semi-annual report 30 Sep 2008 - SEB Asset Management

semi-annual report 30 Sep 2008 - SEB Asset Management

semi-annual report 30 Sep 2008 - SEB Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

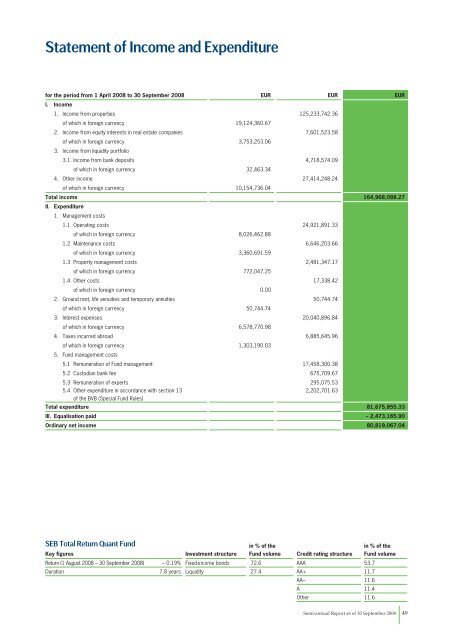

Statement of Income and Expenditure<br />

for the period from 1 April <strong>2008</strong> to <strong>30</strong> <strong>Sep</strong>tember <strong>2008</strong> EUR EUR EUR<br />

I. Income<br />

1. Income from properties 125,233,742.36<br />

of which in foreign currency 19,124,360.67<br />

2. Income from equity interests in real estate companies 7,601,523.58<br />

of which in foreign currency 3,753,253.06<br />

3. Income from liquidity portfolio<br />

3.1. Income from bank deposits 4,718,574.09<br />

of which in foreign currency 32,463.34<br />

4. Other income 27,414,248.24<br />

of which in foreign currency 10,154,736.04<br />

Total income 164,968,088.27<br />

II. Expenditure<br />

1. <strong>Management</strong> costs<br />

1.1 Operating costs 24,921,891.33<br />

of which in foreign currency 8,026,462.88<br />

1.2 Maintenance costs 6,646,203.66<br />

of which in foreign currency 3,360,691.59<br />

1.3 Property management costs 2,481,347.17<br />

of which in foreign currency 772,047.25<br />

1.4 Other costs 17,338.42<br />

of which in foreign currency 0.00<br />

2. Ground rent, life annuities and temporary annuities 50,744.74<br />

of which in foreign currency 50,744.74<br />

3. Interest expenses 20,040,896.84<br />

of which in foreign currency 6,578,770.98<br />

4. Taxes incurred abroad 6,885,645.96<br />

of which in foreign currency 1,<strong>30</strong>3,190.03<br />

5. Fund management costs<br />

5.1 Remuneration of Fund management 17,458,<strong>30</strong>0.38<br />

5.2 Custodian bank fee 675,709.67<br />

5.3 Remuneration of experts 295,075.53<br />

5.4 Other expenditure in accordance with section 13<br />

of the BVB (Special Fund Rules)<br />

2,202,701.63<br />

Total expenditure 81,675,855.33<br />

III. Equalisation paid – 2,473,165.90<br />

Ordinary net income 80,819,067.04<br />

<strong>SEB</strong> Total Return Quant Fund<br />

Key figures Investment structure<br />

in % of the<br />

Fund volume Credit rating structure<br />

Return (1 August <strong>2008</strong> – <strong>30</strong> <strong>Sep</strong>tember <strong>2008</strong>) – 0.19% Fixed-income bonds 72.6 AAA 53.7<br />

Duration 7.8 years Liquidity 27.4 AA+ 11.7<br />

AA– 11.6<br />

A 11.4<br />

Other 11.6<br />

in % of the<br />

Fund volume<br />

Semi-<strong>annual</strong> Report as of <strong>30</strong> <strong>Sep</strong>tember <strong>2008</strong> 49