FUND PROFILE grundbesitz global - RREEF Real Estate

FUND PROFILE grundbesitz global - RREEF Real Estate

FUND PROFILE grundbesitz global - RREEF Real Estate

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

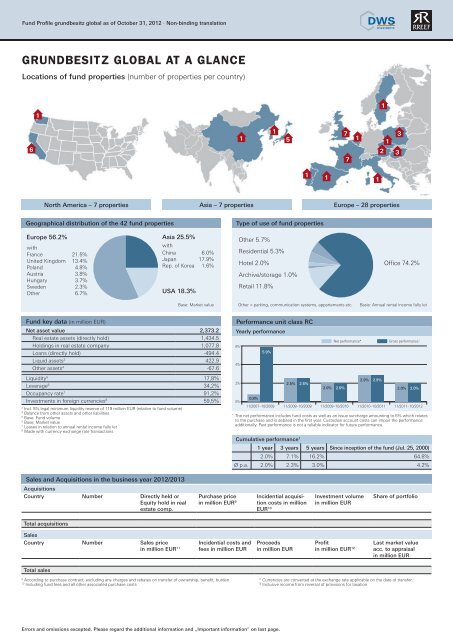

Fund Profi le <strong>grundbesitz</strong> <strong>global</strong> as of October 31, 2012 · Non-binding translation<br />

GRUNDBESITZ GLOBAL AT A GLANCE<br />

Locations of fund properties (number of properties per country)<br />

6<br />

1<br />

North America – 7 properties Asia – 7 properties Europe – 28 properties<br />

Geographical distribution of the 42 fund properties<br />

Europe 56.2%<br />

with<br />

France 21.5%<br />

United Kingdom 13.4%<br />

Poland 4.8%<br />

Austria 3.8%<br />

Hungary 3.7%<br />

Sweden 2.3%<br />

Other 6.7%<br />

Sales and Acquisitions in the business year 2012/2013<br />

Acquisitions<br />

Country Number Directly held or<br />

Equity hold in real<br />

estate comp.<br />

Total acquisitions<br />

Sales<br />

Country Number Sales price<br />

in million EUR 11<br />

Total sales<br />

Asia 25.5%<br />

with<br />

China 6.0%<br />

Japan 17.9%<br />

Rep. of Korea 1.6%<br />

USA 18.3%<br />

Base: Market value<br />

Net asset value 2,373.2<br />

<strong>Real</strong> estate assets (directly hold) 1,434.5<br />

Holdings in real estate company 1,077.8<br />

Loans (directly hold) -494.4<br />

Liquid assets3 422.9<br />

Other assets4 Fund key data (in million EUR)<br />

-67.6<br />

Liquidity5 17,8%<br />

Leverage6 34,2%<br />

Occupancy rate7 91,2%<br />

Investments in foreign currencies8 59,5%<br />

3 Incl. 5% legal minimum liquidity reserve of 119 million EUR (relative to fund volume)<br />

4 Balance from other assets and other liabilities<br />

5 Base: Fund volume<br />

6 Base: Market value<br />

7 Leases in relation to annual rental income fully let<br />

8 Made with currency exchange rate transactions<br />

Purchase price<br />

in million EUR 9<br />

1<br />

Incidential costs and<br />

fees in million EUR<br />

9 According to purchase contract, excluding any charges and rebates on transfer of ownership, benefi t, burden<br />

10 Including fund fees and all other associated purchase costs<br />

1<br />

Type of use of fund properties<br />

Residential 5.3%<br />

5<br />

Archive/storage 1.0%<br />

Retail 11.8%<br />

1<br />

Incidential acquisition<br />

costs in million<br />

EUR 10<br />

Proceeds<br />

in million EUR<br />

Errors and omissions excepted. Please regard the additional information and „Important information“ on last page.<br />

1<br />

Other = parking, communication systems, appartements etc. Basis: Annual rental income fully let<br />

Performance unit class RC<br />

Yearly performance<br />

6%<br />

4%<br />

2%<br />

0%<br />

Other 5.7%<br />

Hotel 2.0%<br />

0.8%<br />

5.9%<br />

2.5%<br />

Cumulative performance 1<br />

2.5%<br />

2.0%<br />

1 year 3 years 5 years Since inception of the fund (Jul. 25, 2000)<br />

7<br />

2.0% 7.1% 16.2% 64.8%<br />

Ø p.a. 2.0% 2.3% 3.0% 4.2%<br />

7<br />

1<br />

Investment volume<br />

in million EUR<br />

Profi t<br />

in million EUR 12<br />

1<br />

Net performance* Gross performance 1<br />

* The net performance includes fund costs as well as an issue surcharge amounting to 5% which relates<br />

to the purchase and is debited in the fi rst year. Custodian account costs can impair the performance<br />

additionally. Past performance is not a reliable indicator for future performance.<br />

1<br />

2<br />

1<br />

3<br />

3<br />

Offi ce 74.2%<br />

11/2007–10/2008 11/2008–10/2009 11/2009–10/2010 11/2010–10/2011 11/2011–10/2012<br />

2.0%<br />

2.9%<br />

2.9%<br />

2.0%<br />

Share of portfolio<br />

Last market value<br />

acc. to appraisal<br />

in million EUR<br />

11 Currencies are converted at the exchange rate applicable on the date of transfer.<br />

12 Inclusive income from reversal of provisions for taxation<br />

2.0%