The Big I Virginia Winter 2022-23

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

• Building 3: $100,000<br />

<strong>The</strong> blanket limit is $550,000. Applying traditional blanket<br />

limits, this total is available for any covered loss to any one<br />

of these three buildings.<br />

If Building 1 suffered a total loss and the actual replacement<br />

cost was $300,000, the entire loss would be covered by the<br />

blanket limit.<br />

However, if a margin clause is attached that applies the<br />

120% option, the maximum available to any one building is:<br />

• Building 1: $240,000<br />

• Building 2: $300,000<br />

• Building 3: $120,000<br />

(Obviously, if all three are destroyed in the same event, the<br />

maximum paid is the policy limit.)<br />

Because of the margin clause, if Building 1 suffered a total<br />

loss requiring $300,000 to replace, the maximum the policy<br />

would pay is $240,000. <strong>The</strong> insured would be out of pocket<br />

$60,000 due to the margin clause.<br />

If the carrier requires attachment of a margin clause,<br />

the highest allowable percentage should be used.<br />

Interestingly, use of a margin clause does lower the<br />

premium attributable to blanket coverage.<br />

INFLATION GUARD OPTION<br />

Unexpected events can increase the cost of reconstruction<br />

during the policy period. Higher than expected building<br />

costs, a natural disaster, a disruption in the construction<br />

material supply chain, an increase in labor costs, etc. are all<br />

possible. Such events increase the cost of reconstruction.<br />

Within the CPP is the option to apply a hedge against<br />

these unexpected increases known as Inflation Guard.<br />

This coverage<br />

option increases<br />

the amount of<br />

coverage on a<br />

daily, pro-rata basis<br />

throughout the policy<br />

term.<br />

For example, assume a building<br />

valued at $100,000 has the 6%<br />

inflation guard option added to the<br />

policy. Six months into the policy term the insured has<br />

$103,000 available if needed (1/2 of 6%). <strong>The</strong> amount of<br />

coverage increases a small amount each day.<br />

Applying the inflation guard option is one more step<br />

in hitting or getting as close to possible to a structure’s<br />

reconstruction cost. <strong>The</strong> available inflation guard<br />

percentages begin at 2%. According to ISO rules, the<br />

percentage is in 2% increments and can be as high as the<br />

carrier will allow (thus the maximum percentage varies<br />

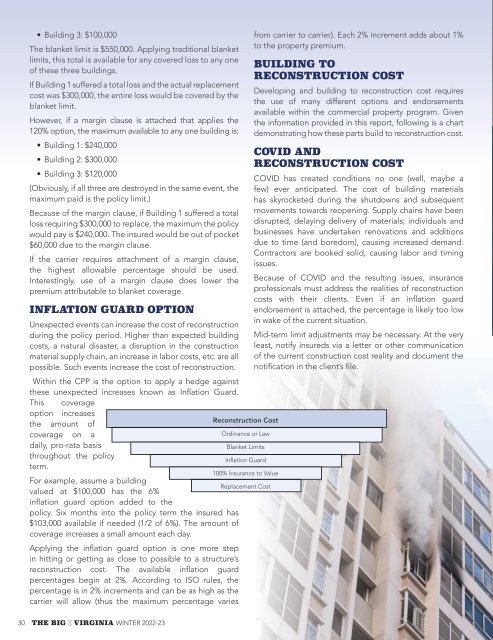

Reconstruction Cost<br />

Ordinance or Law<br />

Blanket Limits<br />

Inflation Guard<br />

100% Insurance to Value<br />

Replacement Cost<br />

from carrier to carrier). Each 2% increment adds about 1%<br />

to the property premium.<br />

BUILDING TO<br />

RECONSTRUCTION COST<br />

Developing and building to reconstruction cost requires<br />

the use of many different options and endorsements<br />

available within the commercial property program. Given<br />

the information provided in this report, following is a chart<br />

demonstrating how these parts build to reconstruction cost.<br />

COVID AND<br />

RECONSTRUCTION COST<br />

COVID has created conditions no one (well, maybe a<br />

few) ever anticipated. <strong>The</strong> cost of building materials<br />

has skyrocketed during the shutdowns and subsequent<br />

movements towards reopening. Supply chains have been<br />

disrupted, delaying delivery of materials; individuals and<br />

businesses have undertaken renovations and additions<br />

due to time (and boredom), causing increased demand.<br />

Contractors are booked solid, causing labor and timing<br />

issues.<br />

Because of COVID and the resulting issues, insurance<br />

professionals must address the realities of reconstruction<br />

costs with their clients. Even if an inflation guard<br />

endorsement is attached, the percentage is likely too low<br />

in wake of the current situation.<br />

Mid-term limit adjustments may be necessary. At the very<br />

least, notify insureds via a letter or other communication<br />

of the current construction cost reality and document the<br />

notification in the client’s file.<br />

30 THE BIG I VIRGINIA WINTER <strong>2022</strong>-<strong>23</strong>