Ocean Sky International Limited - Ocean Sky International Ltd ...

Ocean Sky International Limited - Ocean Sky International Ltd ...

Ocean Sky International Limited - Ocean Sky International Ltd ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CAPITALISATION AND INDEBTEDNESS<br />

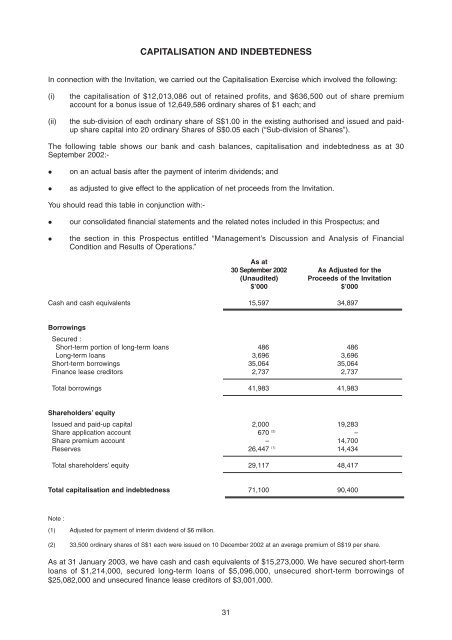

In connection with the Invitation, we carried out the Capitalisation Exercise which involved the following:<br />

(i) the capitalisation of $12,013,086 out of retained profits, and $636,500 out of share premium<br />

account for a bonus issue of 12,649,586 ordinary shares of $1 each; and<br />

(ii) the sub-division of each ordinary share of S$1.00 in the existing authorised and issued and paidup<br />

share capital into 20 ordinary Shares of S$0.05 each (“Sub-division of Shares”).<br />

The following table shows our bank and cash balances, capitalisation and indebtedness as at 30<br />

September 2002:-<br />

� on an actual basis after the payment of interim dividends; and<br />

� as adjusted to give effect to the application of net proceeds from the Invitation.<br />

You should read this table in conjunction with:-<br />

� our consolidated financial statements and the related notes included in this Prospectus; and<br />

� the section in this Prospectus entitled “Management’s Discussion and Analysis of Financial<br />

Condition and Results of Operations.”<br />

As at<br />

30 September 2002 As Adjusted for the<br />

(Unaudited) Proceeds of the Invitation<br />

$’000 $’000<br />

Cash and cash equivalents 15,597 34,897<br />

Borrowings<br />

Secured :<br />

Short-term portion of long-term loans 486 486<br />

Long-term loans 3,696 3,696<br />

Short-term borrowings 35,064 35,064<br />

Finance lease creditors 2,737 2,737<br />

Total borrowings 41,983 41,983<br />

Shareholders’ equity<br />

Issued and paid-up capital 2,000 19,283<br />

Share application account 670 (2) –<br />

Share premium account – 14,700<br />

Reserves 26,447 (1) 14,434<br />

Total shareholders’ equity 29,117 48,417<br />

Total capitalisation and indebtedness 71,100 90,400<br />

Note :<br />

(1) Adjusted for payment of interim dividend of $6 million.<br />

(2) 33,500 ordinary shares of S$1 each were issued on 10 December 2002 at an average premium of S$19 per share.<br />

As at 31 January 2003, we have cash and cash equivalents of $15,273,000. We have secured short-term<br />

loans of $1,214,000, secured long-term loans of $5,096,000, unsecured short-term borrowings of<br />

$25,082,000 and unsecured finance lease creditors of $3,001,000.<br />

31