ETX-10829_Etex-AR2017_WEB_2018_DEF2 (2)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<br />

Key figures<br />

<strong>Etex</strong> Annual Report 2017<br />

<br />

Key figures<br />

Key figures<br />

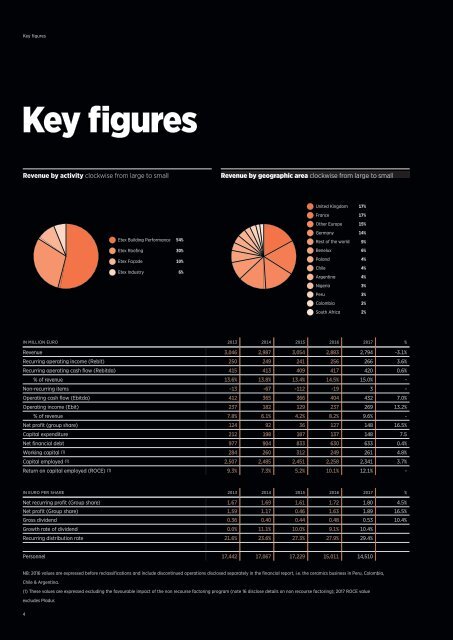

Revenue by activity clockwise from large to small<br />

Revenue by geographic area clockwise from large to small<br />

Revenue in billion euro 2.794<br />

Recurring operating cash flow in million euro 420<br />

United Kingdom 17%<br />

France<br />

Other Europe<br />

Germany<br />

17%<br />

15%<br />

14%<br />

2013<br />

2014<br />

3.046<br />

2.987<br />

<strong>Etex</strong> Building Performance 54%<br />

Rest of the world 9%<br />

2015<br />

3.054<br />

<strong>Etex</strong> Roofing<br />

30%<br />

Benelux 6%<br />

2016<br />

2.883<br />

<strong>Etex</strong> Façade<br />

10%<br />

Poland 4%<br />

<strong>Etex</strong> Industry 6%<br />

Chile 4%<br />

2017<br />

2.794<br />

Argentina 4%<br />

Nigeria 3%<br />

Peru 3%<br />

Colombia 2%<br />

South Africa 2%<br />

2013 415<br />

2014<br />

413<br />

2015<br />

409<br />

2016<br />

417<br />

2017<br />

420<br />

Personnel evolution 14,510<br />

Recurring operating income in million euro 266<br />

IN MILLION EURO 2013 2014 2015 2016 2017 %<br />

Revenue 3,046 2,987 3,054 2,883 2,794 -3.1%<br />

Recurring operating income (Rebit) 250 249 241 256 266 3.6%<br />

Recurring operating cash flow (Rebitda) 415 413 409 417 420 0.6%<br />

2013<br />

17,442<br />

2013<br />

250<br />

% of revenue 13.6% 13.8% 13.4% 14.5% 15.0% -<br />

Non-recurring items -13 -67 -112 -19 3 -<br />

Operating cash flow (Ebitda) 412 365 366 404 432 7.0%<br />

2014<br />

2015<br />

17,067<br />

17,229<br />

2014<br />

2015<br />

249<br />

241<br />

Operating income (Ebit) 237 182 129 237 269 13.2%<br />

% of revenue 7.8% 6.1% 4.2% 8.2% 9.6% -<br />

2016<br />

15,011<br />

2016<br />

256<br />

Net profit (group share) 124 92 36 127 148 16.5%<br />

Capital expenditure 212 198 187 137 148 7.5<br />

2017<br />

14,510<br />

2017<br />

266<br />

Net financial debt 977 904 833 630 633 0.4%<br />

Working capital (1) 284 260 312 249 261 4.8%<br />

Capital employed (1) 2,507 2,485 2,451 2,258 2,341 3.7%<br />

Return on capital employed (ROCE) (1) 9.3% 7.3% 5.2% 10.1% 12.1% -<br />

IN EURO PER SHARE 2013 2014 2015 2016 2017 %<br />

Number of accidents 79<br />

Gravity rate 0.15<br />

Net recurring profit (Group share) 1.67 1.69 1.61 1.72 1.80 4.5%<br />

Net profit (Group share) 1.59 1.17 0.46 1.63 1.89 16.5%<br />

Gross dividend 0.36 0.40 0.44 0.48 0.53 10.4%<br />

Growth rate of dividend 0.0% 11.1% 10.0% 9.1% 10.4%<br />

2013<br />

133<br />

2013<br />

0.16<br />

Recurring distribution rate 21.6% 23.6% 27.3% 27.9% 29.4%<br />

2014<br />

116<br />

2014<br />

0.17<br />

Personnel 17,442 17,067 17,229 15,011 14,510<br />

2015<br />

105<br />

2015<br />

0.15<br />

NB: 2016 values are expressed before reclassifications and include discontinued operations disclosed separately in the financial report, i.e. the ceramics business in Peru, Colombia,<br />

2016<br />

65<br />

2016<br />

0.31<br />

Chile & Argentina.<br />

(1) These values are expressed excluding the favourable impact of the non recourse factoring program (note 16 disclose details on non recourse factoring); 2017 ROCE value<br />

2017<br />

79<br />

2017<br />

0.15<br />

excludes Pladur.<br />

4<br />

5