20211109_LargeModelST

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

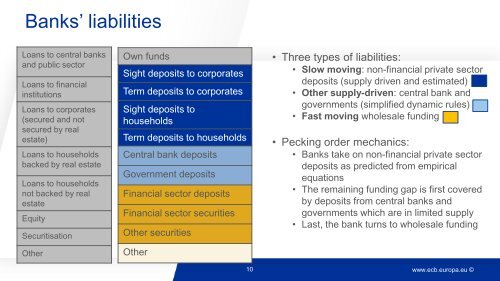

Banks’ liabilities<br />

Loans to central banks<br />

and public sector<br />

Loans to financial<br />

institutions<br />

Loans to corporates<br />

(secured and not<br />

secured by real<br />

estate)<br />

Loans to households<br />

backed by real estate<br />

Loans to households<br />

not backed by real<br />

estate<br />

Equity<br />

Securitisation<br />

Other<br />

Own funds<br />

Sight deposits to corporates<br />

Term deposits to corporates<br />

Sight deposits to<br />

households<br />

Term deposits to households<br />

Central bank deposits<br />

Government deposits<br />

Financial sector deposits<br />

Financial sector securities<br />

Other securities<br />

Other<br />

10<br />

• Three types of liabilities:<br />

• Slow moving: non-financial private sector<br />

deposits (supply driven and estimated)<br />

• Other supply-driven: central bank and<br />

governments (simplified dynamic rules)<br />

• Fast moving wholesale funding<br />

• Pecking order mechanics:<br />

• Banks take on non-financial private sector<br />

deposits as predicted from empirical<br />

equations<br />

• The remaining funding gap is first covered<br />

by deposits from central banks and<br />

governments which are in limited supply<br />

• Last, the bank turns to wholesale funding<br />

www.ecb.europa.eu ©