Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

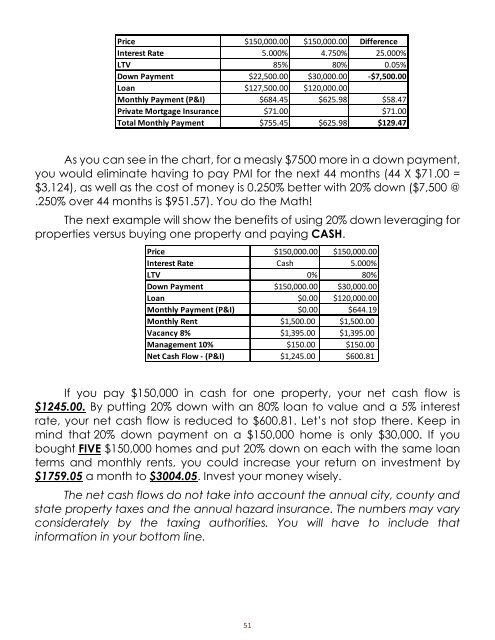

Price $150,000.00 $150,000.00 Difference<br />

Interest Rate 5.000% 4.750% 25.000%<br />

LTV 85% 80% 0.05%<br />

Down Payment $22,500.00 $30,000.00 -$7,500.00<br />

<strong>Loan</strong> $127,500.00 $120,000.00<br />

Monthly Payment (P&I) $684.45 $625.98 $58.47<br />

Private Mortgage Insurance $71.00 $71.00<br />

Total Monthly Payment $755.45 $625.98 $129.47<br />

As you can see in the chart, for a measly $7500 more in a down payment,<br />

you would eliminate having to pay PMI for the next 44 months (44 X $71.00 =<br />

$3,124), as well as the cost of money is 0.250% better with 20% down ($7,500 @<br />

.250% over 44 months is $951.57). You do the Math!<br />

The next example will show the benefits of using 20% down leveraging for<br />

properties versus buying one property and paying CASH.<br />

Price $150,000.00 $150,000.00<br />

Interest Rate Cash 5.000%<br />

LTV 0% 80%<br />

Down Payment $150,000.00 $30,000.00<br />

<strong>Loan</strong> $0.00 $120,000.00<br />

Monthly Payment (P&I) $0.00 $644.19<br />

Monthly Rent $1,500.00 $1,500.00<br />

Vacancy 8% $1,395.00 $1,395.00<br />

Management 10% $150.00 $150.00<br />

Net Cash Flow - (P&I) $1,245.00 $600.81<br />

If you pay $150,000 in cash for one property, your net cash flow is<br />

$1245.00. By putting 20% down with an 80% loan to value and a 5% interest<br />

rate, your net cash flow is reduced to $600.81. Let’s not stop there. Keep in<br />

mind that 20% down payment on a $150,000 home is only $30,000. If you<br />

bought FIVE $150,000 homes and put 20% down on each with the same loan<br />

terms and monthly rents, you could increase your return on investment <strong>by</strong><br />

$1759.05 a month to $3004.05. Invest your money wisely.<br />

The net cash flows do not take into account the annual city, county and<br />

state property taxes and the annual hazard insurance. The numbers may vary<br />

considerately <strong>by</strong> the taxing authorities. You will have to include that<br />

information in your bottom line.<br />

51