Ocean Sky International Limited - Ocean Sky International Ltd ...

Ocean Sky International Limited - Ocean Sky International Ltd ...

Ocean Sky International Limited - Ocean Sky International Ltd ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

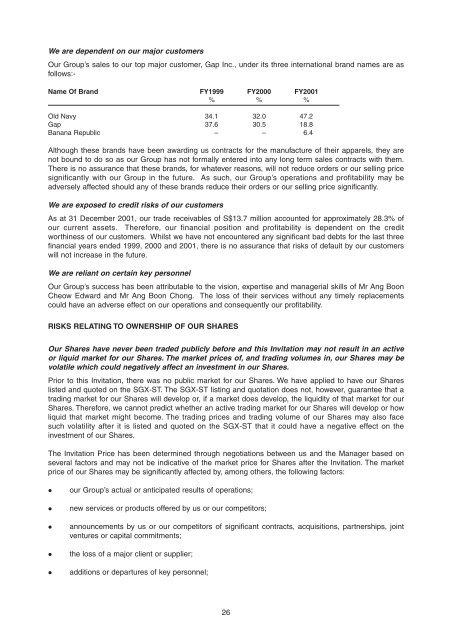

We are dependent on our major customers<br />

Our Group’s sales to our top major customer, Gap Inc., under its three international brand names are as<br />

follows:-<br />

Name Of Brand FY1999 FY2000 FY2001<br />

% % %<br />

Old Navy 34.1 32.0 47.2<br />

Gap 37.6 30.5 18.8<br />

Banana Republic – – 6.4<br />

Although these brands have been awarding us contracts for the manufacture of their apparels, they are<br />

not bound to do so as our Group has not formally entered into any long term sales contracts with them.<br />

There is no assurance that these brands, for whatever reasons, will not reduce orders or our selling price<br />

significantly with our Group in the future. As such, our Group’s operations and profitability may be<br />

adversely affected should any of these brands reduce their orders or our selling price significantly.<br />

We are exposed to credit risks of our customers<br />

As at 31 December 2001, our trade receivables of S$13.7 million accounted for approximately 28.3% of<br />

our current assets. Therefore, our financial position and profitability is dependent on the credit<br />

worthiness of our customers. Whilst we have not encountered any significant bad debts for the last three<br />

financial years ended 1999, 2000 and 2001, there is no assurance that risks of default by our customers<br />

will not increase in the future.<br />

We are reliant on certain key personnel<br />

Our Group’s success has been attributable to the vision, expertise and managerial skills of Mr Ang Boon<br />

Cheow Edward and Mr Ang Boon Chong. The loss of their services without any timely replacements<br />

could have an adverse effect on our operations and consequently our profitability.<br />

RISKS RELATING TO OWNERSHIP OF OUR SHARES<br />

Our Shares have never been traded publicly before and this Invitation may not result in an active<br />

or liquid market for our Shares. The market prices of, and trading volumes in, our Shares may be<br />

volatile which could negatively affect an investment in our Shares.<br />

Prior to this Invitation, there was no public market for our Shares. We have applied to have our Shares<br />

listed and quoted on the SGX-ST. The SGX-ST listing and quotation does not, however, guarantee that a<br />

trading market for our Shares will develop or, if a market does develop, the liquidity of that market for our<br />

Shares. Therefore, we cannot predict whether an active trading market for our Shares will develop or how<br />

liquid that market might become. The trading prices and trading volume of our Shares may also face<br />

such volatility after it is listed and quoted on the SGX-ST that it could have a negative effect on the<br />

investment of our Shares.<br />

The Invitation Price has been determined through negotiations between us and the Manager based on<br />

several factors and may not be indicative of the market price for Shares after the Invitation. The market<br />

price of our Shares may be significantly affected by, among others, the following factors:<br />

� our Group’s actual or anticipated results of operations;<br />

� new services or products offered by us or our competitors;<br />

� announcements by us or our competitors of significant contracts, acquisitions, partnerships, joint<br />

ventures or capital commitments;<br />

� the loss of a major client or supplier;<br />

� additions or departures of key personnel;<br />

26