20211109_LargeModelST

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

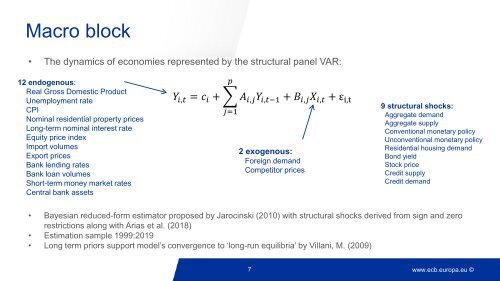

Macro block<br />

• The dynamics of economies represented by the structural panel VAR:<br />

12 endogenous:<br />

Real Gross Domestic Product<br />

Unemployment rate<br />

CPI<br />

Nominal residential property prices<br />

Long-term nominal interest rate<br />

Equity price index<br />

Import volumes<br />

Export prices<br />

Bank lending rates<br />

Bank loan volumes<br />

Short-term money market rates<br />

Central bank assets<br />

pp<br />

YY ii,tt = cc ii + AA ii,jj YY ii,tt−1 + BB ii,jj XX ii,tt + ε i,t<br />

jj=1<br />

2 exogenous:<br />

Foreign demand<br />

Competitor prices<br />

9 structural shocks:<br />

Aggregate demand<br />

Aggregate supply<br />

Conventional monetary policy<br />

Unconventional monetary policy<br />

Residential housing demand<br />

Bond yield<br />

Stock price<br />

Credit supply<br />

Credit demand<br />

• Bayesian reduced-form estimator proposed by Jarocinski (2010) with structural shocks derived from sign and zero<br />

restrictions along with Arias et al. (2018)<br />

• Estimation sample 1999:2019<br />

• Long term priors support model’s convergence to ‘long-run equilibria’ by Villani, M. (2009)<br />

7<br />

www.ecb.europa.eu ©