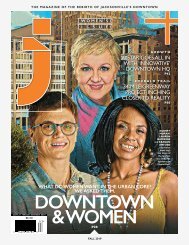

J Magazine Fall 2017

The magazine of the rebirth of Jacksonville's downtown

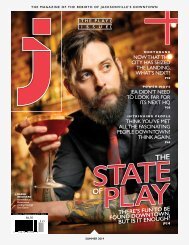

The magazine of the rebirth of Jacksonville's downtown

- TAGS

- jacksonville

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

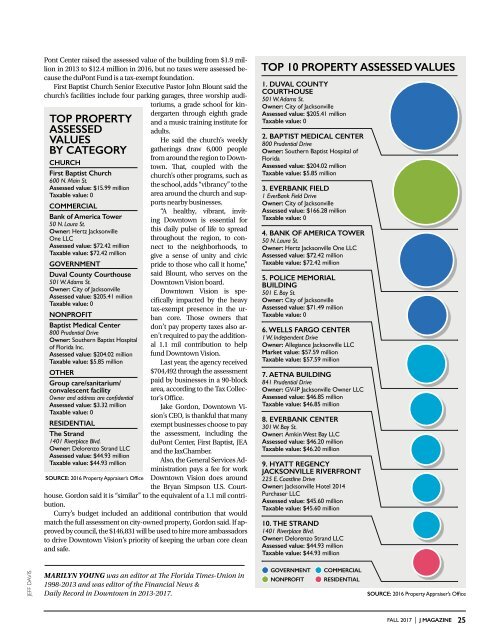

TOP PROPERTY<br />

ASSESSED<br />

VALUES<br />

BY CATEGORY<br />

Church<br />

First Baptist Church<br />

600 N. Main St.<br />

Assessed value: $15.99 million<br />

Taxable value: 0<br />

Commercial<br />

Bank of America Tower<br />

50 N. Laura St.<br />

Owner: Hertz Jacksonville<br />

One LLC<br />

Assessed value: $72.42 million<br />

Taxable value: $72.42 million<br />

Government<br />

Duval County Courthouse<br />

501 W. Adams St.<br />

Owner: City of Jacksonville<br />

Assessed value: $205.41 million<br />

Taxable value: 0<br />

Nonprofit<br />

Baptist Medical Center<br />

800 Prudential Drive<br />

Owner: Southern Baptist Hospital<br />

of Florida Inc.<br />

Assessed value: $204.02 million<br />

Taxable value: $5.85 million<br />

Other<br />

Group care/sanitarium/<br />

convalescent facility<br />

Owner and address are confidential<br />

Assessed value: $3.32 million<br />

Taxable value: 0<br />

Residential<br />

The Strand<br />

1401 Riverplace Blvd.<br />

Owner: Delorenzo Strand LLC<br />

Assessed value: $44.93 million<br />

Taxable value: $44.93 million<br />

SOURCE: 2016 Property Appraiser’s Office<br />

Pont Center raised the assessed value of the building from $1.9 million<br />

in 2013 to $12.4 million in 2016, but no taxes were assessed because<br />

the duPont Fund is a tax-exempt foundation.<br />

First Baptist Church Senior Executive Pastor John Blount said the<br />

church’s facilities include four parking garages, three worship auditoriums,<br />

a grade school for kindergarten<br />

through eighth grade<br />

and a music training institute for<br />

adults.<br />

He said the church’s weekly<br />

gatherings draw 6,000 people<br />

from around the region to Downtown.<br />

That, coupled with the<br />

church’s other programs, such as<br />

the school, adds “vibrancy” to the<br />

area around the church and supports<br />

nearby businesses.<br />

“A healthy, vibrant, inviting<br />

Downtown is essential for<br />

this daily pulse of life to spread<br />

throughout the region, to connect<br />

to the neighborhoods, to<br />

give a sense of unity and civic<br />

pride to those who call it home,”<br />

said Blount, who serves on the<br />

Downtown Vision board.<br />

Downtown Vision is specifically<br />

impacted by the heavy<br />

tax-exempt presence in the urban<br />

core. Those owners that<br />

don’t pay property taxes also aren’t<br />

required to pay the additional<br />

1.1 mil contribution to help<br />

fund Downtown Vision.<br />

Last year, the agency received<br />

$704,492 through the assessment<br />

paid by businesses in a 90-block<br />

area, according to the Tax Collector’s<br />

Office.<br />

Jake Gordon, Downtown Vision’s<br />

CEO, is thankful that many<br />

exempt businesses choose to pay<br />

the assessment, including the<br />

duPont Center, First Baptist, JEA<br />

and the JaxChamber.<br />

Also, the General Services Administration<br />

pays a fee for work<br />

Downtown Vision does around<br />

the Bryan Simpson U.S. Courthouse.<br />

Gordon said it is “similar” to the equivalent of a 1.1 mil contribution.<br />

Curry’s budget included an additional contribution that would<br />

match the full assessment on city-owned property, Gordon said. If approved<br />

by council, the $146,831 will be used to hire more ambassadors<br />

to drive Downtown Vision’s priority of keeping the urban core clean<br />

and safe.<br />

TOP 10 PROPERTY ASSESSED VALUES<br />

1. Duval County<br />

Courthouse<br />

501 W. Adams St.<br />

Owner: City of Jacksonville<br />

Assessed value: $205.41 million<br />

Taxable value: 0<br />

2. Baptist Medical Center<br />

800 Prudential Drive<br />

Owner: Southern Baptist Hospital of<br />

Florida<br />

Assessed value: $204.02 million<br />

Taxable value: $5.85 million<br />

3. EverBank Field<br />

1 EverBank Field Drive<br />

Owner: City of Jacksonville<br />

Assessed value: $166.28 million<br />

Taxable value: 0<br />

4. Bank of America Tower<br />

50 N. Laura St.<br />

Owner: Hertz Jacksonville One LLC<br />

Assessed value: $72.42 million<br />

Taxable value: $72.42 million<br />

5. Police Memorial<br />

Building<br />

501 E. Bay St.<br />

Owner: City of Jacksonville<br />

Assessed value: $71.49 million<br />

Taxable value: 0<br />

6. Wells Fargo Center<br />

1 W. Independent Drive<br />

Owner: Allegiance Jacksonville LLC<br />

Market value: $57.59 million<br />

Taxable value: $57.59 million<br />

7. Aetna Building<br />

841 Prudential Drive<br />

Owner: GV-IP Jacksonville Owner LLC<br />

Assessed value: $46.85 million<br />

Taxable value: $46.85 million<br />

8. EverBank Center<br />

301 W. Bay St.<br />

Owner: Amkin West Bay LLC<br />

Assessed value: $46.20 million<br />

Taxable value: $46.20 million<br />

9. Hyatt Regency<br />

Jacksonville Riverfront<br />

225 E. Coastline Drive<br />

Owner: Jacksonville Hotel 2014<br />

Purchaser LLC<br />

Assessed value: $45.60 million<br />

Taxable value: $45.60 million<br />

10. The Strand<br />

1401 Riverplace Blvd.<br />

Owner: Delorenzo Strand LLC<br />

Assessed value: $44.93 million<br />

Taxable value: $44.93 million<br />

JEFF DAVIS<br />

Marilyn Young was an editor at The Florida Times-Union in<br />

1998-2013 and was editor of the Financial News &<br />

Daily Record in Downtown in 2013-<strong>2017</strong>.<br />

GOVERNMENT<br />

NONPROFIT<br />

COMMERCIAL<br />

RESIDENTIAL<br />

SOURCE: 2016 Property Appraiser’s Office<br />

FALL <strong>2017</strong> | J MAGAZINE 25