Year 2001 - University of Canberra

Year 2001 - University of Canberra

Year 2001 - University of Canberra

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

UNIVERSITY OF CANBERRA ANNUAL REPORT <strong>2001</strong><br />

80<br />

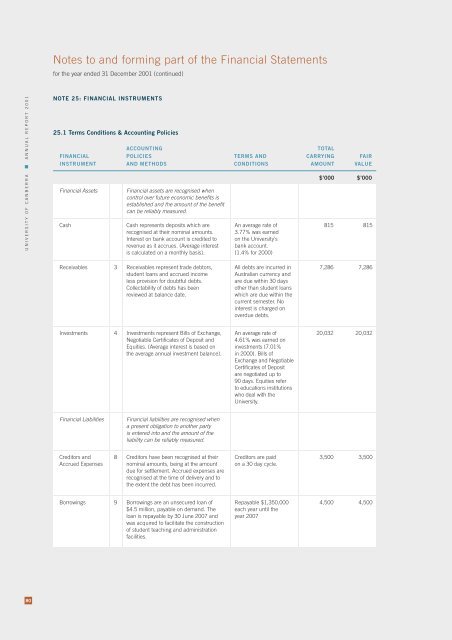

Notes to and forming part <strong>of</strong> the Financial Statements<br />

for the year ended 31 December <strong>2001</strong> (continued)<br />

NOTE 25: FINANCIAL INSTRUMENTS<br />

25.1 Terms Conditions & Accounting Policies<br />

ACCOUNTING TOTAL<br />

FINANCIAL POLICIES TERMS AND CARRYING FAIR<br />

INSTRUMENT AND METHODS CONDITIONS AMOUNT VALUE<br />

Financial Assets Financial assets are recognised when<br />

control over future economic benefits is<br />

established and the amount <strong>of</strong> the benefit<br />

can be reliably measured.<br />

Cash Cash represents deposits which are<br />

recognised at their nominal amounts.<br />

Interest on bank account is credited to<br />

revenue as it accrues. (Average interest<br />

is calculated on a monthly basis).<br />

Receivables 3 Receivables represent trade debtors,<br />

student loans and accrued income<br />

less provision for doubtful debts.<br />

Collectability <strong>of</strong> debts has been<br />

reviewed at balance date.<br />

Investments 4 Investments represent Bills <strong>of</strong> Exchange,<br />

Negotiable Certificates <strong>of</strong> Deposit and<br />

Equities. (Average interest is based on<br />

the average annual investment balance).<br />

Financial Liabilities Financial liabilities are recognised when<br />

a present obligation to another party<br />

is entered into and the amount <strong>of</strong> the<br />

liability can be reliably measured.<br />

Creditors and<br />

Accrued Expenses<br />

8<br />

Creditors have been recognised at their<br />

nominal amounts, being at the amount<br />

due for settlement. Accrued expenses are<br />

recognised at the time <strong>of</strong> delivery and to<br />

the extent the debt has been incurred.<br />

Borrowings 9<br />

Borrowings are an unsecured loan <strong>of</strong><br />

$4.5 million, payable on demand. The<br />

loan is repayable by 30 June 2007 and<br />

was acquired to facilitate the construction<br />

<strong>of</strong> student teaching and administration<br />

facilities.<br />

An average rate <strong>of</strong><br />

3.77% was earned<br />

on the <strong>University</strong>’s<br />

bank account.<br />

(1.4% for 2000)<br />

All debts are incurred in<br />

Australian currency and<br />

are due within 30 days<br />

other than student loans<br />

which are due within the<br />

current semester. No<br />

interest is charged on<br />

overdue debts.<br />

An average rate <strong>of</strong><br />

4.61% was earned on<br />

investments (7.01%<br />

in 2000). Bills <strong>of</strong><br />

Exchange and Negotiable<br />

Certificates <strong>of</strong> Deposit<br />

are negotiated up to<br />

90 days. Equities refer<br />

to educations institutions<br />

who deal with the<br />

<strong>University</strong>.<br />

Creditors are paid<br />

on a 30 day cycle.<br />

Repayable $1,350,000<br />

each year until the<br />

year 2007<br />

$’000 $’000<br />

815 815<br />

7,286 7,286<br />

20,032 20,032<br />

3,500 3,500<br />

4,500 4,500