Green Economy Journal Issue 60

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ENERGY<br />

ENERGY<br />

A utility’s geographic<br />

footprint is one final<br />

major element that<br />

impacts resilience.<br />

A dependable supply<br />

chain, in other words,<br />

will be about trade-offs.<br />

Manufacturers are trying to fill the void by expanding onshore capacity<br />

and developing more advanced equipment, but new facilities and<br />

innovations take time.<br />

Suppliers have told us, in fact, that utilities will need to work with<br />

them more closely than ever to expand production. But how to<br />

do this? Suppliers will have to continue raising prices to cover the<br />

expense of additional manufacturing lines, which means the rands<br />

utilities have won’t go as far. If some utilities don’t meet the higher<br />

prices or other terms that suppliers can set, then they won’t get<br />

contracts, whereas more cooperative utilities will.<br />

Utilities, then, are in a new and unaccustomed position of having<br />

to rethink supplier relationships: from tactical buys to strategic<br />

partnerships. Either find ways to invest in suppliers to ensure future<br />

needs or roll the dice and hope that supplies will be there when<br />

you need them.<br />

A dependable supply chain, in other words, will be about trade-offs.<br />

It will be flexible while maintaining an optimal balance between cost<br />

and performance. Where it has focused on cost to preserve capital,<br />

it will now depend as much on drivers, including time-to-market,<br />

ESG impact and service levels. It will mitigate risks by adjusting for<br />

them, quantifying financial impacts and changing course as priorities<br />

shift (see figure 3).<br />

This dynamic of trade-off and exchange – where utilities will have<br />

to understand demand in operations, match it with supply, and go<br />

to external sources – effectively calls for a procurement and supply<br />

chain clearinghouse.<br />

The clearinghouse approach brings structure to unknowns. Utilities<br />

progress from reactive event management to business continuity<br />

planning, where they gain a much clearer understanding of weak<br />

links in the supply chain. Redundancies are implemented to manage<br />

gaps and responses to unexpected events are planned.<br />

Once those steps are taken, a utility can prepare its supply chain<br />

for the future using forward-looking models to forecast potential<br />

events, prioritise risk and likelihood with sensing systems, and use<br />

manual intervention and decision-making for recovery when adverse<br />

events occur.<br />

Article courtesy of Kearney Consulting<br />

Maximise capital. The third aspect is financial: how a utility will get<br />

the most value for the rands it has to spend. From rands tied up in<br />

inventory of raw materials and finished goods to capital in reserve,<br />

the utility will be able to quickly assess financials for urgent, ongoing<br />

and investment projects.<br />

KEY TO THE ENERGY TRANSITION<br />

A utility’s geographic footprint is one final major element that impacts<br />

resilience. How diverse and available suppliers are to the utility’s<br />

operations is key because it affects how quickly it can activate alternate<br />

routes and locations of focus if something goes awry. If plan A fails, it’s<br />

ready for plan B or C.<br />

Specifically, finding alternatives to reliance on single-sourced<br />

suppliers is what’s pressing (see figure 4). By pre-qualifying alternate<br />

suppliers, a utility can significantly reduce risk and ensure consistent,<br />

cost-effective product flows across the supply chain. The more<br />

suppliers and less variation in products, the lower the supply risk.<br />

As the number of suppliers dwindles and the number of product<br />

stock-keeping units grows or becomes exclusive due to patents<br />

or status as an OEM, the supply risk grows exponentially. These<br />

suppliers require a different level of engagement that elevates them<br />

to strategic partners to utilities.<br />

Pre-qualify where potential future alternatives exist. Dual or<br />

multi-source where there are viable options and fewer suppliers,<br />

and potentially vertically integrate or co-invest in those that are<br />

of the highest value or pose the greatest dependency. Taking<br />

the time to identify and approve alternates will pay dividends<br />

in the long term.<br />

First-mover utilities will proactively identify their supply risks and<br />

develop cooperative relationships with suppliers to lock them in.<br />

When a utility commits to a supplier – especially one that produces<br />

some of the most essential equipment, such as transformers – that<br />

supplier has the confidence to invest in new technology or put<br />

in another production line. By moving beyond an attachment to<br />

slow-moving inventory and committing to a certain volume over<br />

a longer period, a utility can guarantee supply more cost-effectively.<br />

Reclaiming and reigniting supplier relationships is new to the power<br />

sector. However, this approach, along with the dynamic trade-offs<br />

afforded by a clearinghouse-style supply chain, can limit economic risk<br />

and bring utilities the freedom to grow and transition to a new era.<br />

Kearney analysis<br />

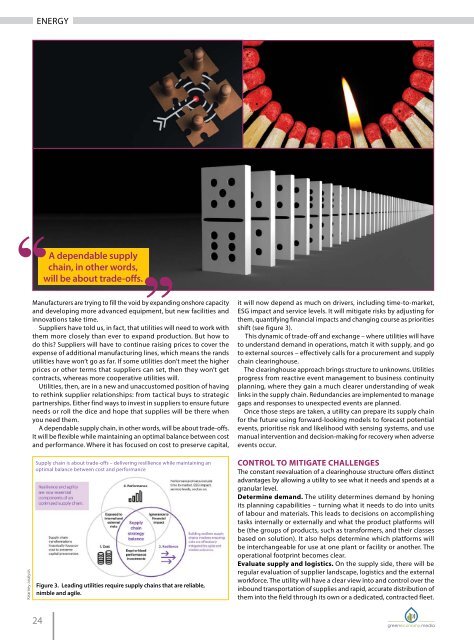

Supply chain is about trade-offs – delivering resillience while maintaining an<br />

optimal balance between cost and performance<br />

Figure 3. Leading utilities require supply chains that are reliable,<br />

nimble and agile.<br />

CONTROL TO MITIGATE CHALLENGES<br />

The constant reevaluation of a clearinghouse structure offers distinct<br />

advantages by allowing a utility to see what it needs and spends at a<br />

granular level.<br />

Determine demand. The utility determines demand by honing<br />

its planning capabilities – turning what it needs to do into units<br />

of labour and materials. This leads to decisions on accomplishing<br />

tasks internally or externally and what the product platforms will<br />

be (the groups of products, such as transformers, and their classes<br />

based on solution). It also helps determine which platforms will<br />

be interchangeable for use at one plant or facility or another. The<br />

operational footprint becomes clear.<br />

Evaluate supply and logistics. On the supply side, there will be<br />

regular evaluation of supplier landscape, logistics and the external<br />

workforce. The utility will have a clear view into and control over the<br />

inbound transportation of supplies and rapid, accurate distribution of<br />

them into the field through its own or a dedicated, contracted fleet.<br />

Kearney analysis<br />

Figure 4. Diversification of single-source suppliers, by pre-qualifying and dual-sourcing, can also help mitigate the risk from geographic concentration.<br />

*Authors: Andre Begosso, Rajeev Prabhakar; partners. Natasha Villacorta, James Guba; principals. The authors would like to thank Kish Khemani for his valuable contributions to this paper.<br />

24 25