Market Report 2011 GerMany - Europe Real Estate

Market Report 2011 GerMany - Europe Real Estate

Market Report 2011 GerMany - Europe Real Estate

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4<br />

Implications of IVG Research for the investment strategy<br />

Leased core properties in the seven major markets: New investments constitute<br />

a bet that rents will rise as yield compression in this segment is already largely<br />

complete. For this reason, an exit strategy is worth mentioning.<br />

Leased modern properties in attractive secondary locations in the major markets:<br />

An interesting investment because entry prices are still relatively low and<br />

because this area offers prospects for value appreciation through yield compression<br />

and rent growth. Hold or invest!<br />

Leased core properties in the regional centres: An attractive investment due<br />

to relatively high initial yields and possible appreciation in value through yield<br />

compression and rental growth. Small markets offer opportunities as well as<br />

risks. Hold or invest!<br />

Speculative new building projects in the seven major markets: An attractive<br />

option but not without risks. Properties will be completed in 2013/2014, when<br />

the rental market is likely to have reached its peak – or have just entered<br />

another downturn. Restrictive financing continues to pose an obstacle to investment.<br />

Speculative new builds in regional centres: Attractiveness and risk depend on<br />

the respective market size. Assuming corresponding demand for space in the<br />

relevant location, pre-letting should be possible.<br />

Older and vacant properties in attractive locations: Value-add strategy in the<br />

form of modernisation (if economically feasible) and new lettings will benefit<br />

from the shortage in modern properties. Strategy can profit in the short term<br />

from attractive entry prices.<br />

Average number of vacant properties in poor locations: There is an on-going risk<br />

of incurring losses due to the extremely high probability of structural vacancy in<br />

this case. Properties are likely to be disposable only at a discount despite the<br />

market recovery.<br />

Properties in an over-rent situation: Interesting, as the over-rent is likely to<br />

reduce over the next two years during the expected market recovery.<br />

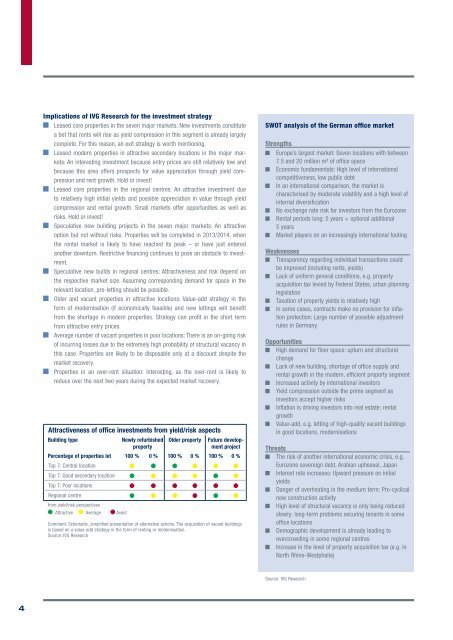

Attractiveness of office investments from yield/risk aspects<br />

Building type Newly refurbished<br />

property<br />

Older property Future development<br />

project<br />

Percentage of properties let 100 % 0 % 100 % 0 % 100 % 0 %<br />

Top 7: Central location<br />

Top 7: Good secondary location<br />

Top 7: Poor locations<br />

Regional centre<br />

from yield/risk perspectives<br />

Attractive Average Avoid<br />

Comment: Schematic, simplified presentation of alternative actions. The acquisition of vacant buildings<br />

is based on a value-add strategy in the form of renting or modernisation.<br />

Source: IVG Research<br />

SWOT analysis of the German office market<br />

Strengths<br />

<strong>Europe</strong>’s largest market: Seven locations with between<br />

7.5 and 20 million m² of office space<br />

Economic fundamentals: High level of international<br />

competitiveness, low public debt<br />

In an international comparison, the market is<br />

characterised by moderate volatility and a high level of<br />

internal diversification<br />

No exchange rate risk for investors from the Eurozone<br />

Rental periods long: 5 years + optional additional<br />

5 years<br />

<strong>Market</strong> players on an increasingly international footing<br />

Weaknesses<br />

Transparency regarding individual transactions could<br />

be improved (including rents, yields)<br />

Lack of uniform general conditions, e.g. property<br />

acquisition tax levied by Federal States, urban planning<br />

legislation<br />

Taxation of property yields is relatively high<br />

In some cases, contracts make no provision for inflation<br />

protection: Large number of possible adjustment<br />

rules in Germany<br />

Opportunities<br />

High demand for floor space: upturn and structural<br />

change<br />

Lack of new building, shortage of office supply and<br />

rental growth in the modern, efficient property segment<br />

Increased activity by international investors<br />

Yield compression outside the prime segment as<br />

investors accept higher risks<br />

Inflation is driving investors into real estate; rental<br />

growth<br />

Value-add, e.g. letting of high-quality vacant buildings<br />

in good locations, modernisations<br />

Threats<br />

The risk of another international economic crisis, e.g.<br />

Eurozone sovereign debt, Arabian upheaval, Japan<br />

Interest rate increases: Upward pressure on initial<br />

yields<br />

Danger of overheating in the medium term: Pro-cyclical<br />

new construction activity<br />

High level of structural vacancy is only being reduced<br />

slowly; long-term problems securing tenants in some<br />

office locations<br />

Demographic development is already leading to<br />

overcrowding in some regional centres<br />

Increase in the level of property acquisition tax (e.g. in<br />

North Rhine-Westphalia)<br />

Source: IVG Research