Debtfree Magazine Sept 2017

SA's Free Debt Counselling and Debt Review industry magazine- The September 2017 issue. We discuss the new possible fees for debt review as suggested by the NCR. We also look at recent industry events, consumer tips and advice for those under debt review.

SA's Free Debt Counselling and Debt Review industry magazine- The September 2017 issue. We discuss the new possible fees for debt review as suggested by the NCR. We also look at recent industry events, consumer tips and advice for those under debt review.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

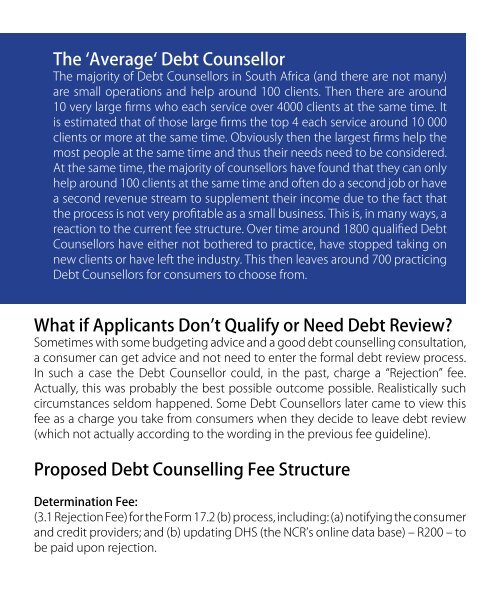

The ‘Average‘ Debt Counsellor<br />

The majority of Debt Counsellors in South Africa (and there are not many)<br />

are small operations and help around 100 clients. Then there are around<br />

10 very large firms who each service over 4000 clients at the same time. It<br />

is estimated that of those large firms the top 4 each service around 10 000<br />

clients or more at the same time. Obviously then the largest firms help the<br />

most people at the same time and thus their needs need to be considered.<br />

At the same time, the majority of counsellors have found that they can only<br />

help around 100 clients at the same time and often do a second job or have<br />

a second revenue stream to supplement their income due to the fact that<br />

the process is not very profitable as a small business. This is, in many ways, a<br />

reaction to the current fee structure. Over time around 1800 qualified Debt<br />

Counsellors have either not bothered to practice, have stopped taking on<br />

new clients or have left the industry. This then leaves around 700 practicing<br />

Debt Counsellors for consumers to choose from.<br />

What if Applicants Don’t Qualify or Need Debt Review?<br />

Sometimes with some budgeting advice and a good debt counselling consultation,<br />

a consumer can get advice and not need to enter the formal debt review process.<br />

In such a case the Debt Counsellor could, in the past, charge a “Rejection” fee.<br />

Actually, this was probably the best possible outcome possible. Realistically such<br />

circumstances seldom happened. Some Debt Counsellors later came to view this<br />

fee as a charge you take from consumers when they decide to leave debt review<br />

(which not actually according to the wording in the previous fee guideline).<br />

Proposed Debt Counselling Fee Structure<br />

Determination Fee:<br />

(3.1 Rejection Fee) for the Form 17.2 (b) process, including: (a) notifying the consumer<br />

and credit providers; and (b) updating DHS (the NCR’s online data base) – R200 – to<br />

be paid upon rejection.