Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

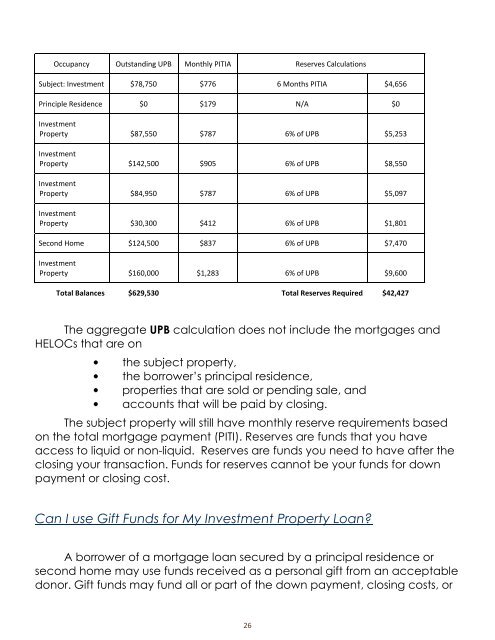

Occupancy Outstanding UPB Monthly PITIA Reserves Calculations<br />

Subject: Investment $78,750 $776 6 Months PITIA $4,656<br />

Principle Residence $0 $179 N/A $0<br />

Investment<br />

Property $87,550 $787 6% of UPB $5,253<br />

Investment<br />

Property $142,500 $905 6% of UPB $8,550<br />

Investment<br />

Property $84,950 $787 6% of UPB $5,097<br />

Investment<br />

Property $30,300 $412 6% of UPB $1,801<br />

Second Home $124,500 $837 6% of UPB $7,470<br />

Investment<br />

Property $160,000 $1,283 6% of UPB $9,600<br />

Total Balances $629,530 Total Reserves Required $42,427<br />

The aggregate UPB calculation does not include the mortgages and<br />

HELOCs that are on<br />

• the subject property,<br />

• the borrower’s principal residence,<br />

• properties that are sold or pending sale, and<br />

• accounts that will be paid <strong>by</strong> closing.<br />

The subject property will still have monthly reserve requirements based<br />

on the total mortgage payment (PITI). Reserves are funds that you have<br />

access to liquid or non-liquid. Reserves are funds you need to have after the<br />

closing your transaction. Funds for reserves cannot be your funds for down<br />

payment or closing cost.<br />

Can I use Gift Funds for My Investment Property <strong>Loan</strong>?<br />

A borrower of a mortgage loan secured <strong>by</strong> a principal residence or<br />

second home may use funds received as a personal gift from an acceptable<br />

donor. Gift funds may fund all or part of the down payment, closing costs, or<br />

26