 0 3,000<br />

Lloyds Bank A1 0 3,000<br />

Standard Chartered Bank A1 3,000 3,000 3,000<br />

Nationwide Building Society A1 0 3,000<br />

HSBC Bank Aa2 3,000 3,000 0<br />

Debt Management Office (T-Bills) 5,989 5,989 0<br />

Leeds Building Society A2 0 1,000<br />

Close Brothers Aa3 1,000 1,000 0<br />

BNP Paribas MMF* Aaa-mf 3,000 3,000 1,500<br />

Goldman Sachs MMF* Aaa-mf 0 1,500<br />

Morgan Stanley MMF* Aaa-mf 376 376 300<br />

Black Rock MMF* Aaa-mf 3,000 3,000 0<br />

CCLA Property Fund 1,504 1,504 1,418<br />

Total 24,365 1,000 1,504 26,869 23,718<br />

*These investments are cash and cash equivalents in the Balance Sheet. The rest are short-term investments,<br />

except for the CCLA Property Fund investment.<br />

The ratings above are from Moody’s credit rating agency. The long-term rating is the benchmark measure of<br />

probability of default. The default based on the experience gathered over the last five financial years is nil and the<br />

default adjusted for current market conditions is nil. Therefore, the estimated maximum exposure to default is nil<br />

as at 31 March 2016 (nil as at 31 March 2015).<br />

A description of the grading is provided below: