Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FINANCE<br />

A PIPELINE<br />

TO CUBA'S<br />

PRIVATE SECTOR<br />

Money remitters<br />

are starting to play<br />

a vital role in business<br />

transactions<br />

By Nick Swyter<br />

When Cuba legalized the U.S. dollar in<br />

1993, it was difficult to use remittances<br />

for anything other than food, household<br />

goods, and utilities. Now, after 24 years of<br />

changes in U.S.-Cuba remittance policies,<br />

cash transfers are so valuable that they are<br />

propelling private businesses on both sides<br />

of the Straits of Florida.<br />

Elsa Vazquez Velar is just one of<br />

several small U.S. business owners who<br />

use money remitters to pay Cubans for<br />

services in the private sector. Her business,<br />

CasasCuba B&B, consists of several casas<br />

particulares (bed & breakfasts) in Santiago<br />

de Cuba. Vazquez Velar manages reservations<br />

from her home in Miami, and uses<br />

Western Union to pay her uncle in Santiago<br />

de Cuba for welcoming those guests.<br />

“I have no complaints,” Vazquez Velar<br />

said. “Obviously, we are over here and my<br />

uncle is running the B&Bs over there, but<br />

it is still very efficient.”<br />

CasasCuba B&B is not alone in<br />

using money remitters to pay for services<br />

in Cuba’s burgeoning private sector. Its<br />

best-known competitor, hospitality giant<br />

Airbnb, pays many of its hosts through the<br />

Miami-based remitter VaCuba.<br />

The casas particulares industry's use<br />

of money remitters to pay hosts illustrates<br />

how remittances are pivoting towards<br />

conducting business transactions. U.S. and<br />

Cuban policy changes helped make that<br />

42 CUBATRADE MARCH 2017<br />

pivot happen at an astonishing speed.<br />

According to the Havana Consulting<br />

Group, annual remittances to Cuba rose<br />

by 116 percent from 2008 to 2014, making<br />

Cuba the fastest-growing remittance<br />

market in Latin America. Cash transfers<br />

to Cuba––worth more than $3 billion<br />

dollars in 2015—now rank among one of<br />

the most valuable sectors of the Cuban<br />

economy.<br />

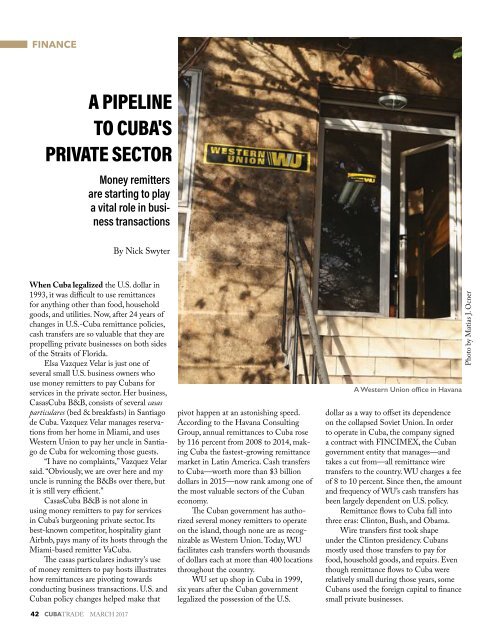

The Cuban government has authorized<br />

several money remitters to operate<br />

on the island, though none are as recognizable<br />

as Western Union. Today, WU<br />

facilitates cash transfers worth thousands<br />

of dollars each at more than 400 locations<br />

throughout the country.<br />

WU set up shop in Cuba in 1999,<br />

six years after the Cuban government<br />

legalized the possession of the U.S.<br />

A Western Union office in Havana<br />

dollar as a way to offset its dependence<br />

on the collapsed Soviet Union. In order<br />

to operate in Cuba, the company signed<br />

a contract with FINCIMEX, the Cuban<br />

government entity that manages—and<br />

takes a cut from—all remittance wire<br />

transfers to the country. WU charges a fee<br />

of 8 to 10 percent. Since then, the amount<br />

and frequency of WU’s cash transfers has<br />

been largely dependent on U.S. policy.<br />

Remittance flows to Cuba fall into<br />

three eras: Clinton, Bush, and Obama.<br />

Wire transfers first took shape<br />

under the Clinton presidency. Cubans<br />

mostly used those transfers to pay for<br />

food, household goods, and repairs. Even<br />

though remittance flows to Cuba were<br />

relatively small during those years, some<br />

Cubans used the foreign capital to finance<br />

small private businesses.<br />

Photo by Matias J. Ocner