MBR_ISSUE 41_Cover_LOW

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Malta Business Review<br />

SURVEY: CONSUMER PERCEPTION FIXED BROADBAND<br />

MCA CONSUMER PERCEPTIONS SURVEY –<br />

FIXED BROADBAND<br />

Main survey findings<br />

The MCA is hereby publishing the findings<br />

of a survey gauging consumer perceptions<br />

based on their experience of fixed broadband<br />

services offered in Malta. The variables<br />

assessed include the level of satisfaction with<br />

the products and services being purchased,<br />

the sensitivities to price changes and switching<br />

providers, and the overall experience with<br />

customer care related to faults.<br />

The survey, which was limited to residential<br />

users, was carried out by Grant Thornton<br />

via telephone interviews. A total of 903<br />

randomly selected respondents participated<br />

in this survey.<br />

The survey explored the quality of fixed<br />

broadband connection and the overall<br />

experience with OTT-based services<br />

accessed via fixed broadband. Survey<br />

questions also focused on the features<br />

sought when purchasing a fixed broadband<br />

connection, the tendency of end-users to<br />

test download speeds and the addition of<br />

over- the-top (OTT) services over a fixed<br />

broadband connection.<br />

Proportion of households with fixed<br />

broadband access on the rise<br />

According to the survey results, a total of<br />

94% of household respondents claim to have<br />

access to fixed broadband at their place of<br />

residence. This represents a 17 percentage<br />

point increase over the 2015 survey.<br />

Just 6% of household respondents say that<br />

they do not have access to fixed broadband,<br />

as the service is unnecessary or ‘too<br />

complicated to use’. Moreover, the majority<br />

of respondents not having a fixed broadband<br />

connection stated that they would not be<br />

purchasing a connection over the next 6<br />

month period.<br />

Knowledge of headline download speed<br />

remains low<br />

Despite download speed ranking 2nd in<br />

priority as a factor influencing type of fixed<br />

broadband purchase, only 28% of respondents<br />

with a fixed broadband connection are aware<br />

of the headline download speed supported<br />

by their connection. A lack of awareness<br />

of headline download speeds has been<br />

observed consistently even in surveys carried<br />

out in 2013 and 2015. Nevertheless, the 2017<br />

figure concerning headline download speed<br />

awareness represents an improvement, up<br />

from 19% in 2013.<br />

More households with fast and ultra-fast<br />

download speeds<br />

Fast download speeds correspond to<br />

fixed broadband connections supporting<br />

a download speed of between 30Mbps<br />

but less than 100Mbps whilst ultra-fast<br />

download speeds correspond to those<br />

connections supporting download speed of<br />

100Mbps or more.<br />

Compared to 2015, the 2017 survey<br />

findings show a big rise in the proportion<br />

of households owning fast and ultra-fast<br />

broadband connections. In the former case,<br />

a 23 percentage point increase has been<br />

registered, whilst in the latter case an 18<br />

percentage point increase was recorded.<br />

A big proportion of household respondents<br />

do not recall their applicable monthly<br />

access fee<br />

46% of household respondents were unable<br />

to identify their monthly expenditure on their<br />

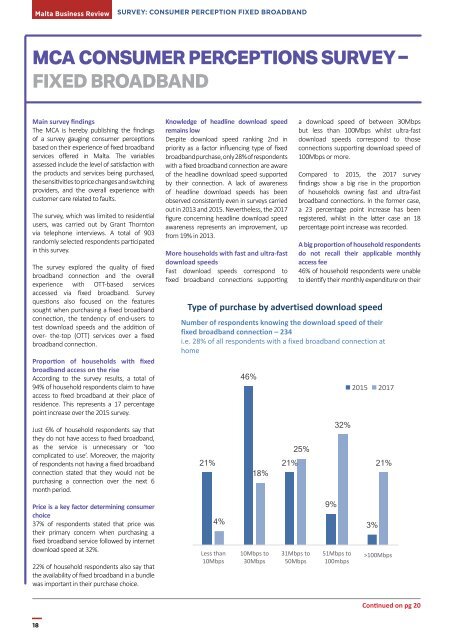

Type of purchase by advertised download speed<br />

Number of respondents knowing the download speed of their<br />

fixed broadband connection – 234<br />

i.e. 28% of all respondents with a fixed broadband connection at<br />

home<br />

21%<br />

46%<br />

18%<br />

21%<br />

25%<br />

32%<br />

2015 2017<br />

21%<br />

Downlo<br />

Are ava<br />

Number<br />

Yes<br />

Price is a key factor determining consumer<br />

choice<br />

37% of respondents stated that price was<br />

their primary concern when purchasing a<br />

fixed broadband service followed by internet<br />

download speed at 32%.<br />

22% of household respondents also say that<br />

the availability of fixed broadband in a bundle<br />

was important in their purchase choice.<br />

4%<br />

Less than<br />

10Mbps<br />

10Mbps to<br />

30Mbps<br />

31Mbps to<br />

50Mbps<br />

9%<br />

51Mbps to<br />

100mbps<br />

3%<br />

>100Mbps<br />

No<br />

Continued on pg 20<br />

18