Jeweller - July, Edition I 2020

» Talking stock: Simple strategies to maximise profits on your product » Fine resilience: First instalment of the 2020 State of the Industry Report » History lesson: Evolution of jewellery chain stores over the past decade

» Talking stock: Simple strategies to maximise profits on your product

» Fine resilience: First instalment of the 2020 State of the Industry Report

» History lesson: Evolution of jewellery chain stores over the past decade

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Chains through the decade | STATE OF THE INDUSTRY<br />

CHAIN REACTIONS<br />

Australian jewellery retailing has undergone significant evolution over the past<br />

decade, but, surprisingly, the changes are very different to what was expected when<br />

<strong>Jeweller</strong> published its last State of the Industry Report in 2010.<br />

A<br />

decade on from <strong>Jeweller</strong>’s first State of<br />

the Industry Report, the jewellery retail<br />

industry – mirroring the broader retail<br />

sector – has undergone momentous change. Yet<br />

over the past 10 years, fine jewellery chain stores<br />

have remained relatively resilient, at least in<br />

terms of store numbers.<br />

However, the same cannot be said for the fashion<br />

jewellery category!<br />

There were 21 fine jewellery chain store ‘brands’ in 2010,<br />

operating a total of 977 stores nationally. On a Like-By-Like<br />

basis, by <strong>2020</strong> that number had declined by 118 stores to 859,<br />

representing a 12 per cent reduction in total store count.<br />

That contraction could be considered small when compared<br />

with the performance of other consumer categories.<br />

Some fine jewellery chains – such as Prouds and Michael Hill<br />

– managed to increase overall store numbers, while others<br />

marginally decreased.<br />

Only two ‘names’ entirely disappeared from the list: Blue<br />

Spirit, a lesser-known small franchise, which operated six<br />

stores in 2010, and the high-profile Thomas <strong>Jeweller</strong>s, with<br />

nine stores.<br />

James Thomas founded Thomas <strong>Jeweller</strong>s in 1896 in<br />

Ballarat. After 121 years of operation, the Thomas family<br />

decided to close its iconic Bourke Street Mall store in<br />

Melbourne in October 2017, as well as the Warnambool,<br />

Wagga Wagga, Albury, Shepparton, Bendigo, Ballarat and<br />

Geelong stores.<br />

In contrast, of the seven fashion jewellery chains listed in the<br />

State of the Industry Report (SOIR) 10 years ago, only one<br />

remains – six closed their physical stores.<br />

The proverbial ‘last man standing’, Lovisa, has grown from 35<br />

locations in Australia to 140 over the past decade, following<br />

the liquidation and closure of major competitors and smaller<br />

fashion jewellery chains alike – including its sister chain Diva.<br />

The ‘downfall’ of the six fashion jewellery chains means<br />

that of the 378 stores that were operating in 2010, 343 no<br />

longer exist.<br />

Demise of fashion chains<br />

For the purpose of research and a report, it is necessary<br />

to create definitions in order to accurately measure and<br />

compare results across categories and over time.<br />

Therefore, a ‘chain’ is defined as a group of five or more<br />

BY THE NUMBERS<br />

Chain Insights<br />

In this report, a ‘chain’<br />

is defined as a group of<br />

five or more jewellery<br />

stores trading under<br />

the one (brand) name,<br />

with one ownership<br />

entity – a person or<br />

company –<br />

co-ordinating buying<br />

and marketing<br />

activities across the<br />

group. It could include a<br />

franchise operation.<br />

859<br />

fine jewellery<br />

chain stores<br />

remain open as<br />

at <strong>July</strong> <strong>2020</strong><br />

343<br />

of 378 fashion<br />

jewellery chain<br />

stores have closed<br />

since 2010<br />

50%<br />

chains in<br />

Australia are<br />

owned and / or<br />

controlled by New<br />

Zealand entities<br />

jewellery stores trading under the one (brand) name, with<br />

one ownership entity – a person or company – co-ordinating<br />

buying and marketing activities across the group. It could<br />

include a franchise operation.<br />

In addition, <strong>Jeweller</strong> notes that a chain store usually has<br />

central management and standardised business methods<br />

and practices and will purchase product from both local<br />

suppliers and/or import its own product.<br />

In <strong>2020</strong>, Lovisa is the largest fashion jewellery chain<br />

operating in Australia. The ASX-listed BB Retail Capital,<br />

founded by retail entrepreneur Brett Blundy, owns it.<br />

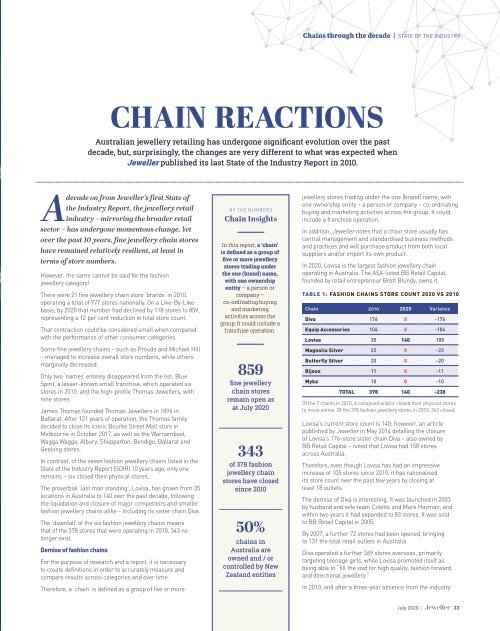

TABLE 1: FASHION CHAINS STORE COUNT <strong>2020</strong> VS 2010<br />

Chain 2010 <strong>2020</strong> Variance<br />

Diva 176 0 -176<br />

Equip Accessories 104 0 -104<br />

Lovisa 35 140 105<br />

Magnolia Silver 22 0 -22<br />

Butterfly Silver 20 0 -20<br />

Bijoux 11 0 -11<br />

Myka 10 0 -10<br />

TOTAL 378 140 -238<br />

Of the 7 chains in 2010, 6 collapsed and/or closed their physical stores<br />

to move online. Of the 378 fashion jewellery stores in 2010, 343 closed.<br />

Lovisa’s current store count is 140; however, an article<br />

published by <strong>Jeweller</strong> in May 2014 detailing the closure<br />

of Lovisa’s 176-store sister chain Diva – also owned by<br />

BB Retail Capital – noted that Lovisa had 158 stores<br />

across Australia.<br />

Therefore, even though Lovisa has had an impressive<br />

increase of 105 stores since 2010, it has rationalised<br />

its store count over the past few years by closing at<br />

least 18 outlets.<br />

The demise of Diva is interesting. It was launched in 2003<br />

by husband and wife team Colette and Mark Hayman, and<br />

within two years it had expanded to 83 stores. It was sold<br />

to BB Retail Capital in 2005.<br />

By 2007, a further 72 stores had been opened, bringing<br />

to 131 the total retail outlets in Australia.<br />

Diva operated a further 369 stores overseas, primarily<br />

targeting teenage girls, while Lovisa promoted itself as<br />

being able to “fill the void for high quality, fashion forward<br />

and directional jewellery.”<br />

In 2010, and after a three-year absence from the industry<br />

<strong>July</strong> <strong>2020</strong> | 33