The Big I Virginia Winter 2022-23

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

uilding code. A replacement cost policy pays only to put<br />

back what was damaged and no more.<br />

A March 2021 New Hampshire Supreme Court ruling<br />

serves as a prime example of the issues with replacement<br />

cost in contrast to reconstruction cost. In 101 Ocean Blvd.<br />

LLC v. Foy Insurance Group Inc., Ocean Boulevard Hotel<br />

in Hampton, N.H. obtained a $2 million replacement<br />

cost policy that provided $10,000 in ordinance or law<br />

insurance coverage.<br />

In October 2015, a fire severely damaged the hotel. <strong>The</strong><br />

insured was told the cost to replace the existing structure<br />

would be about $1.1 million and rebuilding it in compliance<br />

with the current building code would cost an additional<br />

$905,070. This is just slightly more than the $2 million<br />

replacement cost coverage purchased.<br />

<strong>The</strong> insured decided to demolish the structure rather than<br />

rebuild it. After accounting for depreciation, the insurer paid<br />

Ocean $910,141 for the structure’s replacement cost, which<br />

did not include the additional cost necessary to rebuild<br />

the structure in compliance with the building code.<br />

Although the insured had sufficient “replacement cost”<br />

coverage ($2 million), the reality of replacement cost in<br />

the unendorsed policy cost the insured (and ultimately<br />

the agent) $905,070. This is not an isolated incident; in<br />

conversations with insurance agent’s errors and omissions<br />

(E&O) insurance carriers, insufficient or improper<br />

explanation of replacement cost is a common error.<br />

“Replacement cost” does not pay what many have<br />

been led or conditioned to believe. Couple the reality<br />

of replacement cost with the fact that the requirements<br />

found in building codes have the potential to turn a partial<br />

loss into a total loss, and it becomes abundantly clear that<br />

replacement cost is insufficient following a major property<br />

loss. Reconstruction cost is the goal.<br />

• <strong>The</strong> undamaged part of the structure can be repaired;<br />

or<br />

• <strong>The</strong> undamaged part of the structure cannot be<br />

repaired and must be demolished and removed.<br />

Regardless which directive is given, the entire structure<br />

must be brought into compliance with current building<br />

code. Replacement cost, as has been demonstrated, does<br />

not pay these necessitated additional costs.<br />

Achieving reconstruction cost requires endorsements be<br />

attached to the commercial property policy. Specifically,<br />

Ordinance or Law coverage should be attached to every<br />

commercial property policy.<br />

Ordinance or law coverage is the primary step (not the<br />

only step) towards turning a “replacement cost” policy<br />

into “reconstruction cost” coverage. <strong>The</strong> CPP and the<br />

Ordinance or Law coverage dovetail following a “major<br />

loss” to get closer to accomplishing reconstruction<br />

cost. Following is an example demonstrating how these<br />

coverages work towards reconstruction cost.<br />

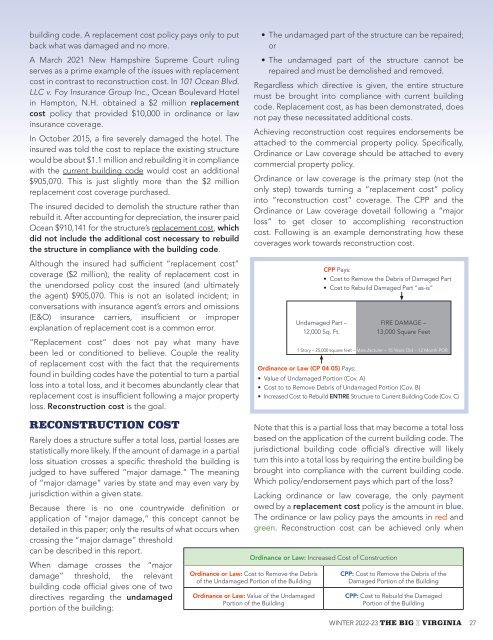

Undamaged Part –<br />

12,000 Sq. Ft.<br />

CPP Pays:<br />

• Cost to Remove the Debris of Damaged Part<br />

• Cost to Rebuild Damaged Part “as-is”<br />

FIRE DAMAGE –<br />

13,000 Square Feet<br />

1 Story – 25,000 square feet – Manufacturer – 15 Years Old – 12 Month POR<br />

Ordinance or Law (CP 04 05) Pays:<br />

• Value of Undamaged Portion (Cov. A)<br />

• Cost to to Remove Debris of Undamaged Portion (Cov. B)<br />

• Increased Cost to Rebuild ENTIRE Structure to Current Building Code (Cov. C)<br />

RECONSTRUCTION COST<br />

Rarely does a structure suffer a total loss, partial losses are<br />

statistically more likely. If the amount of damage in a partial<br />

loss situation crosses a specific threshold the building is<br />

judged to have suffered “major damage.” <strong>The</strong> meaning<br />

of “major damage” varies by state and may even vary by<br />

jurisdiction within a given state.<br />

Because there is no one countrywide definition or<br />

application of “major damage,” this concept cannot be<br />

detailed in this paper; only the results of what occurs when<br />

crossing the “major damage” threshold<br />

can be described in this report.<br />

When damage crosses the “major<br />

damage” threshold, the relevant<br />

building code official gives one of two<br />

directives regarding the undamaged<br />

portion of the building:<br />

Note that this is a partial loss that may become a total loss<br />

based on the application of the current building code. <strong>The</strong><br />

jurisdictional building code official’s directive will likely<br />

turn this into a total loss by requiring the entire building be<br />

brought into compliance with the current building code.<br />

Which policy/endorsement pays which part of the loss?<br />

Lacking ordinance or law coverage, the only payment<br />

owed by a replacement cost policy is the amount in blue.<br />

<strong>The</strong> ordinance or law policy pays the amounts in red and<br />

green. Reconstruction cost can be achieved only when<br />

Ordinance or Law: Increased Cost of Construction<br />

Ordinance or Law: Cost to Remove the Debris<br />

of the Undamaged Portion of the Building<br />

Ordinance or Law: Value of the Undamaged<br />

Portion of the Building<br />

CPP: Cost to Remove the Debris of the<br />

Damaged Portion of the Building<br />

CPP: Cost to Rebuild the Damaged<br />

Portion of the Building<br />

WINTER <strong>2022</strong>-<strong>23</strong> THE BIG I VIRGINIA 27