semi-annual report 30 Sep 2008 - SEB Asset Management

semi-annual report 30 Sep 2008 - SEB Asset Management

semi-annual report 30 Sep 2008 - SEB Asset Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

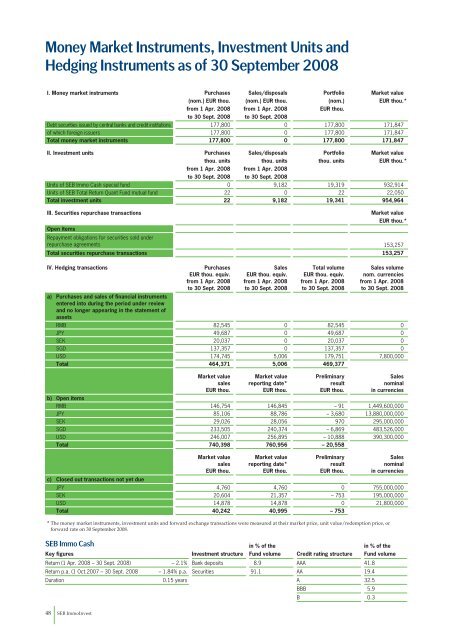

Money Market Instruments, Investment Units and<br />

Hedging Instruments as of <strong>30</strong> <strong>Sep</strong>tember <strong>2008</strong><br />

I. Money market instruments Purchases<br />

48 <strong>SEB</strong> ImmoInvest<br />

(nom.) EUR thou.<br />

from 1 Apr. <strong>2008</strong><br />

to <strong>30</strong> <strong>Sep</strong>t. <strong>2008</strong><br />

Sales/disposals<br />

(nom.) EUR thou.<br />

from 1 Apr. <strong>2008</strong><br />

to <strong>30</strong> <strong>Sep</strong>t. <strong>2008</strong><br />

Portfolio<br />

(nom.)<br />

EUR thou.<br />

Market value<br />

EUR thou. *<br />

Debt securities issued by central banks and credit institutions 177,800 0 177,800 171,847<br />

of which foreign issuers 177,800 0 177,800 171,847<br />

Total money market instruments 177,800 0 177,800 171,847<br />

II. Investment units Purchases<br />

thou. units<br />

from 1 Apr. <strong>2008</strong><br />

to <strong>30</strong> <strong>Sep</strong>t. <strong>2008</strong><br />

Sales/disposals<br />

thou. units<br />

from 1 Apr. <strong>2008</strong><br />

to <strong>30</strong> <strong>Sep</strong>t. <strong>2008</strong><br />

Portfolio<br />

thou. units<br />

Market value<br />

EUR thou. *<br />

Units of <strong>SEB</strong> Immo Cash special fund 0 9,182 19,319 932,914<br />

Units of <strong>SEB</strong> Total Return Quant Fund mutual fund 22 0 22 22,050<br />

Total investment units 22 9,182 19,341 954,964<br />

III. Securities repurchase transactions Market value<br />

Open items<br />

Repayment obligations for securities sold under<br />

repurchase agreements<br />

EUR thou. *<br />

153,257<br />

Total securities repurchase transactions 153,257<br />

IV. Hedging transactions Purchases<br />

EUR thou. equiv.<br />

from 1 Apr. <strong>2008</strong><br />

to <strong>30</strong> <strong>Sep</strong>t. <strong>2008</strong><br />

a)<br />

Purchases and sales of financial instruments<br />

entered into during the period under review<br />

and no longer appearing in the statement of<br />

assets<br />

Sales<br />

EUR thou. equiv.<br />

from 1 Apr. <strong>2008</strong><br />

to <strong>30</strong> <strong>Sep</strong>t. <strong>2008</strong><br />

Total volume<br />

EUR thou. equiv.<br />

from 1 Apr. <strong>2008</strong><br />

to <strong>30</strong> <strong>Sep</strong>t. <strong>2008</strong><br />

Sales volume<br />

nom. currencies<br />

from 1 Apr. <strong>2008</strong><br />

to <strong>30</strong> <strong>Sep</strong>t. <strong>2008</strong><br />

RMB 82,545 0 82,545 0<br />

JPY 49,687 0 49,687 0<br />

SEK 20,037 0 20,037 0<br />

SGD 137,357 0 137,357 0<br />

USD 174,745 5,006 179,751 7,800,000<br />

Total 464,371 5,006 469,377<br />

Market value<br />

sales<br />

EUR thou.<br />

Market value<br />

<strong>report</strong>ing date*<br />

EUR thou.<br />

Preliminary<br />

result<br />

EUR thou.<br />

Sales<br />

nominal<br />

in currencies<br />

b) Open items<br />

RMB 146,754 146,845 – 91 1,449,600,000<br />

JPY 85,106 88,786 – 3,680 13,880,000,000<br />

SEK 29,026 28,056 970 295,000,000<br />

SGD 233,505 240,374 – 6,869 483,526,000<br />

USD 246,007 256,895 – 10,888 390,<strong>30</strong>0,000<br />

Total 740,398 760,956 – 20,558<br />

c) Closed out transactions not yet due<br />

Market value<br />

sales<br />

EUR thou.<br />

Market value<br />

<strong>report</strong>ing date*<br />

EUR thou.<br />

Preliminary<br />

result<br />

EUR thou.<br />

Sales<br />

nominal<br />

in currencies<br />

JPY 4,760 4,760 0 755,000,000<br />

SEK 20,604 21,357 – 753 195,000,000<br />

USD 14,878 14,878 0 21,800,000<br />

Total 40,242 40,995 – 753<br />

* The money market instruments, investment units and forward exchange transactions were measured at their market price, unit value/redemption price, or<br />

forward rate on <strong>30</strong> <strong>Sep</strong>tember <strong>2008</strong>.<br />

<strong>SEB</strong> Immo Cash<br />

Key figures Investment structure<br />

in % of the<br />

Fund volume Credit rating structure<br />

Return (1 Apr. <strong>2008</strong> – <strong>30</strong> <strong>Sep</strong>t. <strong>2008</strong>) – 2.1% Bank deposits 8.9 AAA 41.8<br />

Return p.a. (1 Oct.2007 – <strong>30</strong> <strong>Sep</strong>t. <strong>2008</strong> – 1.84% p.a. Securities 91.1 AA 19.4<br />

Duration 0.15 years A 32.5<br />

BBB 5.9<br />

B 0.3<br />

in % of the<br />

Fund volume