Annual Report 2016

Annual Report 2016 - Federal Audit Oversight Authority FAOA

Annual Report 2016 - Federal Audit Oversight Authority FAOA

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

14<br />

Financial Audit | FAOA <strong>2016</strong><br />

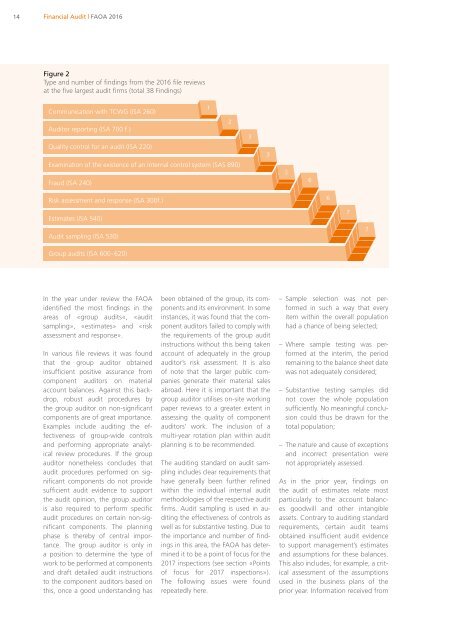

Figure 2<br />

Type and number of findings from the <strong>2016</strong> file reviews<br />

at the five largest audit firms (total 38 Findings)<br />

1<br />

Communication with TCWG (ISA 260)<br />

2<br />

Auditor reporting (ISA 700 f.)<br />

Quality control for an audit (ISA 220)<br />

Examination of the existence of an internal control system (SAS 890)<br />

Fraud (ISA 240)<br />

3<br />

3<br />

3<br />

6<br />

Risk assessment and response (ISA 300f.)<br />

6<br />

Estimates (ISA 540)<br />

Audit sampling (ISA 530)<br />

Group audits (ISA 600-620)<br />

7<br />

7<br />

In the year under review the FAOA<br />

identified the most findings in the<br />

areas of «group audits«, «audit<br />

sampling», «estimates» and «risk<br />

assessment and response».<br />

In various file reviews it was found<br />

that the group auditor obtained<br />

insufficient positive assurance from<br />

component auditors on material<br />

account balances. Against this backdrop,<br />

robust audit procedures by<br />

the group auditor on non-significant<br />

components are of great importance.<br />

Examples include auditing the effectiveness<br />

of group-wide controls<br />

and performing appropriate analytical<br />

review procedures. If the group<br />

auditor nonetheless concludes that<br />

audit procedures performed on significant<br />

components do not provide<br />

sufficient audit evidence to support<br />

the audit opinion, the group auditor<br />

is also required to perform specific<br />

audit procedures on certain non-significant<br />

components. The planning<br />

phase is thereby of central importance.<br />

The group auditor is only in<br />

a position to determine the type of<br />

work to be performed at components<br />

and draft detailed audit instructions<br />

to the component auditors based on<br />

this, once a good understanding has<br />

been obtained of the group, its components<br />

and its environment. In some<br />

instances, it was found that the component<br />

auditors failed to comply with<br />

the requirements of the group audit<br />

instructions without this being taken<br />

account of adequately in the group<br />

auditor’s risk assessment. It is also<br />

of note that the larger public companies<br />

generate their material sales<br />

abroad. Here it is important that the<br />

group auditor utilises on-site working<br />

paper reviews to a greater extent in<br />

assessing the quality of component<br />

auditors’ work. The inclusion of a<br />

multi-year rotation plan within audit<br />

planning is to be recommended.<br />

The auditing standard on audit sampling<br />

includes clear requirements that<br />

have generally been further refined<br />

within the individual internal audit<br />

methodologies of the respective audit<br />

firms. Audit sampling is used in auditing<br />

the effectiveness of controls as<br />

well as for substantive testing. Due to<br />

the importance and number of findings<br />

in this area, the FAOA has determined<br />

it to be a point of focus for the<br />

2017 inspections (see section «Points<br />

of focus for 2017 inspections»).<br />

The following issues were found<br />

repeatedly here.<br />

– Sample selection was not performed<br />

in such a way that every<br />

item within the overall population<br />

had a chance of being selected;<br />

– Where sample testing was performed<br />

at the interim, the period<br />

remaining to the balance sheet date<br />

was not adequately considered;<br />

– Substantive testing samples did<br />

not cover the whole population<br />

sufficiently. No meaningful conclusion<br />

could thus be drawn for the<br />

total population;<br />

– The nature and cause of exceptions<br />

and incorrect presentation were<br />

not appropriately assessed.<br />

As in the prior year, findings on<br />

the audit of estimates relate most<br />

particularly to the account balances<br />

goodwill and other intangible<br />

assets. Contrary to auditing standard<br />

requirements, certain audit teams<br />

obtained insufficient audit evidence<br />

to support management’s estimates<br />

and assumptions for these balances.<br />

This also includes, for example, a critical<br />

assessment of the assumptions<br />

used in the business plans of the<br />

prior year. Information received from