Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

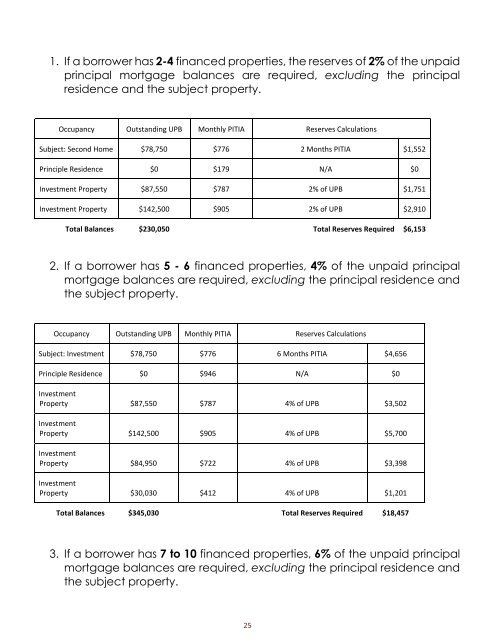

1. If a borrower has 2-4 financed properties, the reserves of 2% of the unpaid<br />

principal mortgage balances are required, excluding the principal<br />

residence and the subject property.<br />

Occupancy Outstanding UPB Monthly PITIA Reserves Calculations<br />

Subject: Second Home $78,750 $776 2 Months PITIA $1,552<br />

Principle Residence $0 $179 N/A $0<br />

Investment Property $87,550 $787 2% of UPB $1,751<br />

Investment Property $142,500 $905 2% of UPB $2,910<br />

Total Balances $230,050 Total Reserves Required $6,153<br />

2. If a borrower has 5 - 6 financed properties, 4% of the unpaid principal<br />

mortgage balances are required, excluding the principal residence and<br />

the subject property.<br />

Occupancy Outstanding UPB Monthly PITIA Reserves Calculations<br />

Subject: Investment $78,750 $776 6 Months PITIA $4,656<br />

Principle Residence $0 $946 N/A $0<br />

Investment<br />

Property $87,550 $787 4% of UPB $3,502<br />

Investment<br />

Property $142,500 $905 4% of UPB $5,700<br />

Investment<br />

Property $84,950 $722 4% of UPB $3,398<br />

Investment<br />

Property $30,030 $412 4% of UPB $1,201<br />

Total Balances $345,030 Total Reserves Required $18,457<br />

3. If a borrower has 7 to 10 financed properties, 6% of the unpaid principal<br />

mortgage balances are required, excluding the principal residence and<br />

the subject property.<br />

25