Year 2001 - University of Canberra

Year 2001 - University of Canberra

Year 2001 - University of Canberra

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

UNIVERSITY OF CANBERRA ANNUAL REPORT <strong>2001</strong><br />

54<br />

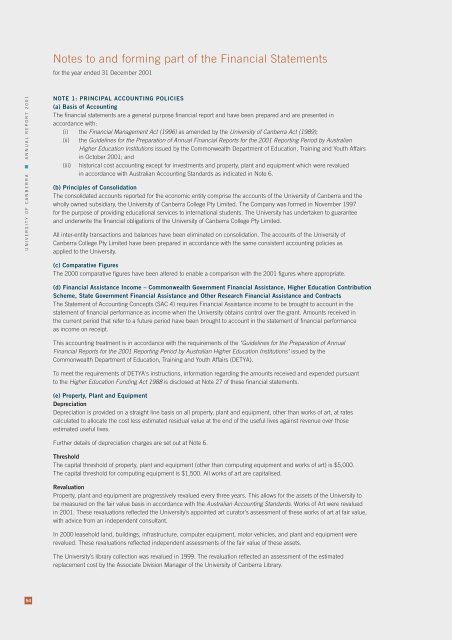

Notes to and forming part <strong>of</strong> the Financial Statements<br />

for the year ended 31 December <strong>2001</strong><br />

NOTE 1: PRINCIPAL ACCOUNTING POLICIES<br />

(a) Basis <strong>of</strong> Accounting<br />

The financial statements are a general purpose financial report and have been prepared and are presented in<br />

accordance with:<br />

(i) the Financial Management Act (1996) as amended by the <strong>University</strong> <strong>of</strong> <strong>Canberra</strong> Act (1989);<br />

(ii) the Guidelines for the Preparation <strong>of</strong> Annual Financial Reports for the <strong>2001</strong> Reporting Period by Australian<br />

Higher Education Institutions issued by the Commonwealth Department <strong>of</strong> Education, Training and Youth Affairs<br />

in October <strong>2001</strong>; and<br />

(iii) historical cost accounting except for investments and property, plant and equipment which were revalued<br />

in accordance with Australian Accounting Standards as indicated in Note 6.<br />

(b) Principles <strong>of</strong> Consolidation<br />

The consolidated accounts reported for the economic entity comprise the accounts <strong>of</strong> the <strong>University</strong> <strong>of</strong> <strong>Canberra</strong> and the<br />

wholly owned subsidiary, the <strong>University</strong> <strong>of</strong> <strong>Canberra</strong> College Pty Limited. The Company was formed in November 1997<br />

for the purpose <strong>of</strong> providing educational services to international students. The <strong>University</strong> has undertaken to guarantee<br />

and underwrite the financial obligations <strong>of</strong> the <strong>University</strong> <strong>of</strong> <strong>Canberra</strong> College Pty Limited.<br />

All inter-entity transactions and balances have been eliminated on consolidation. The accounts <strong>of</strong> the <strong>University</strong> <strong>of</strong><br />

<strong>Canberra</strong> College Pty Limited have been prepared in accordance with the same consistent accounting policies as<br />

applied to the <strong>University</strong>.<br />

(c) Comparative Figures<br />

The 2000 comparative figures have been altered to enable a comparison with the <strong>2001</strong> figures where appropriate.<br />

(d) Financial Assistance Income – Commonwealth Government Financial Assistance, Higher Education Contribution<br />

Scheme, State Government Financial Assistance and Other Research Financial Assistance and Contracts<br />

The Statement <strong>of</strong> Accounting Concepts (SAC 4) requires Financial Assistance income to be brought to account in the<br />

statement <strong>of</strong> financial performance as income when the <strong>University</strong> obtains control over the grant. Amounts received in<br />

the current period that refer to a future period have been brought to account in the statement <strong>of</strong> financial performance<br />

as income on receipt.<br />

This accounting treatment is in accordance with the requirements <strong>of</strong> the "Guidelines for the Preparation <strong>of</strong> Annual<br />

Financial Reports for the <strong>2001</strong> Reporting Period by Australian Higher Education Institutions" issued by the<br />

Commonwealth Department <strong>of</strong> Education, Training and Youth Affairs (DETYA).<br />

To meet the requirements <strong>of</strong> DETYA's instructions, information regarding the amounts received and expended pursuant<br />

to the Higher Education Funding Act 1988 is disclosed at Note 27 <strong>of</strong> these financial statements.<br />

(e) Property, Plant and Equipment<br />

Depreciation<br />

Depreciation is provided on a straight line basis on all property, plant and equipment, other than works <strong>of</strong> art, at rates<br />

calculated to allocate the cost less estimated residual value at the end <strong>of</strong> the useful lives against revenue over those<br />

estimated useful lives.<br />

Further details <strong>of</strong> depreciation charges are set out at Note 6.<br />

Threshold<br />

The capital threshold <strong>of</strong> property, plant and equipment (other than computing equipment and works <strong>of</strong> art) is $5,000.<br />

The capital threshold for computing equipment is $1,500. All works <strong>of</strong> art are capitalised.<br />

Revaluation<br />

Property, plant and equipment are progressively revalued every three years. This allows for the assets <strong>of</strong> the <strong>University</strong> to<br />

be measured on the fair value basis in accordance with the Australian Accounting Standards. Works <strong>of</strong> Art were revalued<br />

in <strong>2001</strong>. These revaluations reflected the <strong>University</strong>’s appointed art curator’s assessment <strong>of</strong> these works <strong>of</strong> art at fair value,<br />

with advice from an independent consultant.<br />

In 2000 leasehold land, buildings, infrastructure, computer equipment, motor vehicles, and plant and equipment were<br />

revalued. These revaluations reflected independent assessments <strong>of</strong> the fair value <strong>of</strong> these assets.<br />

The <strong>University</strong>’s library collection was revalued in 1999. The revaluation reflected an assessment <strong>of</strong> the estimated<br />

replacement cost by the Associate Division Manager <strong>of</strong> the <strong>University</strong> <strong>of</strong> <strong>Canberra</strong> Library.