Market Report 2011 GerMany - Europe Real Estate

Market Report 2011 GerMany - Europe Real Estate

Market Report 2011 GerMany - Europe Real Estate

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

22<br />

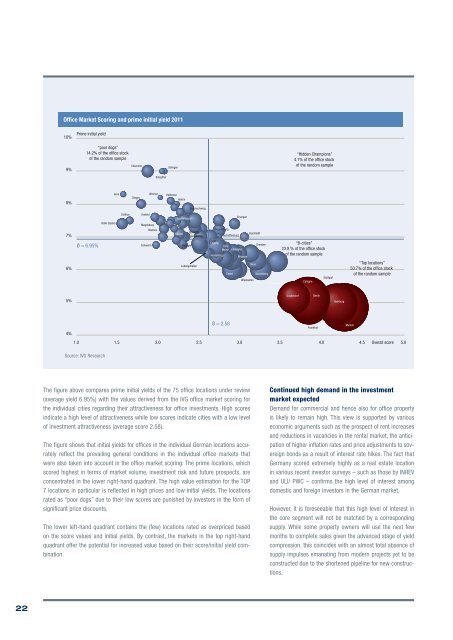

Office <strong>Market</strong> Scoring and prime initial yield <strong>2011</strong><br />

10%<br />

9%<br />

8%<br />

7%<br />

6%<br />

5%<br />

4%<br />

Prime initial yield<br />

“poor dogs”<br />

14.2% of the office stock<br />

of the random sample<br />

Ø = 6.95%<br />

Halle (Saale)<br />

Chemnitz<br />

Salzgitter<br />

The figure above compares prime initial yields of the 75 office locations under review<br />

(average yield 6.95%) with the values derived from the IVG office market scoring for<br />

the individual cities regarding their attractiveness for office investments. High scores<br />

indicate a high level of attractiveness while low scores indicate cities with a low level<br />

of investment attractiveness (average score 2.58).<br />

The figure shows that initial yields for offices in the individual German locations accurately<br />

reflect the prevailing general conditions in the individual office markets that<br />

were also taken into account in the office market scoring: The prime locations, which<br />

scored highest in terms of market volume, investment risk and future prospects, are<br />

concentrated in the lower right-hand quadrant. The high value estimation for the TOP<br />

7 locations in particular is reflected in high prices and low initial yields. The locations<br />

rated as “poor dogs” due to their low scores are punished by investors in the form of<br />

significant price discounts.<br />

The lower left-hand quadrant contains the (few) locations rated as overpriced based<br />

on the score values and initial yields. By contrast, the markets in the top right-hand<br />

quadrant offer the potential for increased value based on their score/initial yield combination.<br />

Solingen<br />

Gera Weimar Heilbronn<br />

Siegen<br />

Hamm<br />

Cottbus<br />

Krefeld<br />

Magdeburg<br />

Schwerin<br />

Rostock<br />

Ludwigshafen<br />

Ø = 2.58<br />

“Hidden Champions”<br />

4.1% of the office stock<br />

of the random sample<br />

“B-cities”<br />

23.8 % of the office stock<br />

of the random sample<br />

1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 Overall score 5.0<br />

Source: IVG Research<br />

Saarbrücken<br />

Kassel<br />

Ratingen<br />

Braunschweig<br />

Bielefeld<br />

Constance<br />

Leipzig<br />

Regensburg<br />

Heidelberg<br />

Aschaffenburg<br />

Ulm<br />

Mainz<br />

Essen<br />

Karlsruhe<br />

Erlangen<br />

Münster<br />

Wiesbaden<br />

Ingolstadt<br />

Bonn<br />

Dresden<br />

Nuremberg<br />

H annover<br />

Dusseldorf<br />

Cologne<br />

Berlin<br />

Frankfurt<br />

Stuttgart<br />

Hamburg<br />

“Top locations”<br />

50.7% of the office stock<br />

of the random sample<br />

Munich<br />

Continued high demand in the investment<br />

market expected<br />

Demand for commercial and hence also for office property<br />

is likely to remain high. This view is supported by various<br />

economic arguments such as the prospect of rent increases<br />

and reductions in vacancies in the rental market, the anticipation<br />

of higher inflation rates and price adjustments to sovereign<br />

bonds as a result of interest rate hikes. The fact that<br />

Germany scored extremely highly as a real estate location<br />

in various recent investor surveys – such as those by INREV<br />

and ULI/ PWC – confirms the high level of interest among<br />

domestic and foreign investors in the German market.<br />

However, it is foreseeable that this high level of interest in<br />

the core segment will not be matched by a corresponding<br />

supply. While some property owners will use the next few<br />

months to complete sales given the advanced stage of yield<br />

compression, this coincides with an almost total absence of<br />

supply impulses emanating from modern projects yet to be<br />

constructed due to the shortened pipeline for new constructions.