September 2022 Digital Issue

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

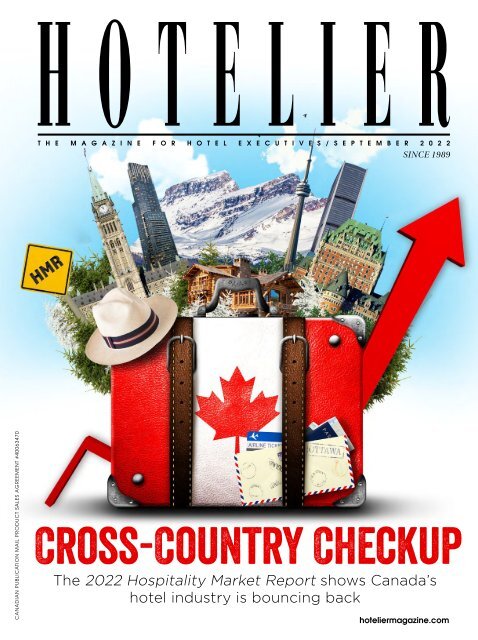

T H E M A G A Z I N E F O R H O T E L E X E C U T I V E S / S E P T E M B E R 2 0 2 2<br />

SINCE 1989<br />

CANADIAN PUBLICATION MAIL PRODUCT SALES AGREEMENT #40063470<br />

Cross-Country Checkup<br />

The <strong>2022</strong> Hospitality Market Report shows Canada’s<br />

hotel industry is bouncing back<br />

hoteliermagazine.com

KOHLER.CA ©<strong>2022</strong> KOHLER CO.<br />

Summon your ultimate shower with a touch.<br />

With the intuitive design of digital controls, supreme power over<br />

water is now at your fingertips. Even Poseidon is impressed.

CONTENTS<br />

FEATURES<br />

10 HIGH-TOUCH HOSPITALITY<br />

HITEC underscores the important role<br />

technology plays in the hospitality world<br />

12 ALL INCLUSIVE<br />

Fostering a culture of DE&I to retain<br />

diverse talent is critically important<br />

13 PUSHING FOR CHANGE<br />

HAC calls on government for much-needed<br />

investments and policy shifts<br />

14 THE BIG REVEAL<br />

124 on Queen achieves project milestone<br />

16 RUNNING THE BASES<br />

Sky McLean expands the Basecamp<br />

Resorts brand<br />

17 THE HOSPITALITY<br />

MARKET REPORT<br />

CBRE’s forecast shows <strong>2022</strong> is on track<br />

to be a year of unparalleled recovery<br />

28 THE PATH FORWARD<br />

The international hotel landscape<br />

continues its spotty recovery in <strong>2022</strong><br />

VOLUME 35, NO. 6 | SEPTEMBER <strong>2022</strong><br />

A SENSE OF PLACE<br />

OZ Architecture looks at<br />

key design opportunities<br />

for resorts<br />

41<br />

36 THE CHANGE-UP<br />

Hospitality design firms create<br />

community-led co-working space<br />

43 SUNNY SIDE UP<br />

Hotels are re-imagining<br />

breakfast offerings<br />

47 DIGITAL CONSUMPTION<br />

Keeping up with digital-asset systems<br />

is crucial for the customer experience<br />

48<br />

HOTELIER<br />

Craig Reaume,<br />

W Toronto<br />

COVER PHOTO: STOCK.ADOBE.COM/ZARYA MAXIM<br />

Feelin’ our content?<br />

33<br />

GETTING<br />

PERSONAL<br />

Operators make efforts<br />

to personalize the<br />

guest experience<br />

DEPARTMENTS<br />

2 EDITOR’S PAGE<br />

5 CHECKING IN<br />

You really should subscribe. Do it now at hoteliermagazine.com/shop/hotelier-subscription/<br />

hoteliermagazine.com SEPTEMBER <strong>2022</strong> | 1

EDITORIAL<br />

WHAT'S ON<br />

THE HORIZON<br />

With summer now fading into our collective<br />

memory, the industry is turning its sights on the<br />

last quarter of the year. For many hoteliers, the<br />

summer has been a great time to solidify sales<br />

and bask in the glow of increased travel trends. Now, they wait<br />

with bated breath to see how the fall will play out and whether<br />

business travel will begin to rebound. But with news that travel<br />

prices are expected to continue their upward trajectory, the<br />

reality may play out differently than many had hoped.<br />

According to the 2023 Global Business Travel Forecast, published<br />

last month by CWT (the B2B4E travel-management platform) and<br />

the Global Business Travel Association (GBTA), rising fuel prices,<br />

labour shortages and inflationary pressures in raw-material costs are<br />

the primary drivers of expected price growth.<br />

Interestingly, the past two years seem to have moved<br />

sustainability on the front burner as consumers and businesses<br />

have become increasingly concerned about combating climate<br />

change. That means there will be a renewed focus on promoting<br />

greater visibility at the point of sale for greener travel options,<br />

as well as carbon footprinting, helping the travel industry to<br />

actively assist in responsible choice-making.<br />

It doesn’t appear prices will decrease any time soon. Pent-up<br />

demand, a desire to build company culture and an uncertain<br />

economic outlook mean the cost-per-attendee for meetings<br />

and events in <strong>2022</strong> is expected to be approximately 25 per<br />

cent higher than in 2019, and it’s forecast to rise a further<br />

seven per cent in 2023.<br />

According to the study, prices are expected to rise 48.5 per cent in <strong>2022</strong>, but even<br />

with this steep price increase, prices are expected to remain below pre-pandemic levels<br />

until 2023. Following an increase of 48.5 per cent in <strong>2022</strong>, prices are expected to rise<br />

8.4 per cent in 2023. Rising demand and continued price rises on jet fuel, are putting<br />

upward pressure on ticket prices.<br />

On the hotel front, prices fell 13.3 per cent in 2020 from 2019 and a further 9.5 per<br />

cent in 2021, however the report expects them to rise 18.5 per cent in <strong>2022</strong> followed by<br />

an 8.2 per cent lift in 2023. Hotel prices have already eclipsed 2019 levels in some areas<br />

such and are expected to do so globally by 2023.<br />

In most parts of the world, hotel rates have risen sharply, including a 22 per cent<br />

increase in North America and a forecast 31.8 per cent across Europe, the Middle East &<br />

Africa. This has been fuelled by an accelerated recovery coupled with continued capacity<br />

constraints.<br />

Hotel rate increases were initially driven by strong<br />

leisure travel in 2021 but group travel for corporate<br />

meetings and events is improving and transient business<br />

travel is gaining healthy pace, putting further pressure on<br />

ADR. To access the full report of the study, click here. ◆<br />

2 | SEPTEMBER <strong>2022</strong><br />

ROSANNA CAIRA rcaira@kostuchmedia.com<br />

CONNECT<br />

WITH US<br />

HotelierMagazine<br />

@RCaira_Kostuch<br />

@rosannacaira<br />

hoteliermagazine.com<br />

PHOTO BY NICK WONG<br />

hoteliermagazine.com<br />

ROSANNA CAIRA<br />

Editor & Publisher<br />

AMY BOSTOCK<br />

Managing Editor<br />

NICOLE DI TOMASSO<br />

Assistant Editor<br />

COURTNEY JENKINS<br />

Art Director<br />

JENNIFER O'NEILL<br />

Design Assistant<br />

WENDY GILCHRIST<br />

Director of Business Development<br />

CATHI KREWICKI<br />

Account Manager<br />

KIMONE CLUNIS<br />

Sales & Marketing Assistant/<br />

Events Co-ordinator<br />

DANNA SMITH<br />

Administrative Assistant<br />

DANIELA PRICOIU<br />

Accounting Services<br />

CIRCULATION PUBLICATION PARTNERS<br />

kml@publicationpartners.com<br />

ADVISORY BOARD<br />

Andrew Weir, Destination Toronto; Anne Larcade, Sequel<br />

Hotels & Resorts; Anthony Cohen, Cresent Hotels — Global<br />

Edge Investments; Bonnie Strome, Hyatt Hotels; Christiane<br />

Germain, Germain Hotels; David McMillan, Axis Hospitality<br />

International; Don Cleary, Marriott Hotels; Geoffrey Allan,<br />

Project Capital Management Hotels; Hani Roustom, Friday<br />

Harbour Resort; Heather McCrory, Accor; Laura Baxter, Co-Star<br />

Reetu Gupta, Easton's Hotels; Ryan Killeen, The Annex Hotel<br />

Ryan Murray, The Pillar + Post Hotel; Stephen Renard, Renard<br />

International Hospitality & Search Consultants<br />

HOTELIER is published eight times a year by Kostuch Media<br />

Ltd., Mailing Address: 14 – 3650 Langstaff Rd. Ste. 33,<br />

Woodbridge, ON L4L 9A8, (416) 447-0888. Subscription rates:<br />

Canada: $25 per year, single issue $4, U.S.A.: $30 per year;<br />

all other countries $40 per year. Canadian<br />

Publication Mail Product Sales Agreement #40063470. Member<br />

of Canadian Circulations Audit Board and Magazines Canada.<br />

Printed in Canada on recycled stock.<br />

All rights reserved. The use of any part of this magazine,<br />

reproduced, transmitted in any form or means, or stored in a<br />

retrieval system, without the written consent of the publisher<br />

is expressly prohibited and is an infringement of copyright law.<br />

Copyright, Hotelier <strong>2022</strong> ©<br />

Return mail to: Publication Partners 1025 Rouge Valley Dr.,<br />

Pickering, Ontario L1V 4N8<br />

Hospitality<br />

Have the<br />

top business<br />

headlines<br />

conveniently<br />

delivered to<br />

your inbox<br />

every Monday<br />

& Wednesday<br />

morning<br />

VISIT hoteliermagazine.com/newsletter/<br />

to activate your subscription<br />

Headlines

SPONSORED CONTENT<br />

CHECKING IN<br />

Dustbane delivers<br />

innovation and<br />

efficiency to cleaning<br />

and disinfection<br />

Hotel cleaning has taken on a whole<br />

new meaning since the pandemic<br />

began. Heightened cleaning and<br />

disinfection protocols, combined<br />

with supply-chain issues and staffing shortages,<br />

have created additional challenges — and costs<br />

— for hotel operations.<br />

“Operators need new, innovative ways<br />

to help them keep their operations<br />

running smoothly while taking pressure<br />

off frontline staff and their budgets,”<br />

says Shannon Hall, president, Sales for<br />

Dustbane Products Ltd.<br />

With guests expecting a more elevated experience when it comes<br />

to cleaning and a sense of safety, housekeeping staff have been<br />

tasked with more frequent cleaning and disinfection protocols. This<br />

is not an easy task given the ongoing staffing shortages and high<br />

turnover rates. Adding to the challenge is that training for the new<br />

protocols has been limited, and new disinfection tools also require<br />

specialized training and specific timelines for applications.<br />

Dustbane’s line of cleaning-and-sanitation products has always<br />

been focused on creating cost savings, labour and productivity<br />

improvements, as well and health-and-safety or environmental reasons<br />

to change, says Hall. “What many operators don’t realize is that many<br />

tools like the Victory Electrostatic Sprayers, can be used for applications<br />

beyond disinfection. Helping to reduce the labour required to do<br />

odour control, soap-scum removal, and even pest control.”<br />

She adds that supply-chain shortages have also made it more<br />

difficult to access common items such as vacuums and auto<br />

scrubbers. “Customers are now starting to look to alternatives to<br />

25 Pickering Pl.<br />

Ottawa, ON K1G 5P4<br />

1-800-387-8226<br />

www.dustbane.ca<br />

traditional upright vacuum types like our DB Series canister vacs<br />

that are also delivering better ROI and improved efficiencies,”<br />

says Hall.<br />

Another area where alternatives can help ease costs and<br />

time is specialized deep cleaning such as tile and grout,<br />

carpets, garbage compactors and odour control. Typically,<br />

these are outsourced to contract cleaners as they are too<br />

time consuming for housekeeping. Hotels can<br />

reduce their costs with technology such as<br />

Dustbane’s Doodle Scrub that can deep clean<br />

those areas in seconds.<br />

The need for more frequent spot<br />

cleaning has also increased, leading to<br />

a growing demand for products such as the Dustbane Power Clean<br />

Mini Spotter and Pivot orbital machine by Square Scrub. “The Victory<br />

sprayer, in combination with Dustbane’s Bio-Bac II or Bio-Bac Free,<br />

can also be a great option for odour control in stairwells, garbage<br />

and organics bins where odour build up can also attract bugs and<br />

rodents,” says Hall.<br />

As a Canadian manufacturer, Dustbane prides itself on developing<br />

chemicals that are less impactful on the environment and provide<br />

a safer alternative to some of the harsher chemicals on the market.<br />

Its Ecologo-certified products help reduce the amount of waste<br />

and packaging created by traditional chemicals, while also reducing<br />

carrying costs and order frequency. “In summary, they help improve<br />

the bottom line while making it simple for staff to use,” says Hall.<br />

For hotels looking to find out more about how to improve<br />

efficiency and costs, Dustbane’s site-survey process can help hotels<br />

identify immediate<br />

program and process<br />

improvements, as<br />

well as a simplified<br />

program that includes<br />

training for their staff.<br />

Click here to<br />

book a site survey or<br />

product demo.<br />

MARGARET MULLIGAN<br />

THE LATEST INDUSTRY NEWS FOR HOTEL EXECUTIVES FROM CANADA AND AROUND THE WORLD<br />

Very saddened<br />

to learn of the<br />

passing of a great<br />

man, Deepak<br />

Ruparell.<br />

He was a mentor<br />

and a beloved<br />

friend to me for<br />

the last 15 years.<br />

Words don’t do<br />

justice to losing<br />

someone like<br />

him. He radiated<br />

kindness and<br />

generosity. This is<br />

a huge loss not just<br />

for his family but<br />

for Canada<br />

IN<br />

MEMORIAM<br />

Hotel industry mourns loss<br />

of Deepak Ruparell<br />

The Canadian hotel industry is mourning<br />

the loss of Silver Hotel Group president<br />

Deepak Ruparell, who passed away<br />

August 8 at the age of 67.<br />

Ruparell, who accepted Hotelier<br />

magazine’s Pinnacle Award for Company<br />

of the Year in December 2021, was renowned for<br />

his modesty, actively shunning the limelight and<br />

downplaying his success and accomplishments.<br />

In an interview last year, Susie Grynol, president, Hotel Association of Canada,<br />

praised the leader for his work with the association during the pandemic. “Deepak<br />

was a champion. When our industry started to unravel, he stepped up. He’s been a<br />

tireless supporter of the association. He didn’t miss a meeting, and he put in the work<br />

at the ground level, to make calls to MPs and to deliver the message that needed to<br />

be delivered in order to move our advocacy objectives forward. This industry hit a<br />

point of massive crisis and there were a few people who really stepped up and provided<br />

leadership, and he was one of them.”<br />

He also founded The Ruparell Foundation, which allows Silver Hotel Group to give<br />

back to staff and community through initiatives such as university scholarships for<br />

employees’ children, professional-development courses, team-building initiatives and<br />

volunteering with organizations such as Habitat for Humanity, and Meals on Wheels.<br />

At each leadership conference, there’s a focus on a particular charitable activity, such<br />

as providing lunch-bag meals for the homeless or building bikes for kids in Toronto’s<br />

Regent Park neighbourhood through the Dixon Hall Music School.<br />

“Very saddened to learn of the passing of a great man Deepak Ruparell,” posted<br />

Brampton mayor Patrick Brown on Twitter. “He was a mentor and a beloved friend to<br />

me for the last 15 years. Words don’t do justice to losing someone like him. He radiated<br />

kindness and generosity. This is a huge loss not just for his family but for Canada.”<br />

Ruparell leaves behind his wife Avni. He was a beloved father (father-in-law) of<br />

Rajeev, Shivani, Aarti and Sonia (Alex) and grandfather to Priya and Simran. A<br />

private funeral service was held in New York, with only close family in attendance.<br />

The family appreciates everyone’s support, prayers and words of comfort and asks for<br />

privacy at this time.◆<br />

hoteliermagazine.com SEPTEMBER <strong>2022</strong> | 5

Now Open:<br />

Ace Hotel Toronto<br />

Ace Hotel Toronto, located in the city’s<br />

historic Garment District, has opened its<br />

doors. The 123-room hotel and its public<br />

spaces were designed by Toronto-based Shim-<br />

Sutcliffe Architects and Atelier Ace.<br />

Chef-partner Patrick Kriss, who holds<br />

the title of “Outstanding Chef” by Canada’s<br />

100 Best Restaurants consecutively from<br />

2017 to 2020, oversees all dining menus<br />

at Ace Hotel Toronto. He works alongside<br />

executive chef Devin Murphy, who runs daily<br />

kitchen operations, and pastry chef Victoria<br />

Ammendolia. Anchoring the building is<br />

Alder, a seasonal wood-fired restaurant. For<br />

its menu, chef Kriss draws inspiration from<br />

traditions and techniques in and around the<br />

Mediterranean while the hotel bar program is<br />

overseen by beverage manager James Park and<br />

sommelier Arashasp Shroff.<br />

Additionally, The Lobby offers a menu of pastries and locally roasted Sam James<br />

Coffee in the morning, followed by craft cocktails, wine by the glass, beers, snacks and<br />

shareable small plates at night. The Lobby also features a robust calendar of music, arts and<br />

cultural programming. Atop of the hotel is Evangeline, an 80-seat rooftop bar and lounge<br />

spread across a cozy indoor area and an open-air patio. Expected to open later this year,<br />

Evangeline will serve finger foods and small plates, along with beer, cocktails and wine.<br />

“Long a leading global light for its forward-thinking approach to city-making and<br />

design, Toronto is a city that embraces originality and is rooted in the same open-toall<br />

philosophy that founded Ace,” says Brad Wilson, CEO of Atelier Ace / Ace Hotel<br />

Group. “We could not be more proud to open Ace Hotel Toronto — the architectural<br />

magnificence of Shim-Sutcliffe Architects’ work has created a bonafide wonder. They<br />

have built an inherently civic space that respects the neighbourhood’s storied past<br />

while nurturing its future. Likewise, chef Patrick Kriss has worked in tandem with our<br />

team to create something exceptional at Alder.”<br />

6 | SEPTEMBER <strong>2022</strong><br />

Setting<br />

Sail<br />

After 28 years of dedicated<br />

service, Stuart Laurie<br />

has retired from IHG<br />

Hotels & Resorts. Laurie’s<br />

accomplishments are vast and<br />

his influence on Canadian<br />

hotel development extends<br />

beyond the impressive<br />

distribution of IHG brands<br />

across the country. His<br />

mark on the Canadian<br />

hospitality space can be<br />

seen from coast-to-coast.<br />

Laurie will be enjoying his<br />

retirement by continuing his<br />

passion for sailing.<br />

New GM at<br />

The St. Regis Toronto<br />

Hiren Prabhakar has been appointed general manager at The St. Regis Toronto,<br />

bringing 29 years of hospitality experience in luxury and full-service hotels to his<br />

new role. A member of the Marriott team for the past eight years, Prabhakar most<br />

recently opened the Toronto Marriott Markham, the first newly built, re-designed<br />

Marriott in Canada. Previously, he led the first global re-branding for St. Regis Hotels<br />

& Resorts at The St. Regis Moscow Nikolskaya in Russia. He has also held roles<br />

across India, Dubai, Poland, Spain, Germany, Zambia and Saudi Arabia. Additionally,<br />

Prabhakar’s time with Marriott has included the coveted Hotel of the Year, Marriott<br />

Luxury Brands Europe Award in 2017 at The St. Regis Moscow. He was also awarded<br />

General Manager of the Year at the Toronto Marriott Markham in 2019.<br />

WILLIAM JESS LAIRD [ACE HOTEL]<br />

Reaching Milestones<br />

Easton’s Group of Hotels has marked the completion of structural framework for its<br />

upcoming hotel, Canopy by Hilton Toronto Yorkville Hotel, which is slated to open in<br />

November <strong>2022</strong>. Studio Munge led the hotel’s unique design.<br />

Upon completion, the hotel will feature a modern café with retail offerings from<br />

local businesses on the main floor, a highly anticipated restaurant, an indoor heated<br />

pool, yoga and fitness rooms and comfortable meeting spaces. The guestrooms can be<br />

found from the second to ninth floors, while the remainder of the building rising 55<br />

floors comprises of Gupta Group Developments’ Rosedale on Bloor residential units.<br />

“[This] is a significant milestone for the construction of this property and a testament<br />

to the skill and diligence of all parties involved,” says Reetu Gupta, Chairwoman<br />

and Ambassadress of The Gupta Group and Easton’s Group of Hotels. “We’re excited<br />

to bring Canada’s very first Canopy by Hilton Hotel to Toronto. The hotel with its<br />

premium location will bring a unique blend of luxury, convenience and urban living,<br />

offering a new way for guests near and far to experience the city.”<br />

Making a Difference<br />

Coast Hotels Limited, a fully owned<br />

subsidiary of APA Hotel Canada, Inc.,<br />

has joined UNESCO and Expedia Group<br />

in the global expansion of the UNESCO<br />

Sustainable Travel Pledge. The brand<br />

and eight owned/managed hotels have<br />

committed to adhering to responsible<br />

environmental and cultural practices to<br />

make a difference in their communities.<br />

The UNESCO Pledge promotes<br />

responsible practices such as<br />

environmental protection, community<br />

resilience and heritage conservation,<br />

with the goal of changing the nature and<br />

impact of global tourism. With 22 hotels<br />

already certified by Green Key Global<br />

with a Green Key Eco-Rating of two or<br />

more keys, Coast Hotels adds a further<br />

commitment to sustainability practices.<br />

“Coast Hotels are nestled in magnificent<br />

mountain ranges and spectacular cities, in<br />

quaint towns and coastal retreats. We want<br />

to keep those places beautiful and be better<br />

stewards of the planet,” says Jin Sasaki,<br />

president of Coast Hotels. “An important<br />

factor in sustainable tourism is allowing<br />

the communities and cultures in which we<br />

operate to thrive. As part of this pledge, we<br />

commit to supporting our local communities<br />

through actions such as sourcing produce<br />

locally and hiring local people.”<br />

Best<br />

of the<br />

Best<br />

Manoir Hovey has been<br />

named the number-1 resort<br />

hotel in Canada for the<br />

second-consecutive year<br />

and No.50 in the Top 100<br />

Hotels in the World by Travel<br />

+ Leisure magazine’s World<br />

Best Awards.<br />

Built in 1900, Manoir Hovey<br />

is a family-run five-star Relais<br />

& Châteaux estate. In spring<br />

2023, Manoir Hovey will<br />

expand its wellness offerings<br />

with the debut of a new spa<br />

and lakefront spa pavilion.<br />

This addition will include an<br />

outdoor infinity pool, open<br />

year-round, and three luxury<br />

spa suites.<br />

“We are thrilled with the<br />

news and truly appreciative<br />

of the engagement and<br />

contribution of our valued<br />

guests,” says Jason Stafford,<br />

managing director of<br />

Manoir Hovey. “As a thirdgeneration<br />

family-owned and<br />

operated property, we are<br />

honoured to be recognized<br />

by this esteemed award for<br />

a second-consecutive year.<br />

This sizable achievement<br />

speaks volumes about the<br />

long-standing tradition of<br />

excellence that characterizes<br />

Manoir Hovey and was made<br />

possible by the generous<br />

efforts of our entire staff.”<br />

hoteliermagazine.com hoteliermagazine.com<br />

SEPTEMBER <strong>2022</strong> | 7

Supporting<br />

Guests’ Sleep<br />

Health<br />

SPONSORED CONTENT<br />

NTEN<br />

RISE... AND SHINE?<br />

By<br />

Matt Carter<br />

Given the pandemic-induced focus on air quality,<br />

social distancing and sanitation – not to mention<br />

the regular stresses of modern life – many of us<br />

are paying greater attention to our personal health<br />

than ever before. While self-care was previously<br />

seen as a luxury that involved occasionally<br />

indulging oneself as a treat, it’s come to be viewed<br />

as a daily requirement, essential to both physical<br />

and mental health.<br />

Indeed, wellness is now a dominant consumer<br />

value around the world – and a key driver for the<br />

travel and tourism industry. According to a 2021<br />

report, the Global Wellness Institute expects<br />

our increasing emphasis on well-being and<br />

work-life balance to power a 21 percent<br />

annual growth rate in wellness tourism<br />

as we approach 2025. Hoteliers are<br />

responding with an abundance of<br />

health-related amenities, including<br />

on-site experts, meditation classes<br />

and personalized spa services. Many<br />

are also ramping up offerings related<br />

to another key consideration with<br />

particular relevance for hotels: sleep.<br />

As the Centers for Disease Control and<br />

Prevention emphasizes, “getting enough<br />

sleep is not a luxury—it is something<br />

people need for good health.” If we’re<br />

deficient in this regard, it can weaken our<br />

immune system, making us more likely<br />

to catch a cold. Research also links sleep<br />

deprivation with more serious conditions,<br />

including type 2 diabetes, high blood pressure,<br />

heart disease, cancer, and obesity. Additionally,<br />

lack of quality slumber affects our brains,<br />

accelerating aging and increasing risk of dementia,<br />

depression, anxiety, and generally ‘fuzzy thinking.’<br />

Alarmingly, drowsy driving is likely responsible<br />

for around 6,000 fatal crashes per year in the<br />

United States alone.<br />

Today’s health-conscious guests expect their chosen<br />

property to provide them with a good night’s rest.<br />

In fact, a TripAdvisor survey found 55 percent<br />

look for reviews that specifically mention sleep<br />

quality before they make a reservation. Guests are<br />

also increasingly on the lookout for sleep-related<br />

amenities, such as tech-free rooms, high-quality<br />

mattresses, pillow menus, and even in-room consultations<br />

aimed at resetting unhealthy sleep patterns.<br />

Of course, no such offering is complete without<br />

addressing noise – a problem with which hoteliers are<br />

all too familiar. For decades, it’s ranked among the top<br />

guest complaints across all property types, and is known<br />

to disrupt sleep by preventing onset, prompting shifts<br />

to lighter stages, and causing awakenings. However, the<br />

solution to this issue might come as a surprise to those<br />

unfamiliar with the science of acoustics.<br />

Studies conducted in healthcare, residential and military<br />

facilities show the likelihood a noise will disrupt an<br />

occupant largely depends on how much change it causes<br />

in their room’s typical ambient conditions. The greater<br />

the change, the harder it is for them to ignore, even<br />

while asleep. The ambient level in most guest<br />

rooms is often just 28 to 33 A-weighted<br />

decibels. In these ‘pin-drop’ environments,<br />

just about any noise – even normal<br />

conversation in the hallway – creates<br />

a significant change.<br />

Guests can be made more comfortable<br />

by taking a simple step that initially<br />

seems to contradict the goal of<br />

reducing noise:<br />

increase their room’s<br />

background sound level using masking<br />

sound. Although often compared to<br />

softly blowing air, the sound produced<br />

by a commercial-grade device such as<br />

MODIO Guestroom Acoustic Control<br />

follows a specific spectrum developed by<br />

the National Research Council to balance<br />

the need for acoustic control with that of<br />

occupant comfort. It covers many noises<br />

and reduces the disruptive impact of others,<br />

creating a less variable – and, therefore, more<br />

comfortable – sleeping environment.<br />

The rapidly-growing demand for such wellness offerings<br />

provides abundant opportunities as hotels continue<br />

to recover from the pandemic. Equipping your guest<br />

rooms with masking will ensure your guests get the<br />

‘healthy-dose’ of sleep they need to feel refreshed and<br />

rejuvenated – and singing your property’s praises,<br />

rather than anxiously awaiting their return home.<br />

Make sure your guests wake refreshed and ready to face the<br />

day – with MODIO, the only sound masking device specifically<br />

designed to let them control their room’s acoustics, just as<br />

they do temperature and lighting. The result? Fewer sleepless<br />

nights for them. Fewer noise complaints for your hotel.<br />

And a lot of praise for MODIO. It’s a win-win-win situation.<br />

CONTACT US FOR A DEMO | WWW.MODIO.AUDIO<br />

© <strong>2022</strong> K.R. MOELLER ASSOCIATES LTD. PATENT INFORMATION AT MODIO.AUDIO/PATENTS. MODIO AND LOGISON ARE TRADEMARKS OF 777388 ONTARIO LIMITED

HIGH-TOUCH HOSPITALITY<br />

Amidst the focus on tech trends, HITEC also offered labour solutions<br />

TECHNOLOGY<br />

BY LARRY AND ADAM MOGELONSKY<br />

This year’s HITEC — perhaps the world’s foremost<br />

hospitality-technology tradeshow — marked its<br />

first full return since the cancelled 2020 outing<br />

and the scaled-back exhibition in Dallas last<br />

<strong>September</strong>. A whirlwind of a show, the light<br />

at the end of the tunnel for hotels across Canada is that<br />

every technology vendor was keenly focused on helping the<br />

industry solve our labour issues.<br />

And while the exhibition, — this year, held in Orlando,<br />

Fla. — may already be several months in the rearview<br />

mirror, the industry’s current challenges are not, so it serves<br />

as a reminder on the importance of tech to support hotel<br />

operations and evolve the brand with new service offerings.<br />

Key to helping with labour is automation, automation<br />

and more automation. But there still seems to be a stigma<br />

around this word because of the implied creative destruction<br />

underpinning it — an assumed organizational downsizing.<br />

The opposite is, in fact, true.<br />

The automation of hotel operations is actually about using<br />

software, and perhaps a few ounces of machine learning and<br />

behavioural science, to handle the repetitive tasks that some<br />

associates would have to carry out manually in order to keep<br />

things running smoothly. Now, with those basic functions<br />

digitized then digitalized, your teams have more time to focus<br />

on complex tasks — the work that gives their jobs meaning<br />

— be it direct contact with guests, finalizing a big sales deal,<br />

10 | SEPTEMBER <strong>2022</strong><br />

developing a new brand initiative or anything else that gives<br />

a staffer or manager a sense of accomplishment.<br />

Even a platform that helps reduce e-mail notification<br />

volume will do wonders to lessen the interruptive work that<br />

blocks managers from devoting large chunks of time to a<br />

singular project and produce quality results. E-mail can be<br />

a silent stressor of nearly any modern workplace, so aiming<br />

for the Holy Grail of ‘inbox zero’ via a slate of automation<br />

tools will have a profound ripple effect on the happiness of<br />

your teams.<br />

To paraphrase one of the smartest technologists in the<br />

hotel industry, this ‘no touch’ automation enables the ‘high<br />

touch’ of hospitality.<br />

So, how exactly is tech helping hotels address their labour<br />

challenges through automation? This would take more than<br />

a 100 pages to properly demonstrate all the neat features that<br />

specific vendors have rolled out. Instead, we can summarize<br />

the solutions presented at HITEC and a general approach to<br />

hotel technology in five broad principles.<br />

1. Develop a process for continuous success.<br />

Deploying anything new is hard. From evaluation and<br />

implementation, through to team training and ensuring<br />

ongoing ‘daily active usage,’ technology needs to be<br />

hardcoded into your culture through SOPs, rich data<br />

integrations and, above all, a tacit ‘why’ that every member<br />

hoteliermagazine.com<br />

of the team understands. With so many vendors, a hotel<br />

stack can easily become convoluted to the point where<br />

incremental improvements to the guest experience are<br />

stymied by incompatibilities or ‘zombie platforms’ that no<br />

one really uses.<br />

2. Protect your human stack. Regardless of the<br />

hardware and software deployed, ultimately everything in a<br />

hotel comes down to the people you have who find the best<br />

solutions, develop the platform interfaces and maintain all<br />

the systems. The more the world of hotels becomes entangled<br />

with technology, the more central your IT team becomes and,<br />

at the same time, the more paramount it is that everyone<br />

in every department have a firm grasp of how it all works.<br />

Nurture your people that make this happen by embracing<br />

technology on the cultural level and supporting this process<br />

through continuing professional development.<br />

3. Simplify before you expand. The whole notion<br />

of ‘zombie platforms’ implies many disparate silos of data<br />

co-existing and overlapping. Look to simplify by finding<br />

partners that can deploy versatile solutions. Quite often,<br />

the best solution is to first deepen your relationship with<br />

existing vendors rather than deploy a new one to fit a narrow<br />

range of functionality. Again, part of the process must be<br />

to continually upgrade your human stack by ensuring team<br />

members are trained on all current systems and have time to<br />

keep up-to-date with all the latest technology news.<br />

4. Build rich data connections. Whether it’s an<br />

integration or interface, hotel tech stacks are gradually<br />

moving towards unified guest profiles and sophisticated<br />

customer personas at the centre, with onion-like layers of<br />

automation software extending outward to all departments.<br />

You will unavoidably need a field manual to understand the<br />

alphabet soup of hotel technology acronyms out there —<br />

PMS, CRS, POS, CRM, RMS, BI, WBE, CMS, PM, CDP<br />

and so on — but these pieces cannot exist in isolation. You<br />

need good IT professionals and a clear vision to build the<br />

data connections that will make all these tools actionable<br />

and improve the guest experience.<br />

• A CONSTRUCTION<br />

SOLUTIONS COMPANY<br />

• SPECIALIZING IN<br />

HOTEL CONSTRUCTION<br />

5. There will always be more you can do. One of<br />

the most profound beauties of technology is that it never<br />

stops improving. Each vendor is hard at work developing<br />

new features to stay competitive, while companies outside<br />

the hotel industry will influence the direction of the guest<br />

experience, either directly through bespoke products and<br />

sales efforts or implicitly by influencing customer behaviour<br />

or traveller demands. Technology is as much a process of<br />

evolution as it is any given function, thus reaching a likewise<br />

mindset to ensure success.<br />

With labour hard to find for the foreseeable future,<br />

automation is of critical importance for hospitality, starting with<br />

the process that will define the timetable of priorities for the year<br />

ahead. Then, luckily for you, HITEC next year takes place at the<br />

end of June 2023 in Toronto, offering all Canadians a great host<br />

city in which to learn and be inspired. ◆<br />

Larry and Adam Mogelonsky are partners<br />

of Hotel Mogel Consulting Limited. You<br />

can reach Larry at larry@hotelmogel.com<br />

or Adam at adam@hotelmogel.com<br />

EXPERIENCE...<br />

THE DIFFERENCE<br />

416-625-2522<br />

BAYCON.CA

PUSHING FOR CHANGE<br />

12 | SEPTEMBER <strong>2022</strong> hoteliermagazine.com<br />

hoteliermagazine.com SEPTEMBER <strong>2022</strong> | 13<br />

DIVERSITY HAC<br />

ALL INCLUSIVE<br />

Retaining diverse talent means focusing on more than diversity<br />

BY CAYLEY DOW<br />

HAC continues to<br />

lobby government for<br />

policy shifts to aid in<br />

industry growth<br />

The talent<br />

leaders and employees<br />

BY SUSIE GRYNOL<br />

shortage and<br />

at all levels.<br />

retention<br />

issues have<br />

Develop Inclusive<br />

been felt most<br />

Leaders<br />

deeply by the<br />

A culture of DE&I needs The Hotel Association of Canada<br />

hospitality<br />

to come from the most<br />

(HAC) team has been hard at<br />

industry and, although<br />

senior leadership levels.<br />

work this summer to build out<br />

it has always mattered,<br />

Truly inclusive leaders<br />

a bold tourism-and-hospitality<br />

diversity, equity and<br />

inclusion (DE&I) in our<br />

industry is now more critical<br />

than ever.<br />

The hospitality industry<br />

naturally attracts diverse<br />

talent, but diversity alone<br />

is only one part of the<br />

equation. Most organizations<br />

put great energy into<br />

getting diverse talent in<br />

the door by offering unique<br />

perks, compensation and<br />

recognition, but these<br />

initiatives will fall short for<br />

an employee who simply<br />

doesn’t feel they belong.<br />

Creating a culture of<br />

belonging fosters equity and<br />

inclusion, which are also key<br />

to the diversity equation.<br />

DE&I Defined<br />

Although commonly<br />

grouped in a phrase, the<br />

terms diversity, equity and<br />

inclusion (DE&I) are quite<br />

distinct. “Diversity” is the<br />

‘mix’ — it encompasses the<br />

variety of unique dimensions,<br />

qualities and characteristics<br />

we all possess. “Inclusion”<br />

creating a culture that<br />

embraces, respects and<br />

values differences. “Equity”<br />

is the promise of equal access<br />

to opportunity, where all<br />

people are given resources<br />

to participate, perform and<br />

engage to the same extent.<br />

Why DE&I?<br />

In a recent McKinsey &<br />

Company study, it was<br />

found that companies in<br />

the top quartile for gender,<br />

cultural and ethnic diversity<br />

outperformed bottom<br />

quartile companies by up to<br />

36 per cent in profitability.<br />

A mix of backgrounds,<br />

perspectives and life<br />

experiences is more likely<br />

to generate more and better<br />

solutions to problems than<br />

a group of “like-minded”<br />

people. This mix also<br />

nurtures a more vibrant and<br />

engaging community.<br />

Fostering a Culture<br />

of DE&I<br />

Building culture is about<br />

can be who they are and<br />

be valued for their unique<br />

experiences. This is what<br />

makes them want to stay.<br />

Employees who differ from<br />

most of their colleagues<br />

often hide important parts of<br />

themselves at work for fear<br />

of negative consequences.<br />

Understand how your<br />

employees are feeling by<br />

asking their permission to<br />

discuss the issues and barriers<br />

they’re facing at work.<br />

Consider holding one-onone’s,<br />

not only with your<br />

active employees, but also<br />

those who have departed.<br />

Use this knowledge to assess<br />

how diverse, equitable and<br />

inclusive your organization<br />

is, to understand where there<br />

may be barriers in hiring,<br />

advancement and retention<br />

of certain groups, and to<br />

strategize meaningful ways to<br />

remove them. As a starting<br />

point, initiatives should<br />

include mandatory<br />

DE&I training for<br />

seek to understand the<br />

challenges and inequalities<br />

that exist for underrepresented<br />

groups such as<br />

women, visible minorities,<br />

Indigenous people, people<br />

with disabilities and people in<br />

the LGTBQ2+ communities.<br />

They approach people with<br />

humility and a learning<br />

mindset, asking questions<br />

such as “If you were giving<br />

me advice on how to make<br />

the workplace fairer and<br />

more welcoming, what<br />

would you say?” In group<br />

settings, they ensure diverse<br />

participation by asking<br />

“whose perspective are we<br />

missing?” They are allies<br />

and collaborators, driving<br />

systemic improvements to<br />

workplace policies, practices<br />

and culture.<br />

At a time when difficulty<br />

retaining employees is<br />

making headlines, one must<br />

focus not only on diversity,<br />

but on the other key elements<br />

of the equation — equity and<br />

inclusion — as well. ◆<br />

growth strategy that will prioritize<br />

the sector as a key economic engine<br />

for government, with much-needed<br />

investments and policy shifts.<br />

The new Federal Tourism Growth<br />

Strategy is a unique opportunity to<br />

shape the government’s approach to<br />

our industry over the long term. HAC<br />

developed its policy recommendations<br />

through member consultations,<br />

surveys, focus groups and thorough<br />

economic analysis. We asked members<br />

about the biggest barriers to recovery<br />

and what is needed to kick-start<br />

growth across the hotel sector. The<br />

results of the consultations brought to<br />

light key concerns regarding labour,<br />

the hotel-investment environment,<br />

restrictive travel regulations and the<br />

need to support and celebrate our<br />

industry’s environmental and socialresponsibility<br />

endeavours.<br />

Chief among our asks is reform to<br />

Canada’s immigration system that will<br />

prioritize accommodation workers<br />

for processing and increase quota<br />

allocation. This will be essential in<br />

alleviating the critical labour shortage<br />

being felt across industry. To address<br />

domestic labour force gaps, we have<br />

recommended targeted recruitment<br />

campaigns for Canadians and tax<br />

and skills development and support for<br />

key demographics.<br />

Second is a sizeable investment<br />

strategy that will deliver new sources of<br />

patient capital, tax credits for retrofits<br />

and capital-cost allowance write-offs.<br />

And, of course, central to our asks<br />

is a predictable, frictionless travel<br />

experience, with increased air access to<br />

secondary and tertiary markets. You can<br />

find our submission on our website at<br />

hotelassociation.ca.<br />

We have been working closely with<br />

other leading national associations,<br />

including The Tourism Industry<br />

Association of Canada, Tourism HR<br />

Canada, the Indigenous Tourism<br />

Industry Association and Destination<br />

Canada to coordinate sector-wide<br />

alignment. We’ve also mobilized more<br />

than 120 tourism-and-hospitality<br />

business associations under the banner<br />

of the Coalition of the Hardest Hit<br />

Businesses (founded by HAC during<br />

COVID), to amplify our key asks. In<br />

fact, the Coalition has submitted our<br />

ambitious growth plan for a stronger<br />

and more inclusive tourism sector.<br />

Naturally, we have also been working<br />

alongside our Minister of Tourism,<br />

Randy Boissonnault and have had a<br />

series of meetings with him regarding<br />

the Growth Strategy this summer. First,<br />

a select group of senior hoteliers met<br />

with the Minister in Ottawa in July to<br />

discuss the needs of the sector. A big<br />

thank you to those that flew to Ottawa<br />

to attend the meeting. Next, HAC was<br />

also invited to the Minister’s riding<br />

in Edmonton to meet with him and a<br />

small group of national leaders in the<br />

tourism industry to further refine the<br />

Growth Strategy.<br />

Next up will be a major lobbying<br />

effort in the Fall to get action on<br />

all the big, bold ideas in the growth<br />

Strategy. We will need a full court press<br />

to get this across the finish line. Stay<br />

tuned for more details on how you can<br />

support this work. ◆<br />

is making the ‘mix’ work. focusing on behavioural<br />

Cayley Dow is the founder and CEO of Thrivity Inc., a<br />

credits to encourage worker mobility. recommendations for the Growth<br />

human-resources consulting and coaching firm that<br />

Susie Grynol is the president of<br />

It unlocks the power of change that creates an<br />

Our labour recommendations also Strategy regarding labour, borders and<br />

helps service-oriented businesses to thrive in the<br />

the Hotel Association of Canada.<br />

diversity by collectively environment where people<br />

ever-evolving world of work.<br />

include increased funding for training transportation, investment and an

14 | SEPTEMBER <strong>2022</strong> hoteliermagazine.com<br />

hoteliermagazine.com<br />

SEPTEMBER <strong>2022</strong> | 15<br />

PROFILE<br />

Queen. “It’s much larger than what you<br />

see from the street. You are more a part<br />

of a community. There is nothing like<br />

it in the region, and a great place for<br />

world travellers that want to disconnect<br />

and have fun.”<br />

He points to the newly constructed<br />

bar area that serves as the nervous<br />

system of the hotel, providing a<br />

relaxing and spacious setting for<br />

enjoying cocktails and small bites.<br />

The property offers 72 guestrooms ranging<br />

from single to full apartment-style suites<br />

original building in 2013, the<br />

partners bought an adjacent 2,700<br />

exceeding<br />

sq. ft. non-heritage building. They<br />

replaced it with an 11,000 sq. ft.<br />

building, which increased the room<br />

The 12,000-sq.-ft. world-class<br />

Nordic-inspired destination spa<br />

count from 16 to 26.<br />

At the same time, they moved<br />

Treadwell Cuisine, a popular local<br />

The floor-to-ceiling windows<br />

overlooking the courtyard create an<br />

al-fresco ambiance, while a small<br />

speakeasy dining area in a hidden<br />

restaurant and recognized leader in the<br />

farm-to-table movement to the site. The<br />

welcoming restaurant features an open<br />

kitchen and outdoor patio dining where<br />

corner provides the perfect spot for an guests can enjoy the courtyard gardens.<br />

124 ON QUEEN CREATES A<br />

intimate gathering.<br />

The Gate House was another critical<br />

TREASURE TROVE OF DELIGHTS<br />

The layout of the hallways on the addition in 2018. “We didn’t have<br />

BY DENISE DEVEAU<br />

main floor offers multiple exits to<br />

the street, courtyard and storefronts,<br />

space for events so spent $1.5 million<br />

on renovations, adding another 10<br />

including a Starbucks, The Budapest rooms, a bistro also run by Treadwell, “Delivering the highest level of service<br />

When a small apartment 40,000-sq.-ft. signature building on aesthetic typically seen in the town.<br />

Baker, Maple Fudge, OLiV Tasting and wedding facilities,” says Capasso. has been a constant since day-1.<br />

rental property in the the back of the original site. The new “We were aiming for a different<br />

Room, Pistachio’s Gelato and Pastries, Another acquisition of note is the Certainly, we made mistakes along the<br />

Old Town district of build includes 39 rooms, an expansive market,” he explains. “Instead, we<br />

Maison Apothecare and Ghost Walks. Caroline Building. Built in the early way, but we never lost sight of that part<br />

Niagara-on-the-Lake, cocktail lounge and meeting spaces, opted for pastel furnishings, light floors<br />

“We wanted to maintain the 2000s, it is home to four one- and twobedroom<br />

of the business.”<br />

Ont. came up for sale, 124 on Queen<br />

Hotel & Spa owners Nick Capasso<br />

and David Jones decided to join forces<br />

to build a unique hotel legacy in the<br />

picturesque town. Given they had no<br />

history in the industry, they relied on<br />

their extensive travel experiences to<br />

create stays that would check all the<br />

right boxes for guests.<br />

“We didn’t really know what we<br />

were doing when we started, but we<br />

knew what we liked in hotels when we<br />

travelled,” says Capasso.<br />

The 124 on Queen that you see<br />

today has come a long way. After 12<br />

years of expansion efforts, the team is<br />

celebrating its biggest milestone yet:<br />

the official launch of a newly minted<br />

plus a world-class spa that draws guests<br />

from miles around. Architects for the<br />

project were St. Catharines-based<br />

Quartek Group Inc.<br />

Factoring in all six of its properties,<br />

124 on Queen now offers a total of 72<br />

guestrooms, ranging from single to fullfledged<br />

apartment-style suites.<br />

The owners take pride in the fact<br />

that 124 on Queen is far from the<br />

typical Niagara-on-the-Lake property.<br />

“When we first started, it was still called<br />

Victorian Villas,” says Capasso. “We<br />

realized right away we didn’t want to be<br />

another traditional, red velvet, darkwood<br />

type of property, so we settled on<br />

a new name.”<br />

They dispensed with the Victorian<br />

and a contemporary wine-country feel.<br />

The cabinets, flooring and furniture<br />

are modern, while still honouring the<br />

town’s heritage.”<br />

Suites are generous in size (350 sq. ft.<br />

is the smallest), offering a large helping<br />

of high-end amenities, custom-designed<br />

mattresses, state-of-the-art appliances<br />

and electronically programmed<br />

fireplaces. Many have kitchen facilities.<br />

“We sought out the best materials and<br />

structural components and took every<br />

soundproofing precaution to ensure<br />

guest privacy,” says Capasso.<br />

General manager Eric Quesnel, who<br />

spent decades with Fairmont Hotels and<br />

Resorts, says guests are not experiencing<br />

a typical hotel when they stay at 124 on<br />

connection to the streets and old<br />

town,” explains Capasso. “It’s almost<br />

like a village. We’re not a 19-storey<br />

Hilton. We’re quite the opposite, so we<br />

made sure that our hotel flowed with<br />

the buildings on Main Street.”<br />

A particular point of pride is the<br />

12,000-sq.-ft. world-class Nordicinspired<br />

destination spa in the lower<br />

level of the new building. It features<br />

treatment rooms, a relaxation lounge<br />

and a one-of-a-kind a hydrotherapy<br />

circuit, complete with hot and cold<br />

pools, sensory showers, steam rooms, a<br />

sauna and snow room.<br />

Getting to this point took years of<br />

patience and a keen eye for acquisition<br />

opportunities. After purchasing the<br />

suites with full kitchenettes<br />

and living rooms.<br />

While the major part of the latest<br />

renovation project is completed,<br />

Capasso says there is more to come.<br />

Hidden below the main property is a<br />

new 20,000-sq.-ft. underground parking<br />

garage. Plans are to build a green roof<br />

and wellness area on top, which will<br />

include an outdoor yoga/meditation<br />

area, spa cabanas, and reflecting pools.<br />

A key component throughout its<br />

history has been a focus on highlevel<br />

customer service, he stresses.<br />

During COVID the owners continued<br />

to employ staff to ensure they were<br />

ready and able to continue their work<br />

when the hospitality sector re-opened.<br />

The new building was originally<br />

targeted to open around mid 2021,<br />

but like many hotel projects across<br />

the country, COVID slowed down the<br />

schedule considerably, he adds. “The<br />

pandemic was the biggest challenge<br />

we have had to face, from managing<br />

overhead and staffing to construction<br />

and supply delays.”<br />

With the worst behind them,<br />

Capasso says they are now ready<br />

to welcome guests with open arms.<br />

“Business has come back very strong as<br />

people are looking for somewhere to go.<br />

We’re seeing a huge surge in corporate<br />

groups. Weddings and reservations are<br />

off the charts. So far everything has<br />

exceeded our expectations.” ◆<br />

JOHN TRIGIANI

PROFILE<br />

running<br />

the bases<br />

Sky McLean has built a<br />

successful empire with<br />

Basecamp Resorts<br />

BY NICOLE DI TOMASSO<br />

Sky McLean is changing the<br />

face of the hospitality industry<br />

as the founder and CEO of<br />

Western Canada’s fastestgrowing<br />

hospitality brand, Basecamp<br />

Resorts. After receiving her MBA in<br />

real estate from the Schulich School of is slated to open December 2024; and<br />

Business at York University, McLean Basecamp Resorts Fernie, which is also<br />

moved to Calgary where she gained an slated to open December 2024. Many<br />

interest in the Airbnb business model. properties are BUILT GREEN to reduce<br />

In 2017, at the age of 33, McLean their environmental impact and feature<br />

opened the doors to Basecamp Resorts pet-friendly units, premium bedding, fully<br />

Canmore, a modern boutique hotel equipped kitchens and outdoor hot tubs.<br />

with 32 apartment-style suites that Guests also have access to various outdoor<br />

provides guests with the comfort of activities, including skiing, snowboarding,<br />

Airbnb but the amenities of a hotel. skating, hiking trails and more.<br />

Soon after, McLean launched the Over the years, McLean says she has<br />

Basecamp Resorts brand.<br />

enjoyed forming business relationships<br />

The company debuted on Hotelier’s the most. Additionally, the company<br />

Top 35 Report with gross sales of $10 raises money at least once a year for<br />

million in 2021. Currently, McLean the Canmore hospital, as well as other<br />

and her team run eight properties, local charities.<br />

with plans to open four more locations “I’ve enjoyed my experience<br />

over the next few years. Properties with people. Most importantly, I’ve<br />

currently open include Basecamp enjoyed building a team that’s equally<br />

Resorts Canmore, Basecamp Suites passionate about the brand and its<br />

Canmore, Basecamp Lodge Canmore, growth. We’ve been able to create jobs<br />

Basecamp Resorts Revelstoke in B.C., and give back to the community. We<br />

Basecamp Lodge Golden in B.C., have built, and continue to build, a<br />

Lamphouse Hotel Canmore, Northwinds lot of great [relationships within the]<br />

Hotel by Basecamp in Canmore and community that go beyond just the<br />

Baker Creek by Basecamp in Lake accommodation.”<br />

Louise, Alta. The brand’s newest<br />

She admits being a hospitality CEO<br />

hotels include Basecamp Suites Banff, comes with challenges. “Running<br />

which opens this month [<strong>September</strong>]; a business and [being a mom and<br />

Basecamp Suites Revelstoke in B.C., wife is a juggling act]. There’s more<br />

which is slated to open in December responsibility at home and keeping the<br />

2023; Basecamp Resorts Golden, which business going poses a significant, but<br />

16 | SEPTEMBER <strong>2022</strong><br />

Basecamp Resorts Revelstoke<br />

Basecamp<br />

Resorts Revelstoke<br />

also very rewarding, challenge.”<br />

Undoubtedly, the COVID-19<br />

pandemic posed the biggest threat,<br />

placing extraordinary demand on<br />

business leaders, but McLean says she<br />

has come out better on the other side.<br />

“In March 2020, we laid off about 45<br />

staff. There were only five of us running<br />

around trying to do everything to just<br />

keep the lights on, literally. Luckily,<br />

we were able to bring everybody back<br />

and then some. Now we’re at about 120<br />

staff. It’s all really promising for the first<br />

time in two years and I’m really happy<br />

about that.”<br />

As one of the few female CEOs in<br />

the industry, McLean offers a short<br />

and punchy piece of advice for women<br />

looking to obtain managerial positions:<br />

“Don’t let what anyone says or thinks<br />

have any bearing on a decision that you<br />

feel is right.” ◆<br />

hoteliermagazine.com<br />

STOCK.ADOBE.COM/ZARYA MAXIM<br />

HOSPITALITY MARKET REPORT<br />

Bouncing Back<br />

CBRE’s forecast shows <strong>2022</strong> is on track to be a<br />

year of unparalleled recovery<br />

BY NICOLE NGUYEN, SENIOR DIRECTOR, CBRE HOTELS<br />

hoteliermagazine.com SEPTEMBER <strong>2022</strong> | 17

If 2021 was widely<br />

considered to be a<br />

lost year, with only<br />

a minimal recovery<br />

from the impacts<br />

of COVID, then<br />

<strong>2022</strong> should be<br />

deemed the year, of<br />

the bounce back.<br />

In 2021, national<br />

Revenue Per<br />

Available Room<br />

(RevPAR) growth<br />

was 47 per cent,<br />

increasing to $57,<br />

which on a relative basis was only 54<br />

per cent of 2019 RevPAR. Occupancy<br />

finished at 42 per cent, with about $7<br />

of Average Daily Rate (ADR) growth<br />

over 2020. Aside from the summer<br />

and early fall, which saw strong leisure<br />

demand, the balance of the year was<br />

only moderately better than the last<br />

two quarters of 2020.<br />

Heading into 2020, the<br />

accommodation industry in Canada<br />

was operating at peak performance<br />

levels, running 65 per cent occupancy<br />

with an ADR of $163 and a RevPAR of<br />

$106. Similarly, operating profits were<br />

at peak levels in the range of $$15,000<br />

PAR. The industry’s growth over the<br />

2015 to 2019 period was fuelled by<br />

moderate supply growth, strong demand<br />

growth and national ADR growth of<br />

four per cent on a compounded annual<br />

basis. There was strong domestic<br />

and international visitation taking<br />

place and Canada’s reputation as a<br />

destination for both corporate and<br />

Indicator<br />

leisure travel was growing. According<br />

to Destination Canada, at the end of<br />

2019, tourism spending in Canada was<br />

$105.1 billion, of which $82 billion was<br />

generated by domestic spending.<br />

With the impacts of COVID in<br />

2020, the industry saw the singlebiggest<br />

year of declines, with RevPAR<br />

nationally falling by 64 per cent to<br />

just $39. Occupancy was 30 per cent,<br />

with the almost complete shutdown<br />

of travel from all demand segments.<br />

Rate declined by 21 per cent to $128,<br />

effectively wiping out all rate growth<br />

the industry had realized since 2013.<br />

CBRE’s Annual Trends 2021 report<br />

indicates that, in general, operating<br />

profits fell to $800 PAR.<br />

Heading into this year, the<br />

expectation was that <strong>2022</strong> would see<br />

incremental recovery of occupancy<br />

and ADR and, ultimately, RevPAR.<br />

The recovery of occupancy was<br />

expected to come from more diversified<br />

segmentation, more traditional<br />

seasonality patterns and ADR<br />

growth from rate yield generated by<br />

segmentation and seasonal pricing<br />

pressures. The expectation was that<br />

through the year there would be a steady,<br />

month over month improvement in the<br />

top-line metrics and that the gap to 2019<br />

RevPAR would narrow. After a bit of a<br />

slow start in January and February with<br />

the Omicron wave, RevPAR recovery<br />

month to month has accelerated sharply<br />

and beginning in June has hit 100 per<br />

cent of 2019 levels.<br />

CBRE's current forecast is for <strong>2022</strong><br />

to be a year of unparalleled recovery,<br />

with a sharp V-shaped curve becoming<br />

apparent. The industry is projected<br />

to see RevPAR growth of 70 per cent<br />

in <strong>2022</strong>. This growth will result in a<br />

RevPAR of $97, rebounding to 91 per<br />

cent of 2019 levels.<br />

Previously, when the industry has<br />

recovered from a demand shock-driven<br />

downturn, the recovery has been led<br />

by a relatively rapid return of demand<br />

levels (typically one to two years)<br />

with ADR recovery taking several<br />

more years to return to the prior peak<br />

(typically three to four years) with<br />

total RevPAR rebound taking between<br />

four and six years.<br />

However, based on the current<br />

market dynamics, it appears the<br />

industry’s recovery from COVID<br />

will be anything but typical — in<br />

fact, this time around everything is<br />

turned upside-down. At the end of<br />

<strong>2022</strong>, ‘forecast that demand growth<br />

will be 40 per cent, increasing<br />

occupancy nationally to 59 per cent.<br />

While occupied room nights will be<br />

approximately 91 per cent of 2019<br />

levels, this will leave more than 9.3<br />

million occupied room nights still to<br />

be recovered.<br />

The biggest surprise to the recovery<br />

in <strong>2022</strong> has been the strength of<br />

ADR, which is forecast to be up by 22<br />

per cent, finishing the year at $165,<br />

approximately 101 per cent of 2019<br />

levels. In general, ADR in tertiary<br />

and resort markets has been at or<br />

above 2019 levels since the start of<br />

the year, while downtown, airport<br />

and secondary markets have only<br />

Year-Over-Year Change<br />

Occupancy ADR RevPAR Supply Demand OCC ADR RevPAR<br />

Historic<br />

2019 65% $163 $106 1.4% 1% -1 pt 5% 5%<br />

<strong>2022</strong> 30% $128 $39 0.7% -54% -35 pts -21% -64%<br />

2021 42% $135 $57 0.5% 40% 12 pts 6% 47%<br />

Forecast<br />

<strong>2022</strong> 59% $165 $97 0.6% $40% 17pts 22% 70%<br />

$31<br />

$46<br />

$55<br />

$70<br />

Confidential & Proprietary | © <strong>2022</strong> CBRE, Inc. 1<br />

Source CBRE Hotels<br />

RevPAR<br />

$180<br />

$160<br />

$140<br />

$120<br />

$100<br />

$80<br />

$60<br />

$40<br />

$20<br />

$0<br />

56%<br />

$75<br />

$42<br />

70%<br />

$88<br />

$62<br />

87%<br />

$89<br />

$78<br />

93%<br />

$95<br />

$88<br />

seen rates-exceed 2019 levels since<br />

about May. However, pricing in these<br />

markets through the peak summer<br />

season will more than offset any lag<br />

from the early part of the year.<br />

Operators have been able to<br />

drive significantly higher-thanexpected<br />

ADR levels for myriad<br />

reasons, including general economic<br />

inflationary conditions, very high levels<br />

of leisure demand due to pent-up travel<br />

desire and excess discretionary income,<br />

as well as both direct and indirect<br />

capacity constraints due to labour<br />

shortages in the hospitality, tourism<br />

and related industries. While these<br />

conditions have been favourable, it is<br />

unlikely that this level of ADR growth<br />

can continue over the longer term.<br />

CAPACITY CONSTRAINTS:<br />

A SHORT-TERM ISSUE OR<br />

HERE TO STAY?<br />

As discussed, national occupancy is<br />

expected to rebound in <strong>2022</strong> to 59 per<br />

cent, which is about six points behind<br />

the 2019 occupancy. Since early spring,<br />

89%<br />

$112<br />

$100<br />

$84<br />

105%<br />

$139<br />

$132<br />

$104<br />

$144<br />

$137<br />

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Canada<br />

$152<br />

$142<br />

$131<br />

$107<br />

there has been considerable discussion<br />

about labour-market conditions<br />

and impact it’s having, and could<br />

continue to have, on the industry’s<br />

recovery. According to Statistics<br />

Canada, as of July 2021 there were<br />

more than 300,000 job vacancies in<br />

the Accommodation and foodservice<br />

sector, while the overall unemployment<br />

rate in Canada remains at a recordlow<br />

4.9 per cent. Many operators have<br />

indicated they’re having to restrict<br />

capacity (i.e. available rooms) in order<br />

to ensure their ability to service guests<br />

and turn over rooms on departure.<br />

At this point, it’s not possible to<br />

quantify the exact extent to which this<br />

restricting of capacity could be limiting<br />

the ability to capture additional<br />

occupied room nights, as this is being<br />

done at the property level in most<br />

cases on a week-to-week basis. To this<br />

point, the restricted capacity has been<br />

mostly favourable as it has allowed<br />

operators to drive rate yield on the<br />

demand they are able to accommodate.<br />

However, as other demand segments<br />

$107<br />

$86<br />

<strong>2022</strong> F <strong>2022</strong> A 2019 Recovery A<br />

$91<br />

$80<br />

$75<br />

$70<br />

$106<br />

$97<br />

120%<br />

110%<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

Recovery to 2019 Levels %<br />

with negotiated or contracted rates this<br />

dynamic will likely shift.<br />

While some relief is expected<br />

to come from Canada’s increased<br />

immigration targets and the recent<br />

changes to the foreign-workers<br />

program, there are several other<br />

industries where there are high levels of<br />

job vacancies, which will compete for<br />

new workers with the accommodation<br />

sector. As such, it’s unlikely the labour<br />

challenges will subside quickly, and this<br />

may be an issue that persists for the<br />

next several years. It will be necessary<br />

to evaluate the impact of restricted<br />

capacity on the industry’s ability to<br />

ramp-up occupied room night demand<br />

back to 2019 levels.<br />

RECOVERY TO 2019 LEVELS: IS<br />

IT THE RIGHT BENCHMARK?<br />

Historically, when judging or<br />

benchmarking the industry’s recovery<br />

from a downturn, it’s been with a<br />

view to getting back to the prior peak.<br />

After surviving the initial months of<br />

COVID, the discussion turned to what<br />

18 | SEPTEMBER <strong>2022</strong><br />

hoteliermagazine.com hoteliermagazine.com<br />

SEPTEMBER <strong>2022</strong> | 19

the recovery could or would look like.<br />

For most industry participants, it was<br />

about how long it would take to get back<br />

to 2019 performance levels, which for<br />

most of the markets across the country<br />

represented peak performance. With<br />

<strong>2022</strong> national RevPAR expected to be<br />

91 per cent of 2019 and ADR expected<br />

to be 101 per cent of 2019, should the<br />

industry begin to consider another<br />

benchmark when talking about recovery?<br />

For most properties, getting back to<br />

2019 levels is the focus of revenuemanagement<br />

and sales strategies.<br />

However, this approach doesn’t<br />

consider basic — or in the case of <strong>2022</strong><br />

— historically high, inflation levels<br />

and their impact on operating costs<br />

and profitability levels.<br />

Simply, ignoring COVID and assuming<br />

that the national market was stabilized<br />

in 2019, if ADR grew by 2.5 per cent per<br />

annum, the ADR in <strong>2022</strong> would have<br />

been $176. The current forecast has<br />

ADR recovering to $165 in <strong>2022</strong>, which<br />

although ahead of 2019, is more than $11<br />

behind the inflation-adjusted ADR.<br />

In order to close the gap, bringing<br />

actual ADR in line with the inflation<br />

adjusted ADR would require rate<br />

growth of approximately nine per cent<br />

nationally in 2023.<br />

If this could be achieved, it would<br />

mitigate some, but not all, of the impact<br />

of the escalation of operating costs the<br />

industry is facing. According to TD<br />

Economics, inflation in Canada was<br />

3.4 per cent in 2021 and is estimated to<br />

be approximately 6.7 per cent in <strong>2022</strong>.<br />

While there is not a direct correlation<br />

between the overall inflation rate<br />

and hotel operating costs, there is a<br />

strong relationship in that as inflation<br />

accelerates, so do the costs associated with<br />

many of the more significant expenses<br />

(i.e. utilities, food costs, labour costs,<br />

operating supplies, et cetera), putting<br />

pressure on bottom-line profitability.<br />

While there are many reasons to be<br />

optimistic about the current trajectory<br />

of the recovery for the industry, with<br />

RevPAR within less than 10 per cent<br />

of 2019 levels, it may be prudent for<br />

industry participants to also be tracking<br />

recovery relative to an inflationadjusted<br />

ADR to facilitate a quicker<br />

recovery of profitability levels.<br />

CBRE HOTELS<br />

<strong>2022</strong> MARKET<br />

FORECAST<br />

BY CBRE HOTELS AND<br />

CBRE TOURISM CONSULTING<br />

Heading into <strong>2022</strong>, it<br />

was widely expected<br />

that this year would<br />

be a rebuilding year<br />

for the industry.<br />

The opening of the<br />

Canadian borders<br />

to both U.S. and<br />

overseas visitors, along with the easing<br />

of testing and quarantine requirements,<br />

was expected to have an immediate,<br />

positive impact on travel conditions. In<br />

addition, most provinces and territories<br />

Hypothetical Stabilized National Performance<br />

had, or were, rolling back gathering<br />

limitations and implementing “reopening”<br />

plans aimed at getting people<br />

back to their regular routines and the<br />

economy operating at full capacity.<br />

In reality, <strong>2022</strong> has been another<br />

unprecedented year — but for all the<br />

right reasons. Although the first couple<br />

of months of <strong>2022</strong> were challenged by<br />

the Omicron wave, with occupancies<br />

and Average Daily Rates (ADRs) well<br />

below pre-pandemic levels, as early<br />

as March the industry started to see a<br />

meaningful shift in performance and<br />

sentiment. Since then, there has been<br />

good growth in occupancy monthover-month<br />

and, in general, summer<br />

occupancy levels will be within 10 or 15<br />

points of pre-pandemic levels.<br />

The bigger surprise has been the<br />

strength of the rebound of the ADR. In<br />

many of the markets across the country,<br />

starting in March or April, ADRs<br />

reached or exceeded 2019 ADRs for the<br />

same month. This trend has carried into<br />

the summer months, where operators<br />

have been able to drive a premium<br />

over 2019 levels. Many operators are<br />

reacting to the strong demand levels<br />

and increases in operating costs by<br />

instituting aggressive pricing strategies.<br />

As a result, overall ADR in many<br />

markets for year-end <strong>2022</strong> is projected<br />

to be in the range of, or exceed, 2019<br />

levels. However, the slower pace of<br />

the occupancy recovery will be the<br />

mitigating factor to achieving full<br />