lu_inside12-full

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Inside magazine issue 12 | Part 03 - From a corporate perspective<br />

Sizing the market<br />

In many ways, the excitement around green<br />

bonds is related more to their apparent<br />

potential than their current market share.<br />

Indeed, to date, the green bonds market is<br />

still a very young market in spite of having<br />

been launched in 2007. Relative to the fixed<br />

income space, outstanding green bonds<br />

represent just close to 1 percent of all<br />

outstanding bonds. Still, the year-on-year<br />

growth of the market has been impressive.<br />

With US$41.8 billion worth of labelled<br />

green bonds issued in 2015 2 and a truly<br />

global presence, 3 there’s certainly cause for<br />

enthusiasm. Expected green bond issuance<br />

vo<strong>lu</strong>mes are situated somewhere between<br />

US$50 billion and US$100 billion in 2016<br />

according to reputable sources such as<br />

Bloomberg and Moody’s.<br />

That’s not a small sum.<br />

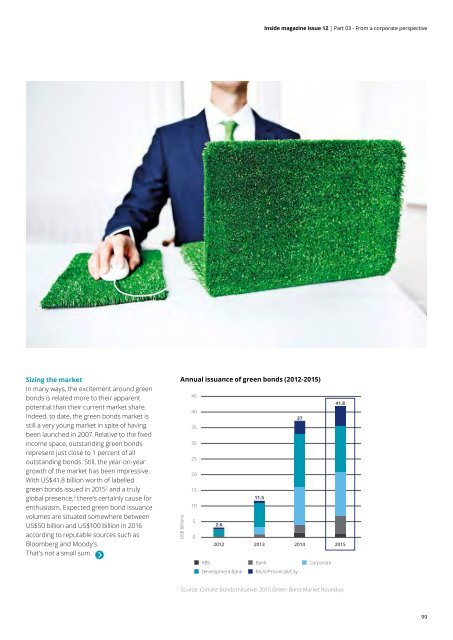

Annual issuance of green bonds (2012-2015)<br />

US$ billions<br />

45<br />

41.8<br />

40<br />

37<br />

35<br />

30<br />

25<br />

20<br />

15<br />

11.5<br />

10<br />

5<br />

2.6<br />

0<br />

2012 2013 2014 2015<br />

ABS<br />

Bank<br />

Corporate<br />

Development Bank Muni/Provincial/City<br />

Source: Climate Bonds Initiative: 2015 Green Bond Market Roundup<br />

99