Annual Report 2016

Annual Report 2016 - Federal Audit Oversight Authority FAOA

Annual Report 2016 - Federal Audit Oversight Authority FAOA

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Appendix | FAOA <strong>2016</strong><br />

57<br />

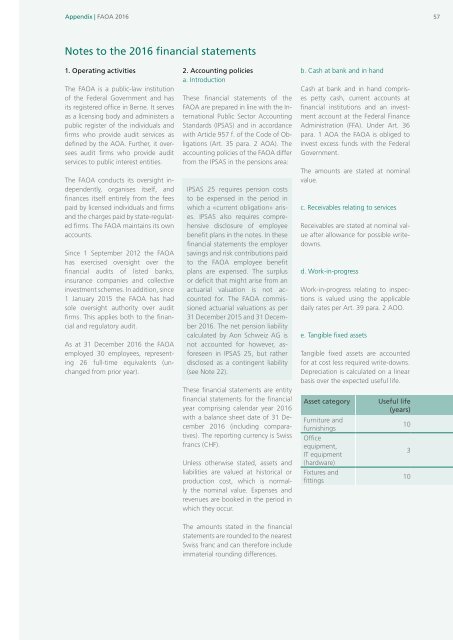

Notes to the <strong>2016</strong> financial statements<br />

1. Operating activities<br />

The FAOA is a public-law institution<br />

of the Federal Government and has<br />

its registered office in Berne. It serves<br />

as a licensing body and administers a<br />

public register of the individuals and<br />

firms who provide audit services as<br />

defined by the AOA. Further, it oversees<br />

audit firms who provide audit<br />

services to public interest entities.<br />

The FAOA conducts its oversight independently,<br />

organises itself, and<br />

finances itself entirely from the fees<br />

paid by licensed individuals and firms<br />

and the charges paid by state-regulated<br />

firms. The FAOA maintains its own<br />

accounts.<br />

Since 1 September 2012 the FAOA<br />

has exercised oversight over the<br />

financial audits of listed banks,<br />

insurance companies and collective<br />

investment schemes. In addition, since<br />

1 January 2015 the FAOA has had<br />

sole oversight authority over audit<br />

firms. This applies both to the financial<br />

and regulatory audit.<br />

As at 31 December <strong>2016</strong> the FAOA<br />

employed 30 employees, representing<br />

26 full-time equivalents (unchanged<br />

from prior year).<br />

2. Accounting policies<br />

a. Introduction<br />

These financial statements of the<br />

FAOA are prepared in line with the International<br />

Public Sector Accounting<br />

Standards (IPSAS) and in accordance<br />

with Article 957 f. of the Code of Obligations<br />

(Art. 35 para. 2 AOA). The<br />

accounting policies of the FAOA differ<br />

from the IPSAS in the pensions area:<br />

IPSAS 25 requires pension costs<br />

to be expensed in the period in<br />

which a «current obligation» arises.<br />

IPSAS also requires comprehensive<br />

disclosure of employee<br />

benefit plans in the notes. In these<br />

financial statements the employer<br />

savings and risk contributions paid<br />

to the FAOA employee benefit<br />

plans are expensed. The surplus<br />

or deficit that might arise from an<br />

actuarial valuation is not accounted<br />

for. The FAOA commissioned<br />

actuarial valuations as per<br />

31 December 2015 and 31 December<br />

<strong>2016</strong>. The net pension liability<br />

calculated by Aon Schweiz AG is<br />

not accounted for however, asforeseen<br />

in IPSAS 25, but rather<br />

disclosed as a contingent liability<br />

(see Note 22).<br />

These financial statements are entity<br />

financial statements for the financial<br />

year comprising calendar year <strong>2016</strong><br />

with a balance sheet date of 31 December<br />

<strong>2016</strong> (including comparatives).<br />

The reporting currency is Swiss<br />

francs (CHF).<br />

Unless otherwise stated, assets and<br />

liabilities are valued at historical or<br />

production cost, which is normally<br />

the nominal value. Expenses and<br />

revenues are booked in the period in<br />

which they occur.<br />

b. Cash at bank and in hand<br />

Cash at bank and in hand comprises<br />

petty cash, current accounts at<br />

financial institutions and an investment<br />

account at the Federal Finance<br />

Administration (FFA). Under Art. 36<br />

para. 1 AOA the FAOA is obliged to<br />

invest excess funds with the Federal<br />

Government.<br />

The amounts are stated at nominal<br />

value.<br />

c. Receivables relating to services<br />

Receivables are stated at nominal value<br />

after allowance for possible writedowns.<br />

d. Work-in-progress<br />

Work-in-progress relating to inspections<br />

is valued using the applicable<br />

daily rates per Art. 39 para. 2 AOO.<br />

e. Tangible fixed assets<br />

Tangible fixed assets are accounted<br />

for at cost less required write-downs.<br />

Depreciation is calculated on a linear<br />

basis over the expected useful life.<br />

Asset category<br />

Furniture and<br />

furnishings<br />

Office<br />

equipment,<br />

IT equipment<br />

(hardware)<br />

Fixtures and<br />

fittings<br />

Useful life<br />

(years)<br />

10<br />

3<br />

10<br />

The amounts stated in the financial<br />

statements are rounded to the nearest<br />

Swiss franc and can therefore include<br />

immaterial rounding differences.