Jeweller - May 2022

A new era: The pearl industry has been strengthened by adversity Responsibly sourced: Retailers want to provide it, but what does it really mean? Crystal ball: In order to predict trends, we learn from the past

A new era: The pearl industry has been strengthened by adversity

Responsibly sourced: Retailers want to provide it, but what does it really mean?

Crystal ball: In order to predict trends, we learn from the past

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

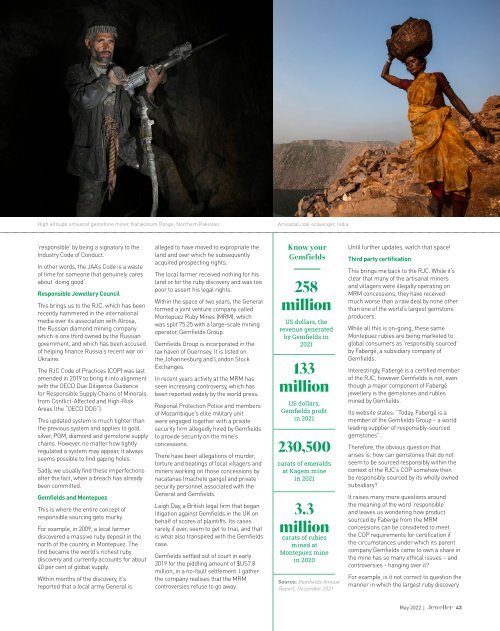

High altitude artisanal gemstone miner, Karakorum Range, Northern Pakistan. Artisanal coal scavenger, India.<br />

‘responsible’ by being a signatory to the<br />

Industry Code of Conduct.<br />

In other words, the JAA’s Code is a waste<br />

of time for someone that genuinely cares<br />

about ‘doing good’.<br />

Responsible <strong>Jeweller</strong>y Council<br />

This brings us to the RJC, which has been<br />

recently hammered in the international<br />

media over its association with Alrosa,<br />

the Russian diamond mining company<br />

which is one third owned by the Russian<br />

government, and which has been accused<br />

of helping finance Russia’s recent war on<br />

Ukraine.<br />

The RJC Code of Practices (COP) was last<br />

amended in 2019 to bring it into alignment<br />

with the OECD Due Diligence Guidance<br />

for Responsible Supply Chains of Minerals<br />

from Conflict-Affected and High-Risk<br />

Areas (the “OECD DDG”).<br />

This updated system is much tighter than<br />

the previous system and applies to gold,<br />

silver, PGM, diamond and gemstone supply<br />

chains. However, no matter how tightly<br />

regulated a system may appear, it always<br />

seems possible to find gaping holes.<br />

Sadly, we usually find these imperfections<br />

after the fact, when a breach has already<br />

been committed.<br />

Gemfields and Montepuez<br />

This is where the entire concept of<br />

responsible sourcing gets murky.<br />

For example, in 2009, a local farmer<br />

discovered a massive ruby deposit in the<br />

north of the country, in Montepuez. The<br />

find became the world’s richest ruby<br />

discovery and currently accounts for about<br />

40 per cent of global supply.<br />

Within months of the discovery, it’s<br />

reported that a local army General is<br />

alleged to have moved to expropriate the<br />

land and over which he subsequently<br />

acquired prospecting rights.<br />

The local farmer received nothing for his<br />

land or for the ruby discovery and was too<br />

poor to assert his legal rights.<br />

Within the space of two years, the General<br />

formed a joint venture company called<br />

Montepuez Ruby Mines (MRM), which<br />

was split 75:25 with a large-scale mining<br />

operator, Gemfields Group.<br />

Gemfields Group is incorporated in the<br />

tax haven of Guernsey. It is listed on<br />

the Johannesburg and London Stock<br />

Exchanges.<br />

In recent years activity at the MRM has<br />

seen increasing controversy, which has<br />

been reported widely by the world press.<br />

Regional Protection Police and members<br />

of Mozambique’s elite military unit<br />

were engaged together with a private<br />

security firm allegedly hired by Gemfields<br />

to provide security on the mine’s<br />

concessions.<br />

There have been allegations of murder,<br />

torture and beatings of local villagers and<br />

miners working on those concessions by<br />

nacatanas (machete gangs) and private<br />

security personnel associated with the<br />

General and Gemfields.<br />

Leigh Day, a British legal firm that began<br />

litigation against Gemfields in the UK on<br />

behalf of scores of plaintiffs. Its cases<br />

rarely, if ever, seem to get to trial, and that<br />

is what also transpired with the Gemfields<br />

case.<br />

Gemfields settled out of court in early<br />

2019 for the piddling amount of $US7.8<br />

million, in a no-fault settlement. I gather<br />

the company realises that the MRM<br />

controversies refuse to go away.<br />

Know your<br />

Gemfields<br />

258<br />

million<br />

US dollars, the<br />

revenue generated<br />

by Gemfields in<br />

2021<br />

133<br />

million<br />

US dollars,<br />

Gemfields profit<br />

in 2021<br />

230,500<br />

carats of emeralds<br />

at Kagem mine<br />

in 2021<br />

3.3<br />

million<br />

carats of rubies<br />

mined at<br />

Montepuez mine<br />

in 2020<br />

Source: Gemfields Annual<br />

Report, December 2021<br />

Until further updates, watch that space!<br />

Third party certification<br />

This brings me back to the RJC. While it’s<br />

clear that many of the artisanal miners<br />

and villagers were illegally operating on<br />

MRM concessions, they have received<br />

much worse than a raw deal by none other<br />

than one of the world’s largest gemstone<br />

producers.<br />

While all this is on-going, these same<br />

Montepuez rubies are being marketed to<br />

global consumers as ‘responsibly sourced’<br />

by Fabergé, a subsidiary company of<br />

Gemfields.<br />

Interestingly, Fabergé is a certified member<br />

of the RJC, however Gemfields is not, even<br />

though a major component of Fabergé<br />

jewellery is the gemstones and rubles<br />

mined by Gemfields.<br />

Its website states: “Today, Fabergé is a<br />

member of the Gemfields Group – a world<br />

leading supplier of responsibly-sourced<br />

gemstones”.<br />

Therefore, the obvious question that<br />

arises is: how can gemstones that do not<br />

seem to be sourced responsibly within the<br />

context of the RJC’s COP somehow then<br />

be responsibly sourced by its wholly owned<br />

subsidiary?<br />

It raises many more questions around<br />

the meaning of the word ‘responsible’<br />

and leaves us wondering how product<br />

sourced by Faberge from the MRM<br />

concessions can be considered to meet<br />

the COP requirements for certification if<br />

the circumstances under which its parent<br />

company Gemfields came to own a share in<br />

the mine has so many ethical issues – and<br />

controversies - hanging over it?<br />

For example, is it not correct to question the<br />

manner in which the largest ruby discovery<br />

<strong>May</strong> <strong>2022</strong> | 43