Market Report 2011 GerMany - Europe Real Estate

Market Report 2011 GerMany - Europe Real Estate

Market Report 2011 GerMany - Europe Real Estate

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Broad market recovery: secondary locations, centres and value-add<br />

In addition, the core segment offers new investors only limited potential to increase<br />

value through yield compression. Most market forecasts – including those of IVG –<br />

point to limited reductions in initial yields of prime office buildings in top locations<br />

during the current year, particularly given that interest rates on sovereign bonds (the<br />

opportunity costs of real estate investment) and financing costs are likely to increase<br />

over the coming months as a consequence of the economic recovery and higher<br />

expected inflation.<br />

Therefore, the willingness of investors to invest in office properties in secondary locations<br />

of the major markets as well as in the regional office centres will in all likelihood<br />

increase during the current year. As a result, yields in secondary locations and regional<br />

centres are also likely to shift in the short term, not least because the difference in<br />

yields compared to prime properties has increased significantly over the past year.<br />

However, investment demand will continue to focus on high-quality, modern properties<br />

because the rental market for properties of average quality in many locations<br />

is facing into a prolonged period of high structural vacancy.<br />

Some investors may seek opportunities to a greater extent in the value-add area: Given<br />

that the decline in new construction activity is leading to a shortage of efficient and<br />

high-quality available office stock and assuming the economic recovery continues,<br />

investments in modern well-situated properties with vacancy problems and in properties<br />

with refurbishment potential offer the prospect of exceptionally high increases<br />

in value.<br />

Aside from the limited supply of core objects, real estate financing continues to restrict<br />

a continued market recovery: In the light of new regulations under Basel III regarding<br />

equity requirements for banks, new lending business in the real estate sector remains<br />

limited. Any further relaxation of credit financing for real estate in the form of higher<br />

lending quotas or lower credit margins is therefore unlikely.<br />

By way of conclusion, it is important to note that recovery in the investment market<br />

will continue during the current year. A significant increase in the transaction volume<br />

above the €20 billion mark will be curtailed by the shortage of fully leased prime<br />

properties and the moderate willingness to lend on the part of the banks. The German<br />

investment market in <strong>2011</strong> will also be dominated by German and foreign investors<br />

supported by equity. Assuming that the economic upturn in Germany continues, they<br />

will to some extent be willing to accept higher risks again – either by expanding their<br />

geographical investment spectrum to include secondary locations and regional locations<br />

with moderate vacancy risks or by investing in the value-add segment.<br />

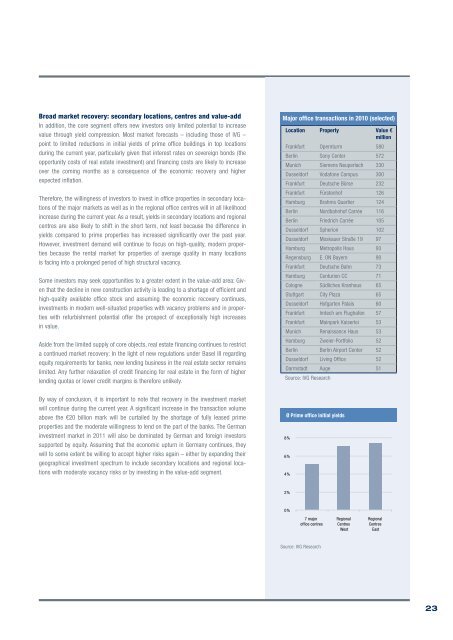

Major office transactions in 2010 (selected)<br />

Location Property Value €<br />

million<br />

Frankfurt Opernturm 580<br />

Berlin Sony Center 572<br />

Munich Siemens Neuperlach 330<br />

Dusseldorf Vodafone Campus 300<br />

Frankfurt Deutsche Börse 232<br />

Frankfurt Fürstenhof 126<br />

Hamburg Brahms Quartier 124<br />

Berlin Nordbahnhof Carrée 116<br />

Berlin Friedrich Carrée 105<br />

Dusseldorf Spherion 102<br />

Dusseldorf Moskauer Straße 19 97<br />

Hamburg Metropolis Haus 93<br />

Regensburg E. ON Bayern 90<br />

Frankfurt Deutsche Bahn 73<br />

Hamburg Centurion CC 71<br />

Cologne Südliches Kranhaus 65<br />

Stuttgart City Plaza 65<br />

Dusseldorf Hofgarten Palais 60<br />

Frankfurt Imtech am Flughafen 57<br />

Frankfurt Mainpark Kaiserlei 53<br />

Munich Renaissance Haus 53<br />

Hamburg Zweier-Portfolio 52<br />

Berlin Berlin Airport Center 52<br />

Dusseldorf Living Office 52<br />

Darmstadt Auge 51<br />

Source: IVG Research<br />

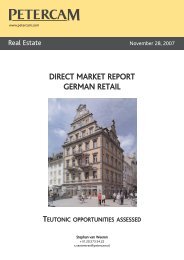

Ø Prime office initial yields<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

7 major<br />

office centres<br />

Source: IVG Research<br />

Regional<br />

Centres<br />

West<br />

Regional<br />

Centres<br />

East<br />

23