Annual Report 2016

Annual Report 2016 - Federal Audit Oversight Authority FAOA

Annual Report 2016 - Federal Audit Oversight Authority FAOA

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Audit | FAOA <strong>2016</strong><br />

15<br />

management is also to be confirmed<br />

using other audit procedures.<br />

Risk assessment and response also<br />

covers general IT and application<br />

controls. If an auditor wishes to rely<br />

on the effectiveness of general IT<br />

and application controls these controls<br />

have to be tested adequately.<br />

The auditor cannot otherwise rely on<br />

system-generated documents that,<br />

in turn, form a basis for the audit of<br />

various account balances. In some instances,<br />

however, reliance was placed<br />

on IT and application controls without<br />

them being tested adequately. It often<br />

appears that these findings result<br />

from a lack of professional scepticism<br />

and the insufficient assessment<br />

of, and response to, risks of material<br />

misstatement.<br />

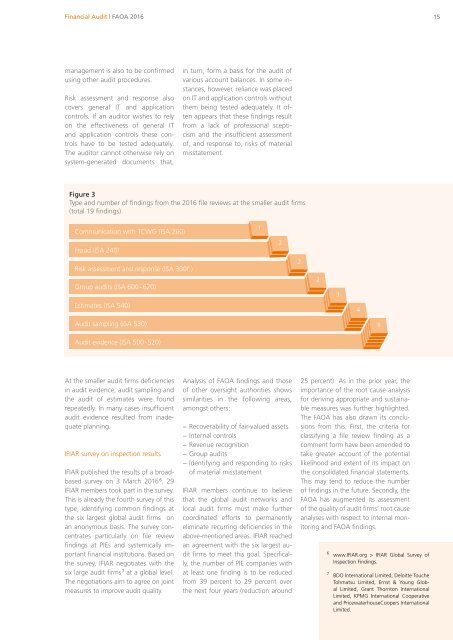

Figure 3<br />

Type and number of findings from the <strong>2016</strong> file reviews at the smaller audit firms<br />

(total 19 findings)<br />

Communication with TCWG (ISA 260)<br />

Fraud (ISA 240)<br />

Risk assessment and response (ISA 300f.)<br />

Group audits (ISA 600-620)<br />

Estimates (ISA 540)<br />

1<br />

2<br />

2<br />

2<br />

3<br />

4<br />

Audit sampling (ISA 530)<br />

5<br />

Audit evidence (ISA 500-520)<br />

At the smaller audit firms deficiencies<br />

in audit evidence, audit sampling and<br />

the audit of estimates were found<br />

repeatedly. In many cases insufficient<br />

audit evidence resulted from inadequate<br />

planning.<br />

IFIAR survey on inspection results<br />

IFIAR published the results of a broadbased<br />

survey on 3 March <strong>2016</strong> 6 . 29<br />

IFIAR members took part in the survey.<br />

This is already the fourth survey of this<br />

type, identifying common findings at<br />

the six largest global audit firms on<br />

an anonymous basis. The survey concentrates<br />

particularly on file review<br />

findings at PIEs and systemically important<br />

financial institutions. Based on<br />

the survey, IFIAR negotiates with the<br />

six large audit firms 7 at a global level.<br />

The negotiations aim to agree on joint<br />

measures to improve audit quality.<br />

Analysis of FAOA findings and those<br />

of other oversight authorities shows<br />

similarities in the following areas,<br />

amongst others:<br />

− Recoverability of fair-valued assets<br />

− Internal controls<br />

− Revenue recognition<br />

− Group audits<br />

− Identifying and responding to risks<br />

of material misstatement<br />

IFIAR members continue to believe<br />

that the global audit networks and<br />

local audit firms must make further<br />

coordinated efforts to permanently<br />

eliminate recurring deficiencies in the<br />

above-mentioned areas. IFIAR reached<br />

an agreement with the six largest audit<br />

firms to meet this goal. Specifically,<br />

the number of PIE companies with<br />

at least one finding is to be reduced<br />

from 39 percent to 29 percent over<br />

the next four years (reduction around<br />

25 percent). As in the prior year, the<br />

importance of the root cause analysis<br />

for deriving appropriate and sustainable<br />

measures was further highlighted.<br />

The FAOA has also drawn its conclusions<br />

from this. First, the criteria for<br />

classifying a file review finding as a<br />

comment form have been amended to<br />

take greater account of the potential<br />

likelihood and extent of its impact on<br />

the consolidated financial statements.<br />

This may tend to reduce the number<br />

of findings in the future. Secondly, the<br />

FAOA has augmented its assessment<br />

of the quality of audit firms’ root cause<br />

analyses with respect to internal monitoring<br />

and FAOA findings.<br />

6 www.IFIAR.org > IFIAR Global Survey of<br />

Inspection Findings.<br />

7 BDO International Limited, Deloitte Touche<br />

Tohmatsu Limited, Ernst & Young Global<br />

Limited, Grant Thornton International<br />

Limited, KPMG International Cooperative<br />

and PricewaterhouseCoopers International<br />

Limited.