Jeweller - July, Edition I 2020

» Talking stock: Simple strategies to maximise profits on your product » Fine resilience: First instalment of the 2020 State of the Industry Report » History lesson: Evolution of jewellery chain stores over the past decade

» Talking stock: Simple strategies to maximise profits on your product

» Fine resilience: First instalment of the 2020 State of the Industry Report

» History lesson: Evolution of jewellery chain stores over the past decade

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

300<br />

200<br />

Chains through the decade | STATE OF THE INDUSTRY<br />

100<br />

ZOOMING OUT<br />

A HISTORY LESSON:<br />

TWISTS & TURNS<br />

0<br />

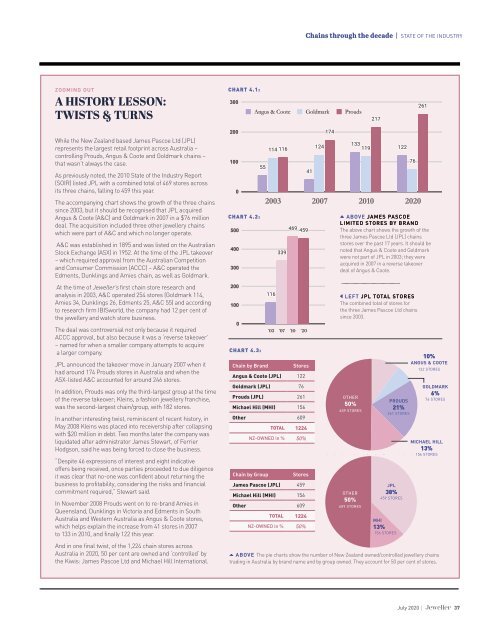

CHART 4.1:<br />

300<br />

Pascoes Group Chart<br />

2003 2007 2010 <strong>2020</strong><br />

Angus & Coote Goldmark Prouds<br />

While the New Zealand based James Pascoe Ltd (JPL)<br />

represents the largest retail footprint across Australia –<br />

controlling Prouds, Angus & Coote and Goldmark chains –<br />

that wasn’t always the case.<br />

As previously noted, the 2010 State of the Industry Report<br />

(SOIR) listed JPL with a combined total of 469 stores across<br />

its three chains, falling to 459 this year.<br />

The accompanying chart shows the growth of the three chains<br />

since 2003, but it should be recognised that JPL acquired<br />

Angus & Coote (A&C) and Goldmark in 2007 in a $76 million<br />

deal. The acquisition included three other jewellery chains<br />

which were part of A&C and which no longer operate.<br />

A&C was established in 1895 and was listed on the Australian<br />

Stock Exchange (ASX) in 1952. At the time of the JPL takeover<br />

– which required approval from the Australian Competition<br />

and Consumer Commission (ACCC) – A&C operated the<br />

Edments, Dunklings and Amies chain, as well as Goldmark.<br />

At the time of <strong>Jeweller</strong>’s first chain store research and<br />

analysis in 2003, A&C operated 254 stores (Goldmark 114,<br />

Amies 34, Dunklings 26, Edments 25, A&C 55) and according<br />

to research firm IBISworld, the company had 12 per cent of<br />

the jewellery and watch store business.<br />

The deal was controversial not only because it required<br />

ACCC approval, but also because it was a ‘reverse takeover’<br />

– named for when a smaller company attempts to acquire<br />

a larger company.<br />

JPL announced the takeover move in January 2007 when it<br />

had around 174 Prouds stores in Australia and when the<br />

ASX-listed A&C accounted for around 246 stores.<br />

In addition, Prouds was only the third-largest group at the time<br />

of the reverse takeover; Kleins, a fashion jewellery franchise,<br />

was the second-largest chain/group, with 182 stores.<br />

In another interesting twist, reminiscent of recent history, in<br />

May 2008 Kleins was placed into receivership after collapsing<br />

with $20 million in debt. Two months later the company was<br />

liquidated after administrator James Stewart, of Ferrier<br />

Hodgson, said he was being forced to close the business.<br />

“Despite 46 expressions of interest and eight indicative<br />

offers being received, once parties proceeded to due diligence<br />

it was clear that no-one was confident about returning the<br />

business to profitability, considering the risks and financial<br />

commitment required,” Stewart said.<br />

In November 2008 Prouds went on to re-brand Amies in<br />

Queensland, Dunklings in Victoria and Edments in South<br />

Australia and Western Australia as Angus & Coote stores,<br />

which helps explain the increase from 41 stores in 2007<br />

to 133 in 2010, and finally 122 this year.<br />

And in one final twist, of the 1,224 chain stores across<br />

Australia in <strong>2020</strong>, 50 per cent are owned and ‘controlled’ by<br />

the Kiwis: James Pascoe Ltd and Michael Hill International.<br />

200<br />

100<br />

0<br />

Pascoes Group Chart<br />

CHART 4.2: Angus & Coote Goldmark ABOVE JAMES Prouds PASCOE<br />

LIMITED STORES BY BRAND<br />

500<br />

The above chart shows the growth of the<br />

three James Pascoe Ltd (JPL) chains<br />

stores over the past 17 years. It should be<br />

400<br />

noted that Angus & Coote and Goldmark<br />

were not part of JPL in 2003; they were<br />

acquired in 2007 in a reverse takeover<br />

300<br />

deal of Angus & Coote.<br />

200<br />

100<br />

0<br />

2003 2007 2010 <strong>2020</strong><br />

‘03 ‘07 ‘10 ‘20<br />

Total Stores<br />

LEFT JPL TOTAL STORES<br />

The combined total of stores for<br />

the three James Pascoe Ltd chains<br />

since 2003.<br />

2003<br />

CHART 4.3:<br />

2007 2010 <strong>2020</strong><br />

Australian chains with New Zealand ownership (By Brand)<br />

10%<br />

Chain by Brand<br />

Stores<br />

ANGUS & COOTE<br />

122 STORES<br />

Angus & Coote (JPL) 122<br />

Goldmark (JPL) 76<br />

Prouds (JPL) 261<br />

Michael Hill (MHI) 156<br />

Other 609<br />

TOTAL 1224<br />

OTHER<br />

50%<br />

609 STORES<br />

NZ-OWNED in % 50%<br />

Australian chains with New Zealand ownership (By MICHAEL Group) HILL<br />

13%<br />

156 STORES<br />

Chain by Group<br />

Stores<br />

James Pascoe (JPL) 459<br />

Michael Hill (MHI) 156<br />

Other 609<br />

TOTAL 1224<br />

NZ-OWNED in % 50%<br />

OTHER<br />

50%<br />

609 STORES<br />

JPL<br />

38%<br />

459 STORES<br />

MHI<br />

13%<br />

156 STORES<br />

PROUDS<br />

21%<br />

261 STORES<br />

GOLDMARK<br />

6%<br />

76 STORES<br />

ABOVE The pie charts show the number of New Zealand owned/controlled jewellery chains<br />

trading in Australia by brand name and by group owned. They account for 50 per cent of stores.<br />

<strong>July</strong> <strong>2020</strong> | 37