Annual Report 2016

Annual Report 2016 - Federal Audit Oversight Authority FAOA

Annual Report 2016 - Federal Audit Oversight Authority FAOA

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Regulatory Audit | FAOA <strong>2016</strong><br />

29<br />

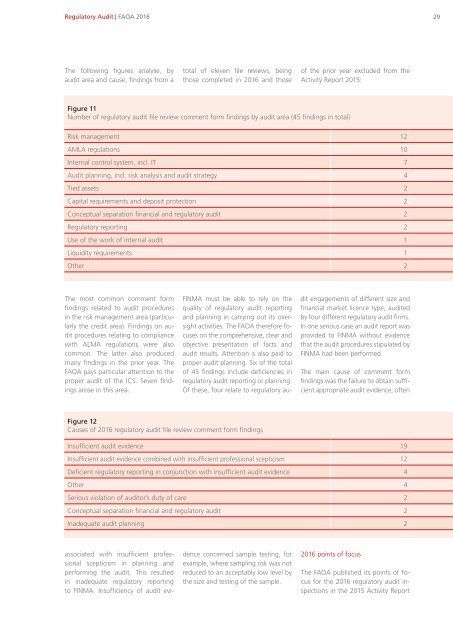

The following figures analyse, by<br />

audit area and cause, findings from a<br />

total of eleven file reviews, being<br />

those completed in <strong>2016</strong> and those<br />

of the prior year excluded from the<br />

Activity <strong>Report</strong> 2015:<br />

Figure 11<br />

Number of regulatory audit file review comment form findings by audit area (45 findings in total)<br />

Risk management 12<br />

AMLA regulations 10<br />

Internal control system, incl. IT 7<br />

Audit planning, incl. risk analysis and audit strategy 4<br />

Tied assets 2<br />

Capital requirements and deposit protection 2<br />

Conceptual separation financial and regulatory audit 2<br />

Regulatory reporting 2<br />

Use of the work of internal audit 1<br />

Liquidity requirements 1<br />

Other 2<br />

The most common comment form<br />

findings related to audit procedures<br />

in the risk management area (particularly<br />

the credit area). Findings on audit<br />

procedures relating to compliance<br />

with ALMA regulations were also<br />

common. The latter also produced<br />

many findings in the prior year. The<br />

FAOA pays particular attention to the<br />

proper audit of the ICS. Seven findings<br />

arose in this area.<br />

FINMA must be able to rely on the<br />

quality of regulatory audit reporting<br />

and planning in carrying out its oversight<br />

activities. The FAOA therefore focuses<br />

on the comprehensive, clear and<br />

objective presentation of facts and<br />

audit results. Attention is also paid to<br />

proper audit planning. Six of the total<br />

of 45 findings include deficiencies in<br />

regulatory audit reporting or planning.<br />

Of these, four relate to regulatory audit<br />

engagements of different size and<br />

financial market licence type, audited<br />

by four different regulatory audit firms.<br />

In one serious case an audit report was<br />

provided to FINMA without evidence<br />

that the audit procedures stipulated by<br />

FINMA had been performed.<br />

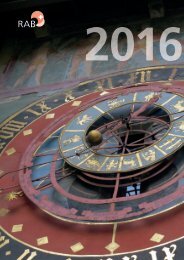

The main cause of comment form<br />

findings was the failure to obtain sufficient<br />

appropriate audit evidence, often<br />

Figure 12<br />

Causes of <strong>2016</strong> regulatory audit file review comment form findings<br />

Insufficient audit evidence 19<br />

Insufficient audit evidence combined with insufficient professional scepticism 12<br />

Deficient regulatory reporting in conjunction with insufficient audit evidence 4<br />

Other 4<br />

Serious violation of auditor’s duty of care 2<br />

Conceptual separation financial and regulatory audit 2<br />

Inadequate audit planning 2<br />

associated with insufficient professional<br />

scepticism in planning and<br />

performing the audit. This resulted<br />

in inadequate regulatory reporting<br />

to FINMA. Insufficiency of audit evidence<br />

concerned sample testing, for<br />

example, where sampling risk was not<br />

reduced to an acceptably low level by<br />

the size and testing of the sample.<br />

<strong>2016</strong> points of focus<br />

The FAOA published its points of focus<br />

for the <strong>2016</strong> regulatory audit inspections<br />

in the 2015 Activity <strong>Report</strong>