J Magazine Fall 2017

The magazine of the rebirth of Jacksonville's downtown

The magazine of the rebirth of Jacksonville's downtown

- TAGS

- jacksonville

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

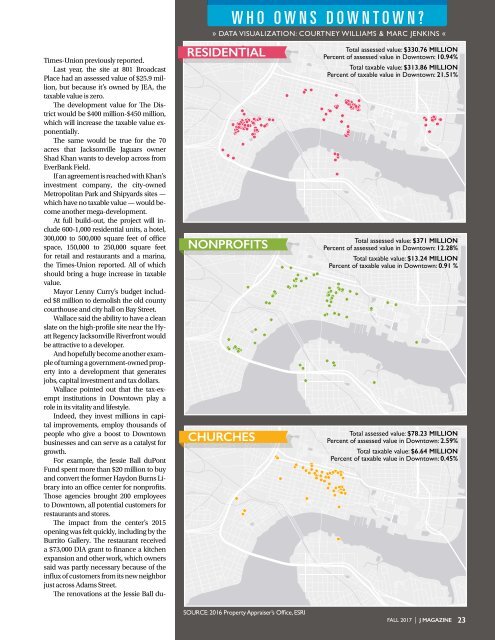

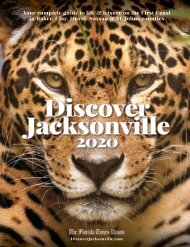

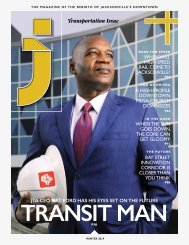

WHO OWNS DOWNTOWN?<br />

» DATA VISUALIZATION: Courtney Williams & MARC JENKINS «<br />

Times-Union previously reported.<br />

Last year, the site at 801 Broadcast<br />

Place had an assessed value of $25.9 million,<br />

but because it’s owned by JEA, the<br />

taxable value is zero.<br />

The development value for The District<br />

would be $400 million-$450 million,<br />

which will increase the taxable value exponentially.<br />

The same would be true for the 70<br />

acres that Jacksonville Jaguars owner<br />

Shad Khan wants to develop across from<br />

EverBank Field.<br />

If an agreement is reached with Khan’s<br />

investment company, the city-owned<br />

Metropolitan Park and Shipyards sites —<br />

which have no taxable value — would become<br />

another mega-development.<br />

At full build-out, the project will include<br />

600-1,000 residential units, a hotel,<br />

300,000 to 500,000 square feet of office<br />

space, 150,000 to 250,000 square feet<br />

for retail and restaurants and a marina,<br />

the Times-Union reported. All of which<br />

should bring a huge increase in taxable<br />

value.<br />

Mayor Lenny Curry’s budget included<br />

$8 million to demolish the old county<br />

courthouse and city hall on Bay Street.<br />

Wallace said the ability to have a clean<br />

slate on the high-profile site near the Hyatt<br />

Regency Jacksonville Riverfront would<br />

be attractive to a developer.<br />

And hopefully become another example<br />

of turning a government-owned property<br />

into a development that generates<br />

jobs, capital investment and tax dollars.<br />

Wallace pointed out that the tax-exempt<br />

institutions in Downtown play a<br />

role in its vitality and lifestyle.<br />

Indeed, they invest millions in capital<br />

improvements, employ thousands of<br />

people who give a boost to Downtown<br />

businesses and can serve as a catalyst for<br />

growth.<br />

For example, the Jessie Ball duPont<br />

Fund spent more than $20 million to buy<br />

and convert the former Haydon Burns Library<br />

into an office center for nonprofits.<br />

Those agencies brought 200 employees<br />

to Downtown, all potential customers for<br />

restaurants and stores.<br />

The impact from the center’s 2015<br />

opening was felt quickly, including by the<br />

Burrito Gallery. The restaurant received<br />

a $73,000 DIA grant to finance a kitchen<br />

expansion and other work, which owners<br />

said was partly necessary because of the<br />

influx of customers from its new neighbor<br />

just across Adams Street.<br />

The renovations at the Jessie Ball du-<br />

RESIDENTIAL<br />

NONPROFITS<br />

CHURCHES<br />

Total assessed value: $330.76 million<br />

Percent of assessed value in Downtown: 10.94%<br />

Total taxable value: $313.86 million<br />

Percent of taxable value in Downtown: 21.51%<br />

Total assessed value: $371 million<br />

Percent of assessed value in Downtown: 12.28%<br />

Total taxable value: $13.24 million<br />

Percent of taxable value in Downtown: 0.91 %<br />

Total assessed value: $78.23 million<br />

Percent of assessed value in Downtown: 2.59%<br />

Total taxable value: $6.64 million<br />

Percent of taxable value in Downtown: 0.45%<br />

SOURCE: 2016 Property Appraiser’s Office, ESRI<br />

FALL <strong>2017</strong> | J MAGAZINE 23